Child tax credit worksheet 2018 information

Home » Trending » Child tax credit worksheet 2018 informationYour Child tax credit worksheet 2018 images are ready. Child tax credit worksheet 2018 are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit worksheet 2018 files here. Get all free photos and vectors.

If you’re looking for child tax credit worksheet 2018 pictures information connected with to the child tax credit worksheet 2018 interest, you have visit the right site. Our website always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

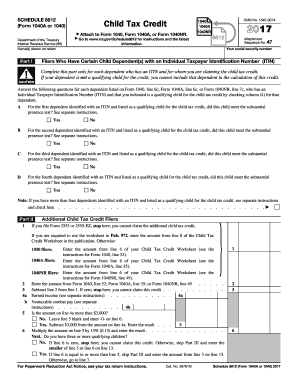

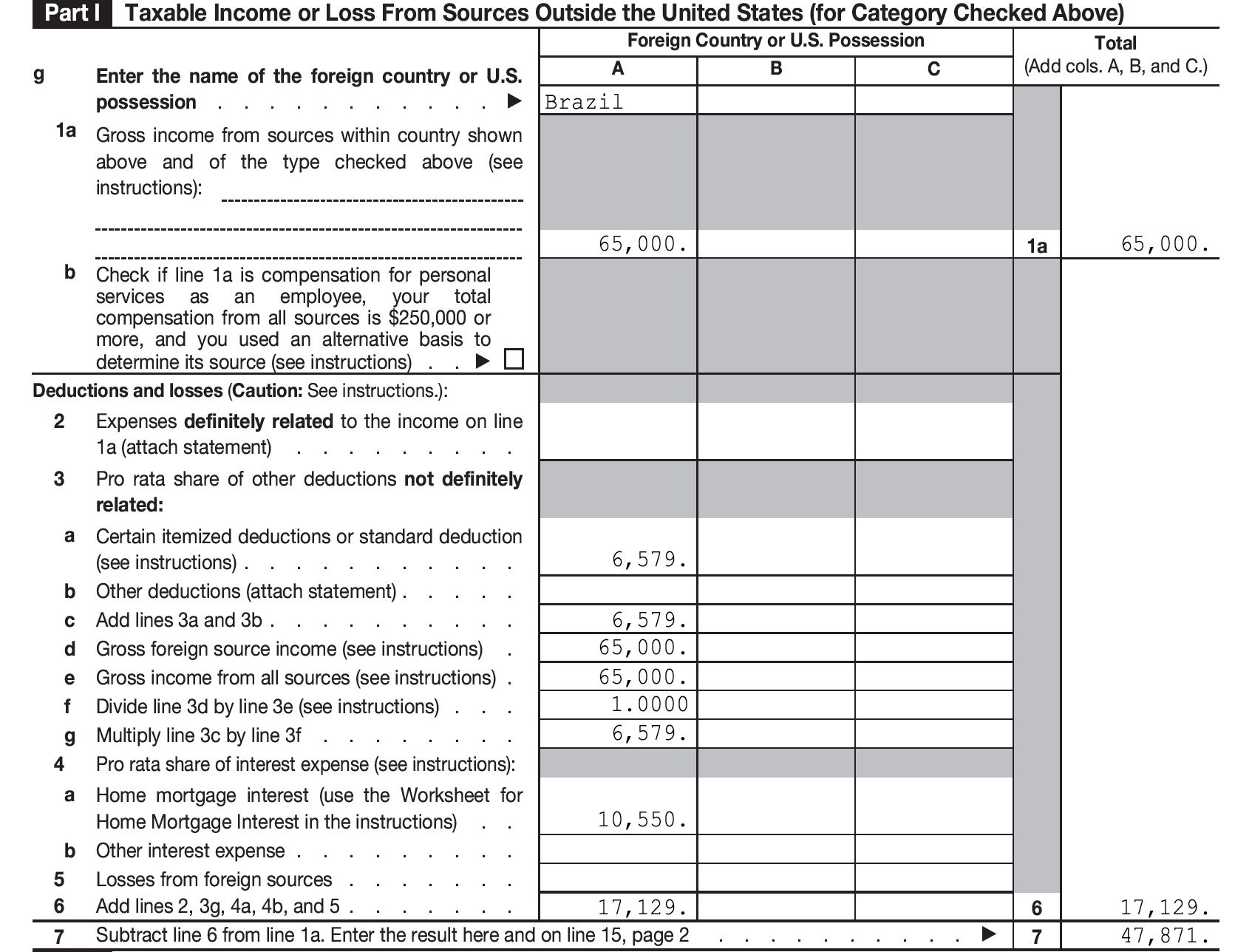

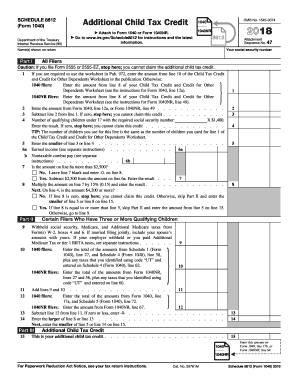

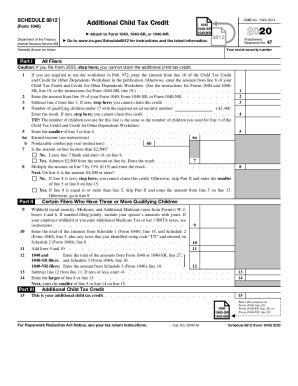

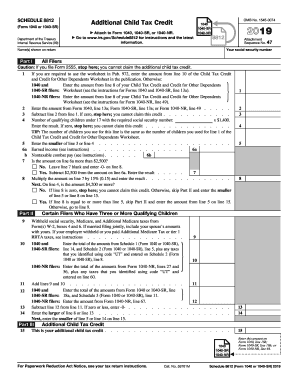

Child Tax Credit Worksheet 2018. Self-Employment Tax Return Including the Additional Child Tax. If you do not have a qualifying child you cannot claim the child tax credit. Requirements listed earlier under Qualifying ChildAlso see Taxpayer identification number needed by due date of return earlier. For 2018 the recently passed GOP tax reform bill doubles the amount of the Child Tax Credit from 1000 to 2000 per qualifying child.

Irs Tax Calculator Shefalitayal From shefalitayal.com

Irs Tax Calculator Shefalitayal From shefalitayal.com

