How much has child tax credit gone up information

Home » Trending » How much has child tax credit gone up informationYour How much has child tax credit gone up images are available in this site. How much has child tax credit gone up are a topic that is being searched for and liked by netizens today. You can Get the How much has child tax credit gone up files here. Get all royalty-free photos and vectors.

If you’re searching for how much has child tax credit gone up images information linked to the how much has child tax credit gone up interest, you have come to the ideal site. Our site always provides you with hints for seeing the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

How Much Has Child Tax Credit Gone Up. It meant working tax credit claimants received an extra 20. There are winners as well as losers in the tax credits check. 10 deduction in what they allow for childcare. Higher-income Child benefit charge threshold not increasing.

Will You Get A 250 Or 300 Child Tax Credit Payment On Thursday Calculate Your Total Here Cnet From cnet.com

Will You Get A 250 Or 300 Child Tax Credit Payment On Thursday Calculate Your Total Here Cnet From cnet.com

Across the UK some claimants will see their income rise increase by 17 percent which is in line with. The government is also uprating Child Benefit other tax credits rates and thresholds and Guardians Allowance by 17 with effect from 6 April 2020. The number of families claiming Child Benefit has decreased in recent years. Child Tax Credit worth up to 2780 per child per year will now only be paid for the first two children in any family. It meant working tax credit claimants received an extra 20. For each disabled child.

How much has Child Benefit gone up by.

As a rule its 2070 a week for your eldest or only child and 1370 per child thereafter. The next tax year starts on April 6 2021 and there will be a number of changes to benefits including Child Benefit. The government is also uprating Child Benefit other tax credits rates and thresholds and Guardians Allowance by 17 with effect from 6 April 2020. Child Tax Credit worth up to 2780 per child per year will now only be paid for the first two children in any family. LIST So whether you win or lose depends on how those three things balance out. LIST Child element has gone up by 255 per child and a few other elements have gone up a bit Deduction for income has gone up a bit.

Source: cnet.com

Source: cnet.com

This is up from 16385 in 2020-21. The next tax year starts on April 6 2021 and there will be a number of changes to benefits including Child Benefit. Child tax credit is gradually being replaced by Universal Credit so not everyone will be able to claim it. 10 deduction in what they allow for childcare. Child Tax Credit worth up to 2780 per child per year will now only be paid for the first two children in any family.

Source: cnet.com

Source: cnet.com

Back in November last year it was announced that working-age benefits will rise by the rate of. Everyone who qualifies for Tax Credit will receive the basic element. The government is also uprating Child Benefit other tax credits rates and thresholds and Guardians Allowance by 17 with effect from 6 April 2020. Higher-income Child benefit charge threshold not increasing. For each disabled child.

Source: cnet.com

Source: cnet.com

If you earn over 26k tax credits are being stopped. LIST So whether you win or lose depends on how those three things balance out. 10 deduction in what they allow for childcare. Child Benefit is a payment to parents carers and others who are bringing up a child in England Wales Scotland and Northern Ireland. For 2021 only it is up to 1600 per child under 6 and 1000 per child under 18 at year-end.

Source: cnet.com

Source: cnet.com

There are no specific age rules for the person making this claim and it. In brief Congress added an extra tax credit for many families with children in its March relief law. You can read the full list of Rates and. This has always been called the High Income Child Benefit. Eligible families could claim a tax credit of up to 2000 per child under age 17 who is a citizen of the US.

Source: cnet.com

Source: cnet.com

You can read the full list of Rates and. This is up from 16385 in 2020-21. Because your award is usually based on the previous years income when your income goes up you basically get the same tax credits for a year and then they go down. You can read the full list of Rates and. LIST So whether you win or lose depends on how those three things balance out.

Source: nmvoices.org

Source: nmvoices.org

This has always been called the High Income Child Benefit. Eligible families could claim a tax credit of up to 2000 per child under age 17 who is a citizen of the US. In brief Congress added an extra tax credit for many families with children in its March relief law. If you earn over 26k tax credits are being stopped. Child tax credit is gradually being replaced by Universal Credit so not everyone will be able to claim it.

