How much will the child tax credit be for 2020 information

Home » Trending » How much will the child tax credit be for 2020 informationYour How much will the child tax credit be for 2020 images are available. How much will the child tax credit be for 2020 are a topic that is being searched for and liked by netizens today. You can Get the How much will the child tax credit be for 2020 files here. Download all royalty-free photos.

If you’re searching for how much will the child tax credit be for 2020 pictures information connected with to the how much will the child tax credit be for 2020 interest, you have pay a visit to the ideal site. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

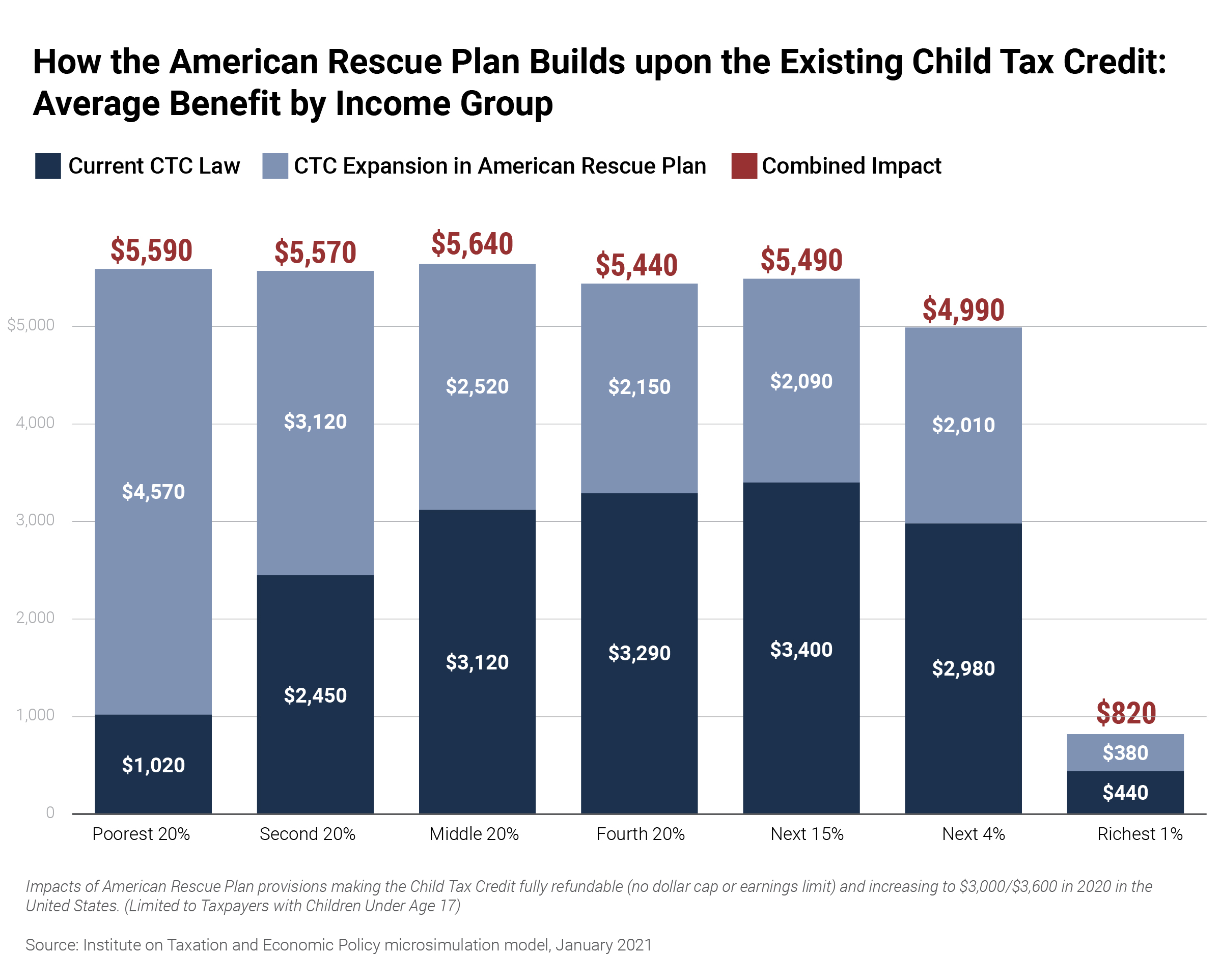

How Much Will The Child Tax Credit Be For 2020. Families with older kids are also eligible. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. Withdrawal threshold rate 41. New changes to the child tax credit may provide families with monthly payments worth up to 250 per child and 300 per child under 6 as soon as.

Xesv2lbdk3quhm From

Xesv2lbdk3quhm From

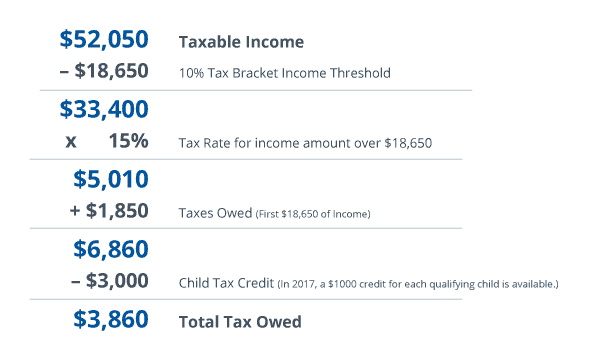

Children with a disability. The maximum amount of the child tax credit per qualifying child. When figuring your income for the purposes of the Child Tax Credit you must include any foreign income exclusions. This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families. The IRS will make a. More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation.

If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit.