Individuals can use a simpler worksheet in their tax return instructions. Number of qualifying children. Were you a nonresident alien for any part of the year. How long have you owned your business. Enter the amount from Form 1040 line 38. Earned Income Tax Credit Worksheet for Tax Year 2018.

972 enter the amount from line 10 of the Child Tax Credit.

Additional Child Tax Credit Spanish Version US. Self-Employment Tax Return Including the Additional Child Tax. Make them reusable by making templates add and complete fillable fields. The Maximum Child Tax Credit. 2018 Child Tax Credit and Credit for Other Dependents Worksheet Line 12a Lin e Instructions Enter the Result Here 1 Number of qualifying children 2000 2 Number of other dependents 500 3 Add lines 1 2 4 Enter the amount from Form 1040 Line 7 5 Enter 400000 for Married filing jointly and 200000 for all other filing statuses 6 Is. Enter the amount from Form 1040 line 38.

Source: pdffiller.com

Source: pdffiller.com

Were you a nonresident alien for any part of the year. Forms and Publications PDF Instructions for Schedule 8812 Additional Child Tax Credit. If you do not have a qualifying child you cannot claim the child tax credit. Additional Child Tax Credit Spanish Version US. Child Tax Credit Worksheet W4 Example Of Child Tax Credit Worksheet 2014 Irs Tax Form 1040 Instructions Form 1040 For 2014 Choice Image Free Form Design Examples.

