How much is the child tax credit going to be starting in july information

Home » News » How much is the child tax credit going to be starting in july informationYour How much is the child tax credit going to be starting in july images are ready. How much is the child tax credit going to be starting in july are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is the child tax credit going to be starting in july files here. Get all free photos.

If you’re searching for how much is the child tax credit going to be starting in july pictures information connected with to the how much is the child tax credit going to be starting in july keyword, you have come to the right blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

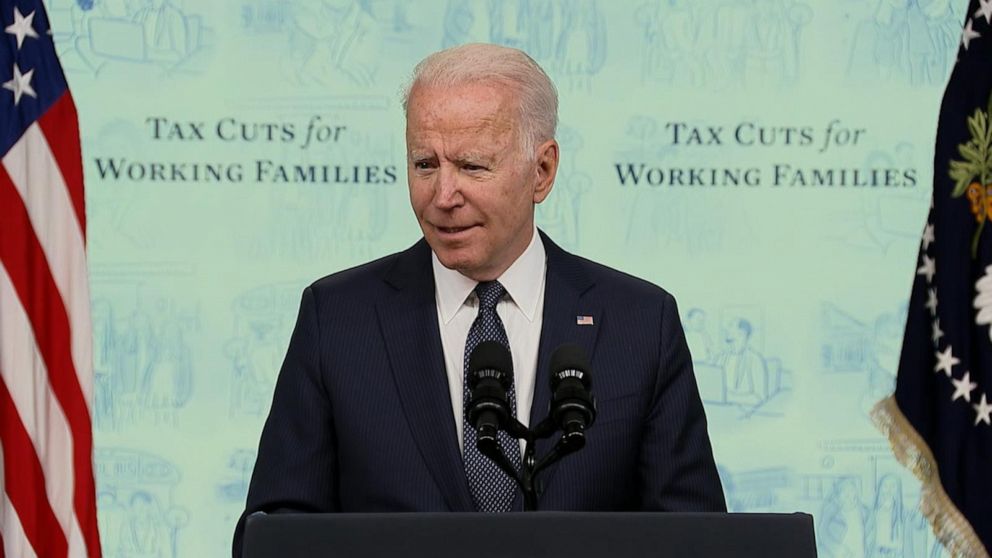

How Much Is The Child Tax Credit Going To Be Starting In July. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15 and 88 of families. You will claim the other half when you file your 2021 income tax return. Monthly payments will be 250 or 300 for children under the age of 6. Theres good news for American families.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor From forbes.com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor From forbes.com

For the current tax year families are set to receive a total of 3600 for each child under the age of 6 or 3000 for each child between 6 and 17 years old. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. Payments for the new 3000 child tax credit start July 15. 8 rows Starting July 15 eligible parents can expect their first advance monthly child tax. The American Rescue Plan a 19 trillion. The credit goes away once a child reaches 18.

The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing.

The remaining half would be claimed during tax season next year. Payments for the new 3000 child tax credit start July 15. On July 15 – this Thursday – your first monthly child tax credit check will be sent out – your payment will be for up to 250 or 300 per kid if your family qualifies. 8 rows Starting July 15 eligible parents can expect their first advance monthly child tax. Why some people should return their stimulus checks It temporarily increases the existing child tax credit from a maximum 2000 a year per child to. Next weekparents who qualifyfor the federal expansion of the child tax credit will be seeing their first payment of 250 or 300 per child paid in advance.

Source: time.com

Source: time.com

And youve got a small. The remaining half would be claimed during tax season next year. Theres good news for American families. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The American Rescue Plan raised the maximum credit amount to 3000 per kid ages 6 to 17 and 3600 for younger children.

Source: fox6now.com

Source: fox6now.com

And youve got a small. Taxpayers can claim up to 3600 per child 5 years or younger and up to 3000 per dependent child ages 6 through 17. Money from the credit will be split. Heres what to know. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing.

Source: turnto10.com

Source: turnto10.com

Payments for the new 3000 child tax credit start July 15. For the current tax year families are set to receive a total of 3600 for each child under the age of 6 or 3000 for each child between 6 and 17 years old. Families can claim the remaining half. Next weekparents who qualifyfor the federal expansion of the child tax credit will be seeing their first payment of 250 or 300 per child paid in advance. Heres what to know.