Source:

Source:

Everyone who qualifies for Tax Credit will receive the basic element. For each disabled child. 10 deduction in what they allow for childcare. This will deny huge sums to large families in future and women who had a. The Government boosted working tax credits by 1040 to 3040 from April last year to help struggling families through the Covid crisis.

Source: cnet.com

Source: cnet.com

For each child this is known as the child element Up to 2845. The size of the credit was reduced by 50 for every 1000 of adjusted gross income. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. Child Benefit will now go up from 2070 to 2105 a week. The Government boosted working tax credits by 1040 to 3040 from April last year to help struggling families through the Covid crisis.

Source: cnet.com

Source: cnet.com

There are no specific age rules for the person making this claim and it. The next tax year starts on April 6 2021 and there will be a number of changes to benefits including Child Benefit. There are winners as well as losers in the tax credits check. Back in November last year it was announced that working-age benefits will rise by the rate of. Claimants could be eligible for just one element or for a few different ones depending on their circumstances.

Source: cnet.com

Source: cnet.com

As a rule its 2070 a week for your eldest or only child and 1370 per child thereafter. If you earn more than this the amount of child tax credit you get reduces. Child Benefit will now go up from 2070 to 2105 a week. This has always been called the High Income Child Benefit. If youre getting tax credits your income can currently change by up to 5000 before it affects the amount you get.

Source: cnet.com

Source: cnet.com

LIST Child element has gone up by 255 per child and a few other elements have gone up a bit Deduction for income has gone up a bit. There are winners as well as losers in the tax credits check. The number of families claiming Child Benefit has decreased in recent years. If youre getting tax credits your income can currently change by up to 5000 before it affects the amount you get. For each child this is known as the child element Up to 2845.

Source: time.com

Source: time.com

LIST Child element has gone up by 255 per child and a few other elements have gone up a bit Deduction for income has gone up a bit. The next tax year starts on April 6 2021 and there will be a number of changes to benefits including Child Benefit. The number of families claiming Child Benefit has decreased in recent years. Because your award is usually based on the previous years income when your income goes up you basically get the same tax credits for a year and then they go down. For 2021 only it is up to 1600 per child under 6 and 1000 per child under 18 at year-end.

