How much is the child tax credit in california information

Home » News » How much is the child tax credit in california informationYour How much is the child tax credit in california images are ready. How much is the child tax credit in california are a topic that is being searched for and liked by netizens now. You can Get the How much is the child tax credit in california files here. Download all royalty-free vectors.

If you’re looking for how much is the child tax credit in california images information linked to the how much is the child tax credit in california interest, you have visit the ideal blog. Our website always provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

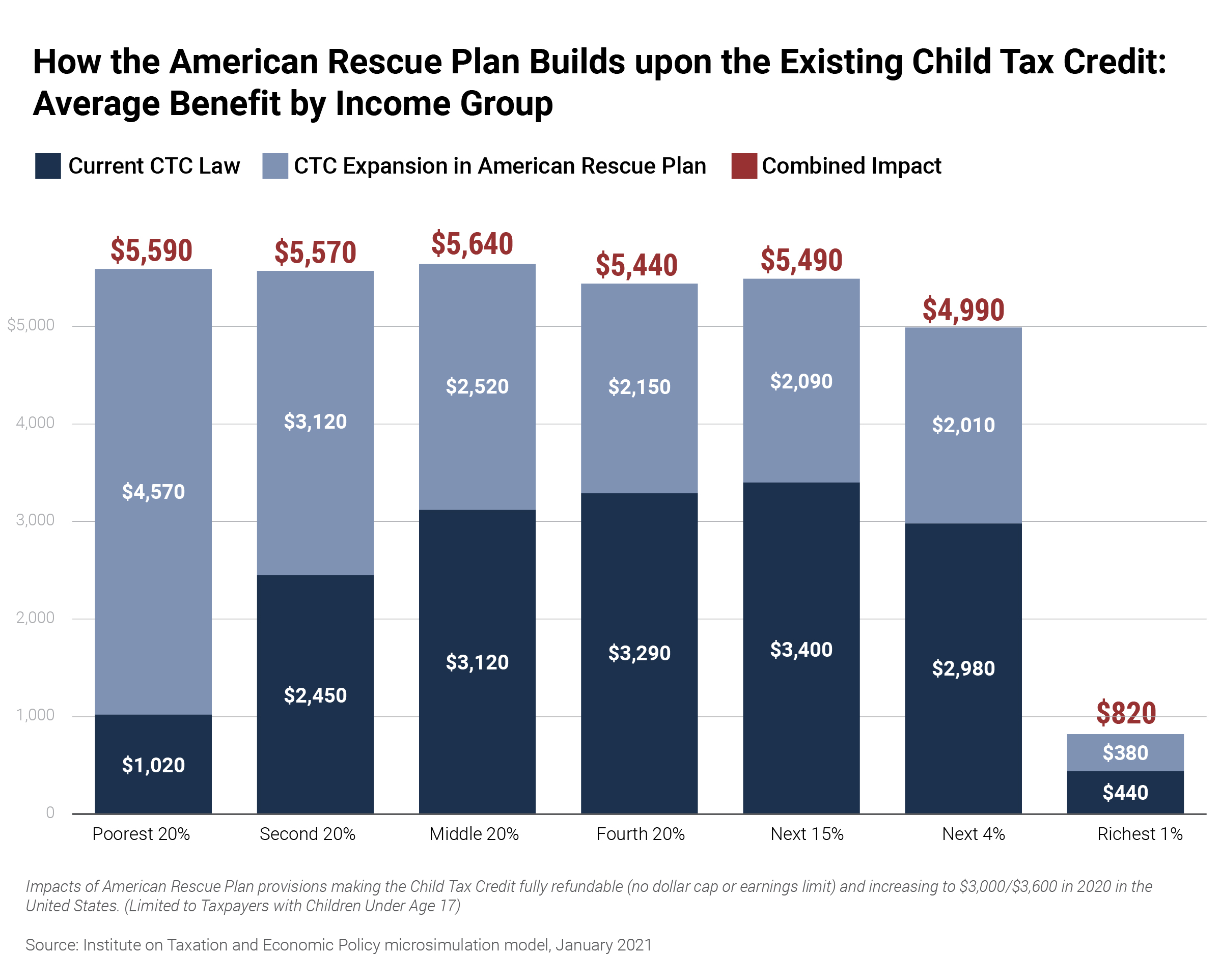

How Much Is The Child Tax Credit In California. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child. The expanded credit was established in the American Rescue Plan signed into law in March. You may go back up to four years to claim CalEITC by filing or amending a state income tax return. You will claim the other half when you file your 2021 income tax return.

Child Tax Credit Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out From winknews.com

Child Tax Credit Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out From winknews.com

You will receive a percentage of the amount you paid as a credit. The Golden State Stimulus provides 600 in one-time relief payments to households that receive the California Earned Income Tax Credit for 2020. The Young Child Tax Credit provides the full 1000 credit at the first 1 of annual earnings. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. A single person with no children making minimum wage 12 an hour in California would collect an estimated 39 according to the state tax calculator whereas a.

3000 for 1 person.

The Child Tax Credit like most tax credits has a phase-out at certain income levels. How much is the child tax credit. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The Young Child Tax Credit provides the full 1000 credit at the first 1 of annual earnings. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: forbes.com

Source: forbes.com

The 19 trillion COVID relief package increases the Child Tax Credit from 2000 to up to 3600 depending on the childs age and the familys income. The Child Tax Credit like most tax credits has a phase-out at certain income levels. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. Heres how to calculate how much youll get. Well issue the first advance payment on July 15 2021.

