What is the tax credit for head of household information

Home » News » What is the tax credit for head of household informationYour What is the tax credit for head of household images are available. What is the tax credit for head of household are a topic that is being searched for and liked by netizens today. You can Get the What is the tax credit for head of household files here. Find and Download all royalty-free vectors.

If you’re searching for what is the tax credit for head of household pictures information related to the what is the tax credit for head of household topic, you have pay a visit to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

What Is The Tax Credit For Head Of Household. Contrast this with single filers and married individuals who file separate returnsthey can claim only a 12400 standard deduction in 2020. Compared to single and married filing separately head of household filing status has a larger standard deduction. Single parent with two children wages of 4000 no federal income tax liability before child tax credit. Thats up 300 from 2019.

2020 Tax Information Standard Deduction Standard Deduction Irs Tax From pinterest.com

2020 Tax Information Standard Deduction Standard Deduction Irs Tax From pinterest.com

A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers. Examples of how the Economic Stimulus Act of 2008 may effect taxpayers who are single file as head of household and have children who qualify for the child tax credit payment. At the 15 percent tax bracket that 2950 difference results in a 442 savings. Just 40125 for single filers. For head of household filers that threshold was 13850. The head of household standard deduction for 2020 is 18650 up from 18350 in 2019.

Standard deductions are higher for.

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single parent also called Head of Household. The IRS set the 2020 standard deduction for heads of household at 18650. For head of household filers that threshold was 13850. If you meet the requirements to file head of household then you can claim education credits for yourself or for a person whom you are eligible to claim on your tax return. For example if you are. The head of household must pay for more than one-half of the qualifying persons support and housing.

Source: pinterest.com

Source: pinterest.com

Head of household filers also benefit from a higher standard deduction. You can qualify if youre single or married with or without dependent children. The standard deduction is much higher for head of household vs. Major tax relief for nearly. The first requirement for filing as head of household is that you must have paid for more than half of the expenses involved in maintaining your household during the tax year.

Source: pinterest.com

Source: pinterest.com

Head of household filers also benefit from a higher standard deduction. Just 40125 for single filers. Compared to single and married filing separately head of household filing status has a larger standard deduction. The IRS set the 2020 standard deduction for heads of household at 18650. Single parent with two children wages of 4000 no federal income tax liability before child tax credit.

Source: pinterest.com

Source: pinterest.com

You can qualify if youre single or married with or without dependent children. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single parent also called Head of Household. Thats up 300 from 2019. Just 40125 for single filers. According to the Tax Foundation head of household filers could also pay less in their respective tax bracket.

Source: pinterest.com

Source: pinterest.com

You can qualify if youre single or married with or without dependent children. Individual rebate is 300. For your 2020 taxes the standard deduction for the head of household will be 18650. The standard deduction is much higher for head of household vs. A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers.

Source: co.pinterest.com

Source: co.pinterest.com

Major tax relief for nearly. If you file head of household however you can earn up to 52850 before being bumped out of the 12 tax bracket. The qualifying person must generally be either a child or parent of the head of household. For example if you are. A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers.

Source: pinterest.com

Source: pinterest.com

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single parent also called Head of Household. The IRS set the 2020 standard deduction for heads of household at 18650. Examples of how the Economic Stimulus Act of 2008 may effect taxpayers who are single file as head of household and have children who qualify for the child tax credit payment. That meant rejiggering the tax brackets and increasing the standard deduction to 24000 for joint returns and to 12000 for individuals among other things. Standard deductions are higher for.

Source: pinterest.com

Source: pinterest.com

Standard deductions are higher for. The qualifying person must generally be either a child or parent of the head of household. The standard deduction is much higher for head of household vs. A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers. If you file head of household however you can earn up to 52850 before being bumped out of the 12 tax bracket.

Source: pinterest.com

Source: pinterest.com

How does the Earned Income Credit apply to heads of household. Major tax relief for nearly. Its popular because its refundable meaning it can give you a refund even if you werent due one based on the taxes you paid throughout the year. As a head of household your AGI will need to be 112500 or less to qualify for the full child tax credit amount. How does the Earned Income Credit apply to heads of household.

Source: pinterest.com

Source: pinterest.com

For your 2020 taxes the standard deduction for the head of household will be 18650. Head of household filers also benefit from a higher standard deduction. Individual filers When the Tax Cuts and Jobs Act passed in December 2017 it revamped our nations tax code. Standard deductions are higher for. The Earned Income Credit EIC is especially beneficial for lower-income taxpayers.

Source: pinterest.com

Source: pinterest.com

The IRS set the 2020 standard deduction for heads of household at 18650. For example if you are. Contrast this with single filers and married individuals who file separate returnsthey can claim only a 12400 standard deduction in 2020. A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers. Single filers are allowed a standard deduction of 6300 for the 2015 tax year while head of household filers receives a 9250 deduction.