Source: cnet.com

Source: cnet.com

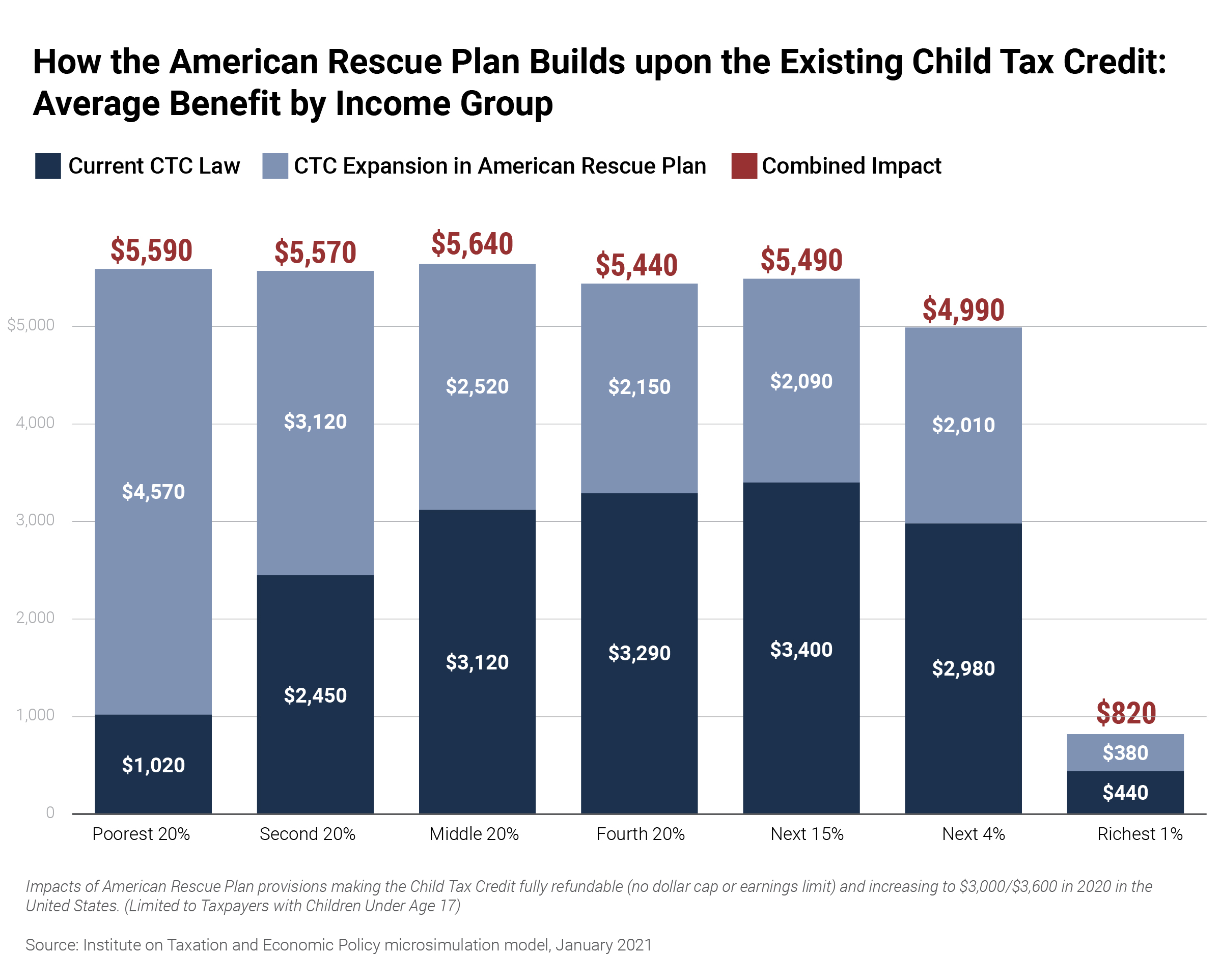

There are winners as well as losers in the tax credits check. Child tax credit is gradually being replaced by Universal Credit so not everyone will be able to claim it. Under the American Rescue Plan the CTC was expanded to 3600 for each child under age 6 and 3000 for each child between ages 6 to 17. This is up from 16385 in 2020-21. Since January 2013 there has been a clawback charge on the higher earner of a couple where one claims Child Benefit and either has an income over 50000.

Source: cnet.com

Source: cnet.com

This has always been called the High Income Child Benefit. Because your award is usually based on the previous years income when your income goes up you basically get the same tax credits for a year and then they go down. This is up from 16385 in 2020-21. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. Across the UK some claimants will see their income rise increase by 17 percent which is in line with.

Source: itep.org

Source: itep.org

How much has Child Benefit gone up by. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. For each child this is known as the child element Up to 2845. If you earn more than this the amount of child tax credit you get reduces. Child Benefit will now go up from 2070 to 2105 a week.

Source: cnet.com

Source: cnet.com

How much has Child Benefit gone up by. For each disabled child. This has always been called the High Income Child Benefit. How much has Child Benefit gone up by. LIST Child element has gone up by 255 per child and a few other elements have gone up a bit Deduction for income has gone up a bit.

Source: pinterest.com

Source: pinterest.com

Higher-income Child benefit charge threshold not increasing. Claimants could be eligible for just one element or for a few different ones depending on their circumstances. Child Tax Credit worth up to 2780 per child per year will now only be paid for the first two children in any family. LIST So whether you win or lose depends on how those three things balance out. There are no specific age rules for the person making this claim and it.

Source: cnet.com

Source: cnet.com

The government is also uprating Child Benefit other tax credits rates and thresholds and Guardians Allowance by 17 with effect from 6 April 2020. If you earn more than this the amount of child tax credit you get reduces. Back in November last year it was announced that working-age benefits will rise by the rate of. Eligible families could claim a tax credit of up to 2000 per child under age 17 who is a citizen of the US. There are winners as well as losers in the tax credits check.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much has child tax credit gone up by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information