Source: litrg.org.uk

Source: litrg.org.uk

2018 Child Tax Credit and Credit for Other Dependents Worksheet Line 12a Lin e Instructions Enter the Result Here 1 Number of qualifying children 2000 4000 2 Number of other dependents 500 1000 3 Add lines 1 2 125000 4 Enter the amount from Form 1040 Line 7 125000 5 Enter 400000 for Married filing jointly and 200000 for all. Names shown on return. Child tax credit or additional child tax credit and any child who was less than 17 years old on December 31 2018 that qualifies for the federal credit for other dependents whether or not you claimed the credit on your federal return see the instructions for. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Earned income credit andor additional child tax credit re-lated refunds will be available in taxpayer bank accounts or on debit cards is February 27 2018 if they chose direct deposit and there are no other issues with the tax return.

Source: irs.gov

Source: irs.gov

Child tax credit or additional child tax credit and any child who was less than 17 years old on December 31 2018 that qualifies for the federal credit for other dependents whether or not you claimed the credit on your federal return see the instructions for. Child Tax Credit and Credit for Other Dependents WorksheetContinued. If you file Form 2555 or 2555-EZ stop here. Number of qualifying children. For 2018 the recently passed GOP tax reform bill doubles the amount of the Child Tax Credit from 1000 to 2000 per qualifying child.

Source: investopedia.com

Source: investopedia.com

Number of qualifying children. Approve forms with a legal electronic signature and share them through email fax or print them out. You cannot claim the additional child tax credit. Individuals can use a simpler worksheet in their tax return instructions. Earned income credit andor additional child tax credit re-lated refunds will be available in taxpayer bank accounts or on debit cards is February 27 2018 if they chose direct deposit and there are no other issues with the tax return.

Source: pinterest.com

Source: pinterest.com

Forms and Publications PDF Instructions for Schedule 8812 Additional Child Tax Credit. In other words if you have one child youll be able to. If you claim the CTC or ACTC but you. Some of the worksheets for this concept are Eic work a and work b updates Schedule eic earned income credit 2018 form 8867 2018 earned income child tax credit hoh eligibility Earned income credit work Lines 66a and 66b earned income credit eic Earned income credit eic work 53 of 117 1416. If you were sent here from your Instructions for Forms 1040 and 1040-SR or your Instructions for Form 1040-NR.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Discover learning games guided lessons and other interactive activities for children. A 2018 Eic - Displaying top 8 worksheets found for this concept. If you were sent here from your Instructions for Schedule 8812. Number of qualifying children. Earned Income Tax Credit Worksheet for Tax Year 2018.

Source: lesgourmetsrestaurants.com

Source: lesgourmetsrestaurants.com

But this doesnt necessarily mean that all qualifying taxpayers will receive that much. Form 1040A line 22. Child tax credit and additional child tax credit may be disallowed. If you do not have a qualifying child you cannot claim the child tax credit. Some of the worksheets for this concept are Eic work a and work b updates Schedule eic earned income credit 2018 form 8867 2018 earned income child tax credit hoh eligibility Earned income credit work Lines 66a and 66b earned income credit eic Earned income credit eic work 53 of 117 1416.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

In other words if you have one child youll be able to. Child Tax Credit and Credit for Other Dependents WorksheetContinued. For 2018 the recently passed GOP tax reform bill doubles the amount of the Child Tax Credit from 1000 to 2000 per qualifying child. In other words if you have one child youll be able to. The TCJA increased the maximum Child Tax Credit to 2000 per child beginning in tax year 2018 up from a maximum of 1000 per child through December 2017.

Source: pdffiller.com

Source: pdffiller.com

Individuals can use a simpler worksheet in their tax return instructions. Some of the worksheets for this concept are Eic work a and work b updates Schedule eic earned income credit 2018 form 8867 2018 earned income child tax credit hoh eligibility Earned income credit work Lines 66a and 66b earned income credit eic Earned income credit eic work 53 of 117 1416. Additional child tax credit ACTC your qualifying child must have the required SSN. Fill out blanks electronically using PDF or Word format. If your qualifying child does not have the required SSN.

Source: pdffiller.com

Source: pdffiller.com

Self-Employment Tax Return Including the Additional Child Tax. Child tax credit worksheet 2021 form. Your income can reduce this amount. Child Tax Credit Worksheet W4 Example Of Child Tax Credit Worksheet 2014 Irs Tax Form 1040 Instructions Form 1040 For 2014 Choice Image Free Form Design Examples. Your social security number.