Source: pinterest.com

Source: pinterest.com

That meant rejiggering the tax brackets and increasing the standard deduction to 24000 for joint returns and to 12000 for individuals among other things. Single parent with two children wages of 4000 no federal income tax liability before child tax credit. The head of household must pay for more than one-half of the qualifying persons support and housing. A higher standard deduction The standard deduction for head of household is 18650 for 2020 versus 12400 for single filers. How does the Earned Income Credit apply to heads of household.

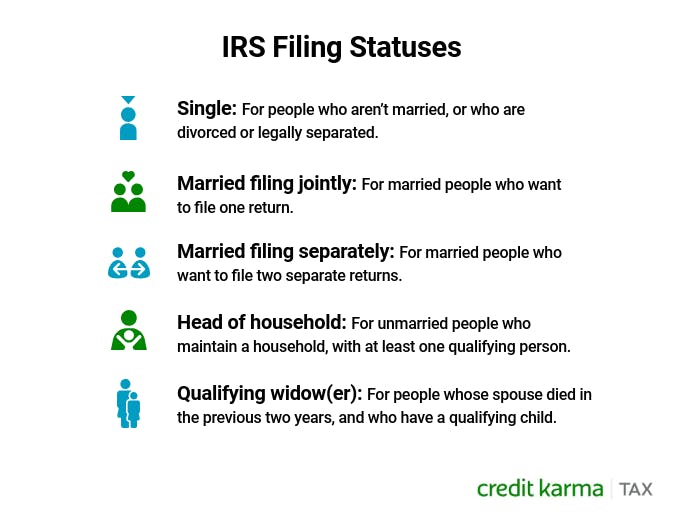

Source: creditkarma.com

Source: creditkarma.com

You can qualify if youre single or married with or without dependent children. The IRS set the 2020 standard deduction for heads of household at 18650. Standard deductions are higher for. You can qualify if youre single or married with or without dependent children. The qualifying person must generally be either a child or parent of the head of household.

Source: pinterest.com

Source: pinterest.com

Head of household filers also benefit from a higher standard deduction. Individual rebate is 300. This means that you must have paid more than half of the total household bills including rent or mortgage utility bills insurance property taxes groceries repairs and other common household expenses. Single filers are allowed a standard deduction of 6300 for the 2015 tax year while head of household filers receives a 9250 deduction. For example a head of household pays a 10 tax rate on income up to 14100 compared to 9875 for single filers and 12 on income up to 53700 vs.

Source: pinterest.com

Source: pinterest.com

Head of household with children. Individual rebate is 300. According to the Tax Foundation head of household filers could also pay less in their respective tax bracket. If you file head of household however you can earn up to 52850 before being bumped out of the 12 tax bracket. The head of household must pay for more than one-half of the qualifying persons support and housing.

Source: pinterest.com

Source: pinterest.com

Head of household with children. If your AGI is 75000 or less as a single filer 112500 as a head of household or 150000 filing jointly youll get the maximum amount. At the 15 percent tax bracket that 2950 difference results in a 442 savings. For example a head of household pays a 10 tax rate on income up to 14100 compared to 9875 for single filers and 12 on income up to 53700 vs. How does the Earned Income Credit apply to heads of household.

Source: pinterest.com

Source: pinterest.com

How does the Earned Income Credit apply to heads of household. This means that you must have paid more than half of the total household bills including rent or mortgage utility bills insurance property taxes groceries repairs and other common household expenses. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single parent also called Head of Household. Just 40125 for single filers. You can qualify if youre single or married with or without dependent children.

Source: pinterest.com

Source: pinterest.com

If your AGI is 75000 or less as a single filer 112500 as a head of household or 150000 filing jointly youll get the maximum amount. Single filers are allowed a standard deduction of 6300 for the 2015 tax year while head of household filers receives a 9250 deduction. Individual filers When the Tax Cuts and Jobs Act passed in December 2017 it revamped our nations tax code. Examples of how the Economic Stimulus Act of 2008 may effect taxpayers who are single file as head of household and have children who qualify for the child tax credit payment. This means that you must have paid more than half of the total household bills including rent or mortgage utility bills insurance property taxes groceries repairs and other common household expenses.

Source: pinterest.com

Source: pinterest.com

Its popular because its refundable meaning it can give you a refund even if you werent due one based on the taxes you paid throughout the year. Head of household with children. Single parent with two children wages of 4000 no federal income tax liability before child tax credit. Compared to single and married filing separately head of household filing status has a larger standard deduction. Just 40125 for single filers.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the tax credit for head of household by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information