How much is the current child tax credit information

Home » News » How much is the current child tax credit informationYour How much is the current child tax credit images are ready in this website. How much is the current child tax credit are a topic that is being searched for and liked by netizens now. You can Download the How much is the current child tax credit files here. Get all free photos.

If you’re searching for how much is the current child tax credit images information connected with to the how much is the current child tax credit interest, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

How Much Is The Current Child Tax Credit. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. If youre eligible to claim the full tax credit the child tax credit is worth 2000 per qualifying child. You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center From taxpolicycenter.org

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center From taxpolicycenter.org

This can include dependents over the age of 16 and dependents who dont have the required SSN. The child tax credit is a refundable tax credit of up to 3600 per qualifying child under 18. If you have more than one child in college. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Half will be paid monthly.

The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States.

That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax. The child tax credit limit is locked in at 2000 per child. That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax. Equally important the Presidents proposal would make the credit fully refundable. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. Money from the credit will be split.

Source: forbes.com

Source: forbes.com

If youre eligible to claim the full tax credit the child tax credit is worth 2000 per qualifying child. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. Equally important the Presidents proposal would make the credit fully refundable.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The child tax credit will be available to parents with children under the age of 18. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The value of the child tax credit has increased substantially since 1998 when it was worth just 400 per qualifying child. For 2020 the maximum amount of the credit is 2000 per qualifying child. The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit.

Source: philadelphia.cbslocal.com

Source: philadelphia.cbslocal.com

This has increased substantially under the Tax Cuts and Jobs Act TCJA which changed the entire tax. But under the new rules they could receive the full 3000 or 3600. Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund. If youre eligible to claim the full tax credit the child tax credit is worth 2000 per qualifying child. This will be the first time those with children aged 17 will receive the tax credit.

Source: whnt.com

Source: whnt.com

President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18. Half will be paid monthly. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. Unlike the Child Tax Credit for children under age 17 the Child Tax Credit for ages 18 to 24 is a one-time check and not a recurring monthly check.

Source: cnet.com

Source: cnet.com

You will claim the other half when you file your 2021 income tax return. That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax. You will claim the other half when you file your 2021 income tax return. The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

Source: cnet.com

Source: cnet.com

The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. The child tax credit is a refundable tax credit of up to 3600 per qualifying child under 18. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. How Can You Claim the Child Tax Credit on Your Taxes. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get.

Source: cnet.com

Source: cnet.com

But under the new rules they could receive the full 3000 or 3600. You will claim the other half when you file your 2021 income tax return. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. If youre eligible to claim the full tax credit the child tax credit is worth 2000 per qualifying child. That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax.

Source: cnet.com

Source: cnet.com

You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers. You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers. Equally important the Presidents proposal would make the credit fully refundable. Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund. This will be the first time those with children aged 17 will receive the tax credit.

Source: itep.org

Source: itep.org

The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. The value of the child tax credit has increased substantially since 1998 when it was worth just 400 per qualifying child. And in 2021 you may be able to get some of the child tax credit you are due sooner in the form of. This can include dependents over the age of 16 and dependents who dont have the required SSN.

Source: cbpp.org

Source: cbpp.org

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. This will be the first time those with children aged 17 will receive the tax credit. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax. The credit will be fully refundable.

Source: newsnationusa.com

Source: newsnationusa.com

But under the new rules they could receive the full 3000 or 3600. And in 2021 you may be able to get some of the child tax credit you are due sooner in the form of. The value of the child tax credit has increased substantially since 1998 when it was worth just 400 per qualifying child. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. The child tax credit limit is locked in at 2000 per child.

Source: cnet.com

Source: cnet.com

The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18. It is a partially refundable tax credit if you had an earned income of at least 2500. Half will be paid monthly. Equally important the Presidents proposal would make the credit fully refundable.

Source:

Source:

This has increased substantially under the Tax Cuts and Jobs Act TCJA which changed the entire tax. If you have more than one child in college. Half will be paid monthly. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18.

