How much is the child tax credit disability element information

Home » Trending » How much is the child tax credit disability element informationYour How much is the child tax credit disability element images are ready. How much is the child tax credit disability element are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is the child tax credit disability element files here. Download all free photos.

If you’re searching for how much is the child tax credit disability element images information linked to the how much is the child tax credit disability element keyword, you have visit the ideal blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

How Much Is The Child Tax Credit Disability Element. You get money for each child that qualifies and child tax credit wont affect your child benefit. Update in October 2020. The disabled child rate. However it was common for everyone including HMRC to refer to a disabled child element and a severely disabled child element.

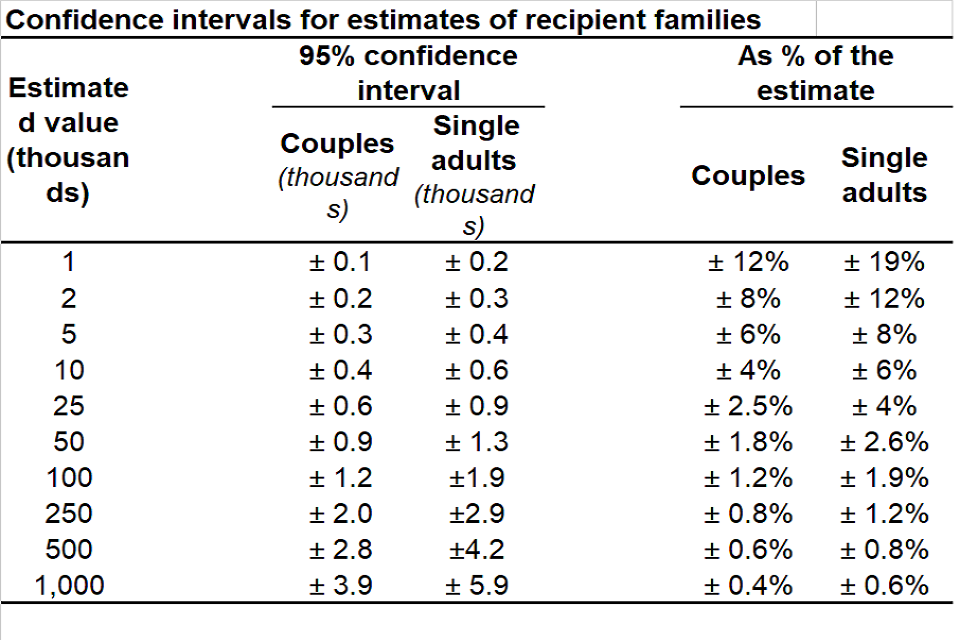

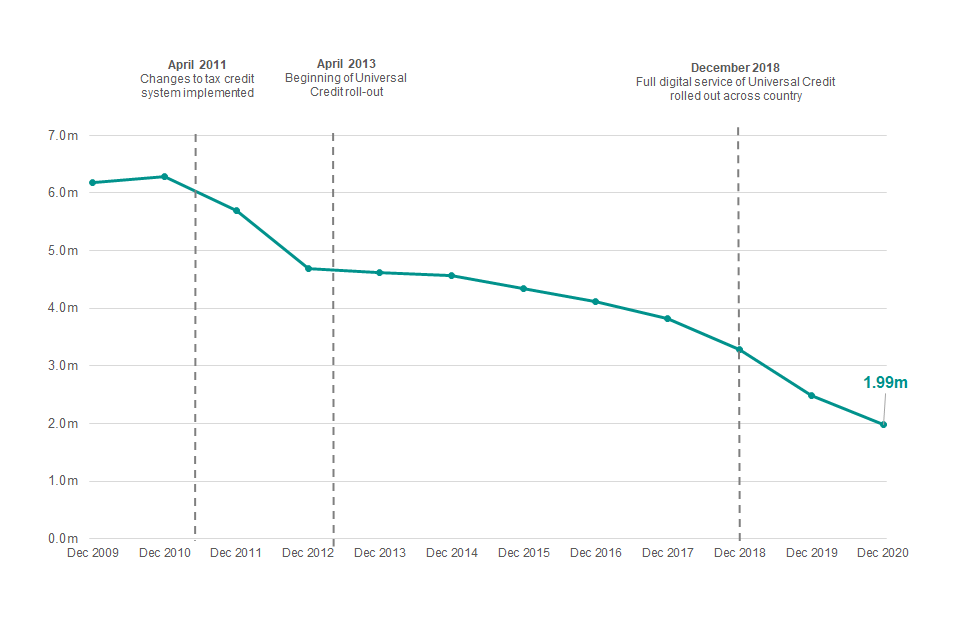

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk From gov.uk

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk From gov.uk

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. However it was common for everyone including HMRC to refer to a disabled child element and a severely disabled child element. The provincial supplemental amount for Ontario is 48790. The American Rescue Plan Act of 2021 expands the child tax credit by allowing qualifying families to offset for the 2021 tax year 3000 per child up to age 17 and 3600 per child under age 6. For a child the Disability element is 31755 Severe disability element is 129210 on top of the disability element. The CTC disability element is payable at 2 rates.

You will claim the other half when you file your 2021 income tax return.

If your first or only child was born before 6 April 2017 you will receive a slightly higher amount for that child of 28250 per month. You could get Child Tax Credit for each child youre responsible for if theyre. It is worth an extra 65 per week for each child in your family who qualifies. The extra amount youd get a week is now 92 up from 84. You will claim the other half when you file your 2021 income tax return. The expanded credit was established in the American Rescue Plan signed into law in March.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit. Tuesday 20 December 2016. How does the tax credit disabled child element affect housing benefit. If your first or only child was born before 6 April 2017 you will receive a slightly higher amount for that child of 28250 per month. You get money for each child that qualifies and child tax credit wont affect your child benefit.

