How much is the child tax credit right now information

Home » Trending » How much is the child tax credit right now informationYour How much is the child tax credit right now images are available. How much is the child tax credit right now are a topic that is being searched for and liked by netizens now. You can Find and Download the How much is the child tax credit right now files here. Download all royalty-free photos and vectors.

If you’re looking for how much is the child tax credit right now images information linked to the how much is the child tax credit right now topic, you have come to the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

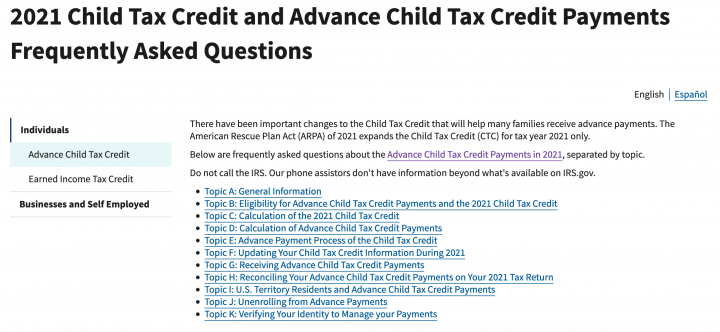

How Much Is The Child Tax Credit Right Now. Furthermore up to 1400 is now refundable as an Additional Child Tax Credit. As it stands right now they only apply to the 2021 tax year. First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. The program has been expanded to cover 17-year-olds in 2021.

2021 Child Tax Credit Does Each Kid Qualify For The Full 3 600 We Ll Explain Cnet From cnet.com

2021 Child Tax Credit Does Each Kid Qualify For The Full 3 600 We Ll Explain Cnet From cnet.com

Previously the amount of the credit was up to 2000 per child age 16 and under. But the TCJA has raised the stakes. Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under age 6. As it stands right now they only apply to the 2021 tax year. However President Biden wants to make the child and dependent care tax credit enhancements. The changes are only temporary though.

As it stands right now they only apply to the 2021 tax year.

Furthermore up to 1400 is now refundable as an Additional Child Tax Credit. The current child tax credit. As it stands right now they only apply to the 2021 tax year. What is the Child Tax Credit. Furthermore up to 1400 is now refundable as an Additional Child Tax Credit. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source:

Source:

As it stands right now they only apply to the 2021 tax year. These improvements have substantial merit. What is the Child Tax Credit. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under age 6.

Source: cnet.com

Source: cnet.com

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. For each disabled child. Eligible families claiming the credit will receive 3000 per qualifying child ages 6 through 17 and 3600 per qualifying child under age 6. The program has been expanded to cover 17-year-olds in 2021. Receives 1800 in 6 monthly installments of 300 between July and.

Source: cnet.com

Source: cnet.com

Parents who qualify are couples who makes under 400000 and. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. For each child this is known as the child element Up to 2845. What is the Child Tax Credit. Previously the amount of the credit was up to 2000 per child age 16 and under.

Source: cnet.com

Source: cnet.com

If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child. If it falls under 80000 for single taxpayers this just one example youll receive a full or partial check that includes up to 1400 per dependent of any age you claim. For 2018 through 2025 the credit is doubled to 2000 per qualifying child. The current child tax credit. However President Biden wants to make the child and dependent care tax credit enhancements.

Source: cnet.com

Source: cnet.com

Receives 1800 in 6 monthly installments of 300 between July and. In addition to making the Child Tax Credit fully available the Heroes Act would increase the value of the credit from 2000 per child to 3000 per child and 3600 per child under age 6 and raise the age of eligible children to include 17-year-olds. If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child. Eligible families claiming the credit will receive 3000 per qualifying child ages 6 through 17 and 3600 per qualifying child under age 6. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

Source: cnet.com

Source: cnet.com

Some Republicans have voiced concern that giving parents so much money would discourage them from looking for jobs and working. But the TCJA has raised the stakes. The child tax credit will start being sent out monthly beginning July 2021 through December 2021. Furthermore up to 1400 is now refundable as an Additional Child Tax Credit. First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year.

Source: cnet.com

Source: cnet.com

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. What is the Child Tax Credit. The current child tax credit. The basic amount this is known as the family element Up to 545. As it stands right now they only apply to the 2021 tax year.

Source: cnet.com

Source: cnet.com

Eligible families claiming the credit will receive 3000 per qualifying child ages 6 through 17 and 3600 per qualifying child under age 6. The program has been expanded to cover 17-year-olds in 2021. Heres how to calculate how much youll get. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

Source:

Source:

Distributed monthly this means eligible families will receive up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. As it stands right now they only apply to the 2021 tax year. Your AGI is also. The changes are only temporary though.

Source: cnet.com

Source: cnet.com

However President Biden wants to make the child and dependent care tax credit enhancements. For each child this is known as the child element Up to 2845. These improvements have substantial merit. If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child. Heres how to calculate how much youll get.

Source: cnet.com

Source: cnet.com

More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under age 6. Families with a joint income of less than 150000 will receive 3600 per child under the age of 6 and up to 3000 for children between 6 and 17 years old in 2021. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. The changes are only temporary though.

Source: cnet.com

Source: cnet.com

If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child. Previously the amount of the credit was up to 2000 per child age 16 and under. In 2019 the average CTC benefit was about 2380 ranging from 619 for those. Receives 1800 in 6 monthly installments of 300 between July and. But the TCJA has raised the stakes.

Source: forbes.com

Source: forbes.com

But the TCJA has raised the stakes. The child tax credit will start being sent out monthly beginning July 2021 through December 2021. However President Biden wants to make the child and dependent care tax credit enhancements. The program has been expanded to cover 17-year-olds in 2021. Your AGI is also.

Source: cnet.com

Source: cnet.com

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. The child tax credit will start being sent out monthly beginning July 2021 through December 2021. For 2018 through 2025 the credit is doubled to 2000 per qualifying child. In addition to making the Child Tax Credit fully available the Heroes Act would increase the value of the credit from 2000 per child to 3000 per child and 3600 per child under age 6 and raise the age of eligible children to include 17-year-olds.

Source: cnet.com

Source: cnet.com

What is the Child Tax Credit. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. For each disabled child. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. Your AGI is also.

Source: cnet.com

Source: cnet.com

The Child Tax Credit is the credit that you get for having a dependent under the age of 17 explains Lisa Greene-Lewis CPA and tax. The basic amount this is known as the family element Up to 545. If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child. First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. Distributed monthly this means eligible families will receive up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

Source: cnet.com

Source: cnet.com

For 2018 through 2025 the credit is doubled to 2000 per qualifying child. Some Republicans have voiced concern that giving parents so much money would discourage them from looking for jobs and working. What is the Child Tax Credit. The Child Tax Credit is the credit that you get for having a dependent under the age of 17 explains Lisa Greene-Lewis CPA and tax. If youre a taxpayer who claims a child as a dependent you may qualify for the credit up to 2000 per child.

Source: cnet.com

Source: cnet.com

Eligible families claiming the credit will receive 3000 per qualifying child ages 6 through 17 and 3600 per qualifying child under age 6. First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. The changes are only temporary though. What is the Child Tax Credit. Parents who qualify are couples who makes under 400000 and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is the child tax credit right now by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information