Source: cnbc.com

Source: cnbc.com

Half will be paid monthly. Money from the credit will be split. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The remaining half would be claimed during tax season next year. For the current tax year families are set to receive a total of 3600 for each child under the age of 6 or 3000 for each child between 6 and 17 years old.

Source: cnbc.com

Source: cnbc.com

Theres good news for American families. These changes apply to tax year 2021 only. This year a family with two young children would receive a tax cut of 7200 with a monthly payment of. 8 rows Starting July 15 eligible parents can expect their first advance monthly child tax. Heres what to know.

Source: cnet.com

Source: cnet.com

Heres what to know. Why some people should return their stimulus checks It temporarily increases the existing child tax credit from a maximum 2000 a year per child to. The remaining half would be claimed during tax season next year. You will claim the other half when you file your 2021 income tax return. Theres good news for American families.

This year a family with two young children would receive a tax cut of 7200 with a monthly payment of. The American Rescue Plan a 19 trillion. For the current tax year families are set to receive a total of 3600 for each child under the age of 6 or 3000 for each child between 6 and 17 years old. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Monthly payments will be 250 or 300 for children under the age of 6.

Source: time.com

Source: time.com

And youve got a small. The remaining half would be claimed during tax season next year. This year a family with two young children would receive a tax cut of 7200 with a monthly payment of. These payments are scheduled to be disbursed to families who filed a 2020 tax return on a monthly basis starting in July continuing into December. IRS Commissioner Charles Rettig said Tuesday the agency is on track to start sending monthly payments of the child tax credit in July.

Source: fox8.com

Source: fox8.com

These payments are scheduled to be disbursed to families who filed a 2020 tax return on a monthly basis starting in July continuing into December. Payments for the new 3000 child tax credit start July 15. Why some people should return their stimulus checks It temporarily increases the existing child tax credit from a maximum 2000 a year per child to. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Theres good news for American families.

Source: forbes.com

Source: forbes.com

Half will be paid monthly. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. There are also new thresholds for. The American Rescue Plan a 19 trillion. Money from the credit will be split.

Source:

Source:

New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The American Rescue Plan a 19 trillion. Starting in July a chunk of that. CPA Kemberley Washington explains how some Louisiana families will get some extra money. Why some people should return their stimulus checks It temporarily increases the existing child tax credit from a maximum 2000 a year per child to.

Source: cnet.com

Source: cnet.com

The remaining half would be claimed during tax season next year. Monthly payments will be 250 or 300 for children under the age of 6. Heres what to know. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. The child tax credit had previously been 2000 per child.

Source: efile.com

Source: efile.com

Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing. This year a family with two young children would receive a tax cut of 7200 with a monthly payment of. The remaining half would be claimed during tax season next year. These changes apply to tax year 2021 only.

Source: forbes.com

Source: forbes.com

Half will be paid monthly. The credit will be fully refundable. Starting in July a chunk of that. There are also new thresholds for. Starting in July families will get monthly payments of up to 300 for each child under 6 years old and up to 250 for each child 6 to 17 years old.

Source: cnet.com

Source: cnet.com

On July 15 – this Thursday – your first monthly child tax credit check will be sent out – your payment will be for up to 250 or 300 per kid if your family qualifies. CPA Kemberley Washington explains how some Louisiana families will get some extra money. The credit goes away once a child reaches 18. Monthly payments will be 250 or 300 for children under the age of 6. Theres good news for American families.

Source: marca.com

Source: marca.com

The credit goes away once a child reaches 18. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Starting in July a chunk of that. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing. The American Rescue Plan a 19 trillion.

That money is designed to help. The American Rescue Plan a 19 trillion. The credit goes away once a child reaches 18. There are also new thresholds for. Families can claim the remaining half.

Source: cnet.com

Source: cnet.com

CPA Kemberley Washington explains how some Louisiana families will get some extra money. There are also new thresholds for. Starting in July a chunk of that. That money is designed to help. The credit will be fully refundable.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is the child tax credit going to be starting in july by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information