Source: communitytax.com

Source: communitytax.com

If you do not have a qualifying child you cannot claim the child tax credit. Form 1040A line 22. But this doesnt necessarily mean that all qualifying taxpayers will receive that much. Requirements listed earlier under Qualifying ChildAlso see Taxpayer identification number needed by due date of return earlier. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: pinterest.com

Source: pinterest.com

Make them reusable by making templates add and complete fillable fields. Or Form 1040NR line 37. Additional child tax credit ACTC your qualifying child must have the required SSN. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Discover learning games guided lessons and other interactive activities for children.

Source: news.energysage.com

Source: news.energysage.com

To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2018 and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. If you are required to use the worksheet in Pub. Enter the amount from Form 1040 line 38. Make sure you checked the box in. If you file Form 2555 or 2555-EZ stop here.

Source: pdffiller.com

Source: pdffiller.com

Taxpayers with Self-Employment Income. If you were sent here from your Instructions for Schedule 8812. Earned Income Worksheet for line 3 of the Line 14 Worksheet or line 6a of Schedule 8812 Additional Child Tax Credit Additional Medicare Tax and RRTA Tax Worksheet for line 7 of the Line 14 Worksheet. If your qualifying child does not have the required SSN. 2018 Child Tax Credit and Credit for Other Dependents Worksheet Line 12a Lin e Instructions Enter the Result Here 1 Number of qualifying children 2000 4000 2 Number of other dependents 500 1000 3 Add lines 1 2 125000 4 Enter the amount from Form 1040 Line 7 125000 5 Enter 400000 for Married filing jointly and 200000 for all.

Source: savingtoinvest.com

Source: savingtoinvest.com

2018 Child Tax Credit and Credit for Other Dependents WorksheetLine 12a Keep for Your Records 1. If you were sent here from your Instructions for Schedule 8812. Child tax credit worksheet 2021 form. Some of the worksheets for this concept are Eic work a and work b updates Schedule eic earned income credit 2018 form 8867 2018 earned income child tax credit hoh eligibility Earned income credit work Lines 66a and 66b earned income credit eic Earned income credit eic work 53 of 117 1416. Earned income credit andor additional child tax credit re-lated refunds will be available in taxpayer bank accounts or on debit cards is February 27 2018 if they chose direct deposit and there are no other issues with the tax return.

Source: khurak.net

Source: khurak.net

2018 Child Tax Credit and Credit for Other Dependents Worksheet Line 12a Lin e Instructions Enter the Result Here 1 Number of qualifying children 2000 4000 2 Number of other dependents 500 1000 3 Add lines 1 2 125000 4 Enter the amount from Form 1040 Line 7 125000 5 Enter 400000 for Married filing jointly and 200000 for all. If you are required to use the worksheet in Pub. Make sure you checked the box in. 2018 Child Tax Credit and Credit for Other Dependents Worksheet Line 12a Lin e Instructions Enter the Result Here 1 Number of qualifying children 2000 4000 2 Number of other dependents 500 1000 3 Add lines 1 2 125000 4 Enter the amount from Form 1040 Line 7 125000 5 Enter 400000 for Married filing jointly and 200000 for all. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: shefalitayal.com

Source: shefalitayal.com

Discover learning games guided lessons and other interactive activities for children. The TCJA increased the maximum Child Tax Credit to 2000 per child beginning in tax year 2018 up from a maximum of 1000 per child through December 2017. If you claim the CTC or ACTC but you. The Maximum Child Tax Credit. Child Tax Credit and Credit for Other Dependents WorksheetContinued.

Source: pinterest.com

Source: pinterest.com

Number of qualifying children. If your qualifying child does not have the required SSN. Discover learning games guided lessons and other interactive activities for children. Could you or your spouse if filing jointly be a qualifying child of another person for the year. Save files on your personal computer or mobile device.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit worksheet 2018 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information