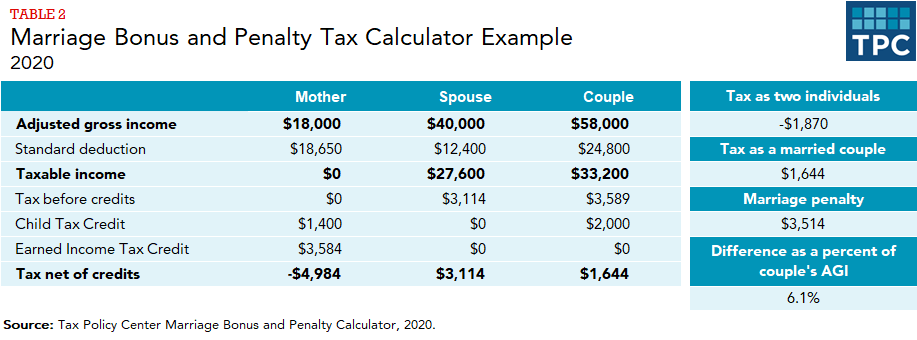

The Child Tax Credit is a federal tax credit that applies to families and taxpayers with children to reduce their taxes. Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. 8 rows For each child ages 6 through 17 the IRS will pay 3000. More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation. Families with kids age 17 and under will receive a credit of 3000 per child.

Source: blog.taxact.com

Source: blog.taxact.com

More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation. Threshold for those entitled to Child Tax Credit only. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. 8 rows For each child ages 6 through 17 the IRS will pay 3000.

Source: cnet.com

Source: cnet.com

For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly. 2020 to 2021 2019 to 2020. More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation. For more information go to CCB young child supplement. For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly.

Source: in.pinterest.com

Source: in.pinterest.com

The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The Child Tax Credit is a federal tax credit that applies to families and taxpayers with children to reduce their taxes. Withdrawal threshold rate 41. To be eligible to claim the child tax credit your child or dependent must first pass all. Children with a disability.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Families with kids age 17 and under will receive a credit of 3000 per child. Children with a disability. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. Threshold for those entitled to Child Tax Credit only. To be eligible to claim the child tax credit your child or dependent must first pass all.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The credit is fully refundable meaning you may receive a refund if the credit reduces your tax bill to zero. You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments. This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. You can claim 500 for each child age 17 and 18 or for full-time college. For more information go to CCB young child supplement.

Source: cnet.com

Source: cnet.com

This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. 2020 to 2021 2019 to 2020. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. For 2020 the maximum amount of the credit is 2000 per qualifying child. Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17.

Source: pinterest.com

Source: pinterest.com

Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17. The Child Tax Credit is a federal tax credit that applies to families and taxpayers with children to reduce their taxes. The maximum amount of the child tax credit per qualifying child. 8 rows For each child ages 6 through 17 the IRS will pay 3000. Withdrawal threshold rate 41.

Source: in.pinterest.com

Source: in.pinterest.com

As long as your adjusted gross income or AGI is 75000 or less single taxpayer parents will qualify for the full child tax credit amount. For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly. You can claim 500 for each child age 17 and 18 or for full-time college. Families with older kids are also eligible. The credit is fully refundable meaning you may receive a refund if the credit reduces your tax bill to zero.

Source: taxfoundation.org

Source: taxfoundation.org

This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. For 2020 the maximum amount of the credit is 2000 per qualifying child. You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments. For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States.

Source: taxfoundation.org

Source: taxfoundation.org

The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The IRS will make a. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return.

Source: cnet.com

Source: cnet.com

The IRS will make a. 8 rows For each child ages 6 through 17 the IRS will pay 3000. Families with kids age 17 and under will receive a credit of 3000 per child. The Child Tax Credit is a federal tax credit that applies to families and taxpayers with children to reduce their taxes. The IRS will make a.

Source: itep.org

Source: itep.org

For more information go to CCB young child supplement. You can claim 500 for each child age 17 and 18 or for full-time college. New changes to the child tax credit may provide families with monthly payments worth up to 250 per child and 300 per child under 6 as soon as. Children with a disability. The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return.

Source: cnet.com

Source: cnet.com

Families with kids age 17 and under will receive a credit of 3000 per child. This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families. 2020 to 2021 2019 to 2020. Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17. Children with a disability.

Source: cnet.com

Source: cnet.com

2020 to 2021 2019 to 2020. Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17. Threshold for those entitled to Child Tax Credit only. The Child Tax Credit is a federal tax credit that applies to families and taxpayers with children to reduce their taxes. Families with kids age 17 and under will receive a credit of 3000 per child.

Source: cbpp.org

Source: cbpp.org

Families with kids age 17 and under will receive a credit of 3000 per child. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return. Families with kids age 17 and under will receive a credit of 3000 per child. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes.

Source: taxfoundation.org

Source: taxfoundation.org

Families with older kids are also eligible. Its worth up to 3600 per qualifying child under 6 and 3000 for each child ages 6 through 17. The credit is fully refundable meaning you may receive a refund if the credit reduces your tax bill to zero. Here is a breakdown of everything you need to know about the Child Tax Credit and Additional Child Tax Credit. The IRS will make a.

Source:

Source:

2020 to 2021 2019 to 2020. You can claim 500 for each child age 17 and 18 or for full-time college. For more information go to CCB young child supplement. More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation. The maximum amount of the child tax credit per qualifying child.

Source: nmvoices.org

Source: nmvoices.org

If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. You can claim 500 for each child age 17 and 18 or for full-time college. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. 8 rows For each child ages 6 through 17 the IRS will pay 3000. The maximum amount of the child tax credit per qualifying child.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much will the child tax credit be for 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information