Source: pinterest.com

Source: pinterest.com

But beware - under the new Universal Credit system which will replace Tax Credits from next year the disability element will be reduced from max of 54week to 27week meaning that families with disabled children will lose up to 1400year. How much you can get depends on your income the number of children you have and whether any of your children are disabled. Any other rate of DLA or PIP or. How does the tax credit disabled child element affect housing benefit. A child or young person qualifies for the disabled child rate if they get.

Source: id.pinterest.com

Source: id.pinterest.com

You get money for each child that qualifies and child tax credit wont affect your child benefit. How does the tax credit disabled child element affect housing benefit. Severely disabled child or. In 2021 the maximum enhanced child tax credit is 3600 for children. You will claim the other half when you file your 2021 income tax return.

Source: pinterest.com

Source: pinterest.com

Therefore considering that you are applying for you childs Disability Tax Credit eligibility if you are approved you can receive up to 328025 for 2018. The expanded credit was established in the American Rescue Plan signed into law in March. If your first or only child was born before 6 April 2017 you will receive a slightly higher amount for that child of 28250 per month. The child element was payable at one of three rates that reflected disability and severe disability. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: pinterest.com

Source: pinterest.com

The disabled child element is an extra amount that is added into your child tax credits award. It is worth an extra 65 per week for each child in your family who qualifies. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. For a child the Disability element is 31755 Severe disability element is 129210 on top of the disability element. How does the tax credit disabled child element affect housing benefit.

Source: litrg.org.uk

Source: litrg.org.uk

The American Rescue Plan Act of 2021 expands the child tax credit by allowing qualifying families to offset for the 2021 tax year 3000 per child up to age 17 and 3600 per child under age 6. Each dependent age 17 and younger. You could get Child Tax Credit for each child youre responsible for if theyre. You get money for each child that qualifies and child tax credit wont affect your child benefit. The disabled child element is an extra amount that is added into your child tax credits award.