Source: ktla.com

Source: ktla.com

File your income tax return. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Heres how to calculate how much youll get. The Golden State Stimulus also provides 600 one-time payments to taxpayers who were unable to receive federal relief payments by filing with Individual Tax Identification Numbers ITINs. The Child Tax Credit like most tax credits has a phase-out at certain income levels.

Source: forbes.com

Source: forbes.com

The guide looks at two tax credits. The Young Child Tax Credit provides the full 1000 credit at the first 1 of annual earnings. For an individual to be eligible for the Child Tax Credit the following six tests must be met. If you qualify you may only claim expenses up to. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: cnet.com

Source: cnet.com

The next deadline to opt out of the child tax credit is Aug. The guide looks at two tax credits. You will receive a percentage of the amount you paid as a credit. In this extensive guide that includes more than 25 comprehensive charts by Senior Policy Analyst Alissa Anderson readers will learn. The Golden State Stimulus provides 600 in one-time relief payments to households that receive the California Earned Income Tax Credit for 2020.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Young Child Tax Credit available to CalEITC-eligible families with children under age 6. The expanded credit was established in the American Rescue Plan signed into law in March. CalEITC available to families and individuals with annual earnings under 30000. Well issue the first advance payment on July 15 2021. Young Child Tax Credit available to CalEITC-eligible families with children under age 6.

Source: winknews.com

Source: winknews.com

This amount will be adjusted for inflation after 2018. File your income tax return. If you qualify you may only claim expenses up to. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child.

Source:

Source:

The expanded credit was established in the American Rescue Plan signed into law in March. A single person with no children making minimum wage 12 an hour in California would collect an estimated 39 according to the state tax calculator whereas a. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. For an individual to be eligible for the Child Tax Credit the following six tests must be met. The Golden State Stimulus provides 600 in one-time relief payments to households that receive the California Earned Income Tax Credit for 2020.

Source: forbes.com

Source: forbes.com

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The next deadline to opt out of the child tax credit is Aug. Young Child Tax Credit available to CalEITC-eligible families with children under age 6. You will claim the other half when you file your 2021 income tax return. A single person with no children making minimum wage 12 an hour in California would collect an estimated 39 according to the state tax calculator whereas a.

Source: al.com

Source: al.com

The Child Tax Credit changes make it worth up to 2000 per qualifying child. Its 3600 for each child under age 6. Heres how to calculate how much youll get. In this extensive guide that includes more than 25 comprehensive charts by Senior Policy Analyst Alissa Anderson readers will learn. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

Source:

Source:

Your child can be the care provider if they are 19 years old or older. Sarah TewCNET For millions of families the first child tax credit payment will arrive this Thursday – and it could be for up to. File your income tax return. A single person with no children making minimum wage 12 an hour in California would collect an estimated 39 according to the state tax calculator whereas a. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Source: cnet.com

Source: cnet.com

These changes apply to tax year 2021 only. The Golden State Stimulus provides 600 in one-time relief payments to households that receive the California Earned Income Tax Credit for 2020. These changes apply to tax year 2021 only. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. If you qualify you may only claim expenses up to.

Source: pinterest.com

Source: pinterest.com

A single person with no children making minimum wage 12 an hour in California would collect an estimated 39 according to the state tax calculator whereas a. The guide looks at two tax credits. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. For certain families and individuals the CalEITC federal EITC and federal Child Tax Credit are determined based on annual adjusted gross income rather than on annual earnings. You may go back up to four years to claim CalEITC by filing or amending a state income tax return.

Source:

Source:

The Child Tax Credit like most tax credits has a phase-out at certain income levels. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. These changes apply to tax year 2021 only. If you qualify you may only claim expenses up to. For children ages 6-17 its 3000 or 250 per month.

Source: pinterest.com

Source: pinterest.com

The Young Child Tax Credit provides the full 1000 credit at the first 1 of annual earnings. If you qualify you may only claim expenses up to. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. The 19 trillion COVID relief package increases the Child Tax Credit from 2000 to up to 3600 depending on the childs age and the familys income. For certain families and individuals the CalEITC federal EITC and federal Child Tax Credit are determined based on annual adjusted gross income rather than on annual earnings.

Source: money.com

Source: money.com

Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. For certain families and individuals the CalEITC federal EITC and federal Child Tax Credit are determined based on annual adjusted gross income rather than on annual earnings. The Child Tax Credit like most tax credits has a phase-out at certain income levels.

Source: itep.org

Source: itep.org

The Golden State Stimulus also provides 600 one-time payments to taxpayers who were unable to receive federal relief payments by filing with Individual Tax Identification Numbers ITINs. Young Child Tax Credit available to CalEITC-eligible families with children under age 6. Qualifying parents will no longer have to wait for their tax refunds to see that money either. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child.

Source: cnet.com

Source: cnet.com

The Child Tax Credit like most tax credits has a phase-out at certain income levels. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6. The 19 trillion COVID relief package increases the Child Tax Credit from 2000 to up to 3600 depending on the childs age and the familys income. Its 3600 for each child under age 6. The expanded credit was established in the American Rescue Plan signed into law in March.

Source: cnet.com

Source: cnet.com

This amount will be adjusted for inflation after 2018. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6. CalEITC available to families and individuals with annual earnings under 30000. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. 3000 for 1 person.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is the child tax credit in california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information