Source: cnet.com

Source: cnet.com

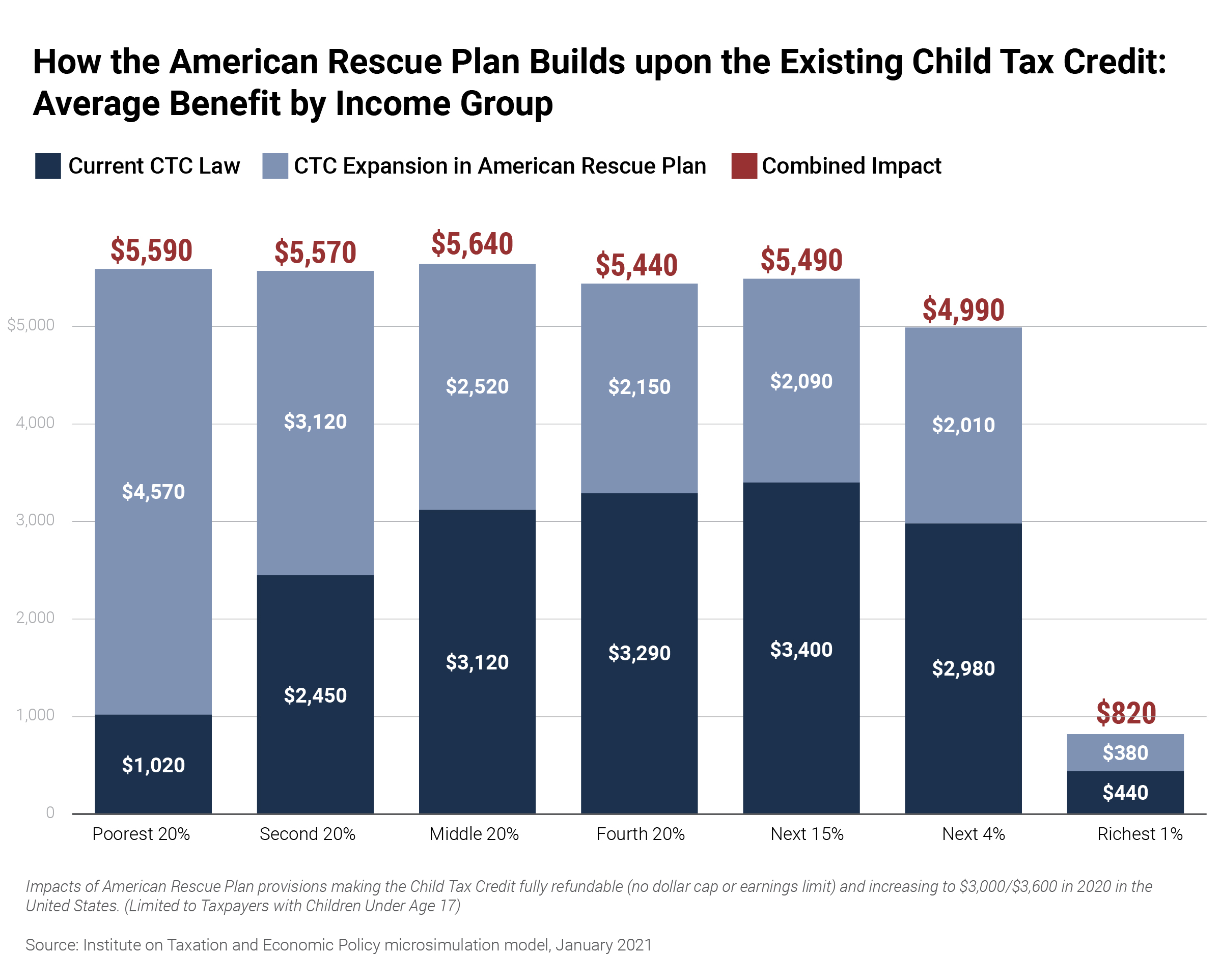

If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child. This can include dependents over the age of 16 and dependents who dont have the required SSN. That means the credit will be paid to taxpayers even if it exceeds the taxpayers tax. Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund.

Source: cnet.com

Source: cnet.com

And in 2021 you may be able to get some of the child tax credit you are due sooner in the form of. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. It is a partially refundable tax credit if you had an earned income of at least 2500. Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get.

Source: time.com

Source: time.com

For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child. The child tax credit limit is locked in at 2000 per child. How Can You Claim the Child Tax Credit on Your Taxes. The value of the child tax credit has increased substantially since 1998 when it was worth just 400 per qualifying child. This can include dependents over the age of 16 and dependents who dont have the required SSN.

Source: cnet.com

Source: cnet.com

Unlike the Child Tax Credit for children under age 17 the Child Tax Credit for ages 18 to 24 is a one-time check and not a recurring monthly check. This has increased substantially under the Tax Cuts and Jobs Act TCJA which changed the entire tax. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child. These changes apply to tax year 2021 only. The child tax credit limit is locked in at 2000 per child.

Source: cnet.com

Source: cnet.com

Equally important the Presidents proposal would make the credit fully refundable. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. The child tax credit limit is locked in at 2000 per child. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is the current child tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information