Source: gov.uk

Source: gov.uk

To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. Due to the introduction of the 2 child limit from 6 April 2017 the legislation was amended to create a new child disability element. This is up from 16385 in 2020-21. For a child the Disability element is 31755 Severe disability element is 129210 on top of the disability element. If your first or only child was born before 6 April 2017 you will receive a slightly higher amount for that child of 28250 per month.

Source: gov.uk

Source: gov.uk

This is up from 16385 in 2020-21. The CTC disability element is payable at 2 rates. How much is the element included in my Working Tax Credit. It is worth an extra 65 per week for each child in your family who qualifies. If you satisfy the above rules for the Disability Element to be included in your Working Tax Credit an additional 3240 from April 2021 will be included in your maximum tax credit award.

Source: pinterest.com

Source: pinterest.com

The disabled child rate. The CTC disability element is payable at 2 rates. The total 2018 supplemental DTC amount is then 120850. This is up from 16385 in 2020-21. Up to 3600 or 3000.

Source: litrg.org.uk

Source: litrg.org.uk

Advance Child Tax Credit Payments in 2021. In 2021 the maximum enhanced child tax credit is 3600 for children. The total 2018 supplemental DTC amount is then 120850. The provincial supplemental amount for Ontario is 48790. The size of the benefit will gradually diminish for single filers earning more than 75000 per year or married couples making more than 150000 a year.

Source: pinterest.com

Source: pinterest.com

You get money for each child that qualifies and child tax credit wont affect your child benefit. Any other rate of DLA or PIP or. How much you can get depends on your income the number of children you have and whether any of your children are disabled. You will claim the other half when you file your 2021 income tax return. This is up from 16385 in 2020-21.

Source: gov.uk

Source: gov.uk

Therefore considering that you are applying for you childs Disability Tax Credit eligibility if you are approved you can receive up to 328025 for 2018. The size of the benefit will gradually diminish for single filers earning more than 75000 per year or married couples making more than 150000 a year. If your first or only child was born before 6 April 2017 you will receive a slightly higher amount for that child of 28250 per month. Update in October 2020. How much is the element included in my Working Tax Credit.

Source: in.pinterest.com

Source: in.pinterest.com

If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit. The extra amount youd get a week is now 92 up from 84. If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit. A child or young person qualifies for the disabled child rate if they get. Your Universal Credit will include a child element if you are responsible for a child or qualifying young person who normally lives with you.

Source: gov.uk

Source: gov.uk

The size of the benefit will gradually diminish for single filers earning more than 75000 per year or married couples making more than 150000 a year. Advance Child Tax Credit Payments in 2021. Severely disabled child or. Therefore considering that you are applying for you childs Disability Tax Credit eligibility if you are approved you can receive up to 328025 for 2018. The child element was payable at one of three rates that reflected disability and severe disability.

Source: litrg.org.uk

Source: litrg.org.uk

How much you can get depends on your income the number of children you have and whether any of your children are disabled. The provincial supplemental amount for Ontario is 48790. The disabled child element is an extra amount that is added into your child tax credits award. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. The expanded credit was established in the American Rescue Plan signed into law in March.

Source: gov.uk

Source: gov.uk

Who qualifies for the disabled child element. How does the tax credit disabled child element affect housing benefit. Due to the introduction of the 2 child limit from 6 April 2017 the legislation was amended to create a new child disability element. Under 20 and in approved education. The child element was payable at one of three rates that reflected disability and severe disability.

Source: gov.uk

Source: gov.uk

The provincial supplemental amount for Ontario is 48790. How does the tax credit disabled child element affect housing benefit. Each dependent age 17 and younger. Up to 3600 or 3000. While this issue might have been going on since 2011 HMRC was only prepared to backdate the child element to.

Source: pinterest.com

Source: pinterest.com

Under 20 and in approved education. The total 2018 supplemental DTC amount is then 120850. Child Tax Credit family element. Therefore considering that you are applying for you childs Disability Tax Credit eligibility if you are approved you can receive up to 328025 for 2018. How does the tax credit disabled child element affect housing benefit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is the child tax credit disability element by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information