Child tax credit threshold uk information

Home » News » Child tax credit threshold uk informationYour Child tax credit threshold uk images are available in this site. Child tax credit threshold uk are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit threshold uk files here. Download all royalty-free images.

If you’re searching for child tax credit threshold uk pictures information related to the child tax credit threshold uk keyword, you have pay a visit to the right blog. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Child Tax Credit Threshold Uk. Child Tax Credit will not affect your Child Benefit. However unlike John in the previous example Chrissies income is above the 6565 threshold which means that HMRC will reduce her maximum tax credits award. The income threshold for receiving the maximum amount of child tax credit is 16480. The starting rate limit for savings is 2710 for 2012-13 and will increase in line with RPI to 2790 for 2013-14.

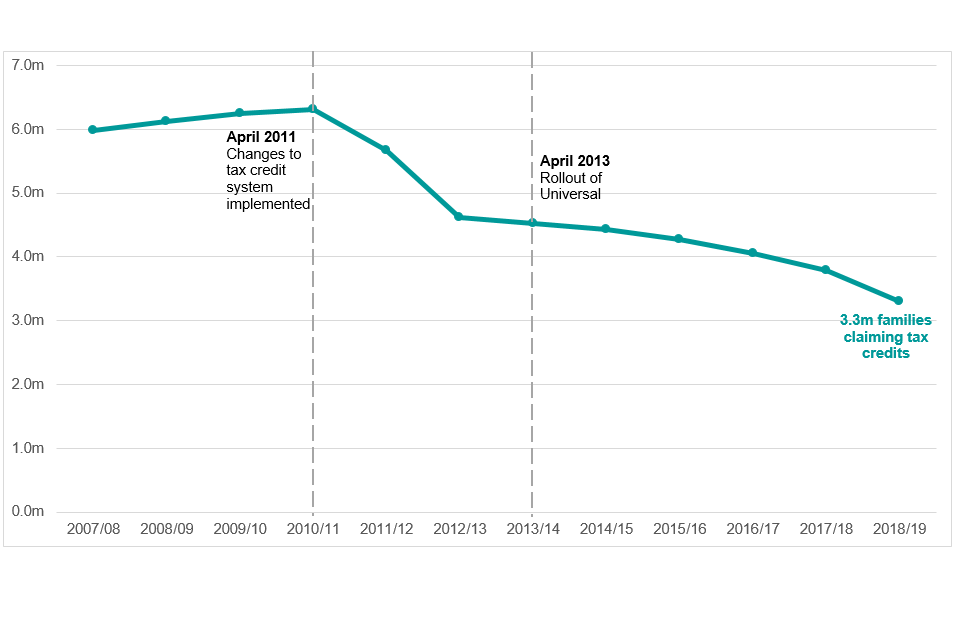

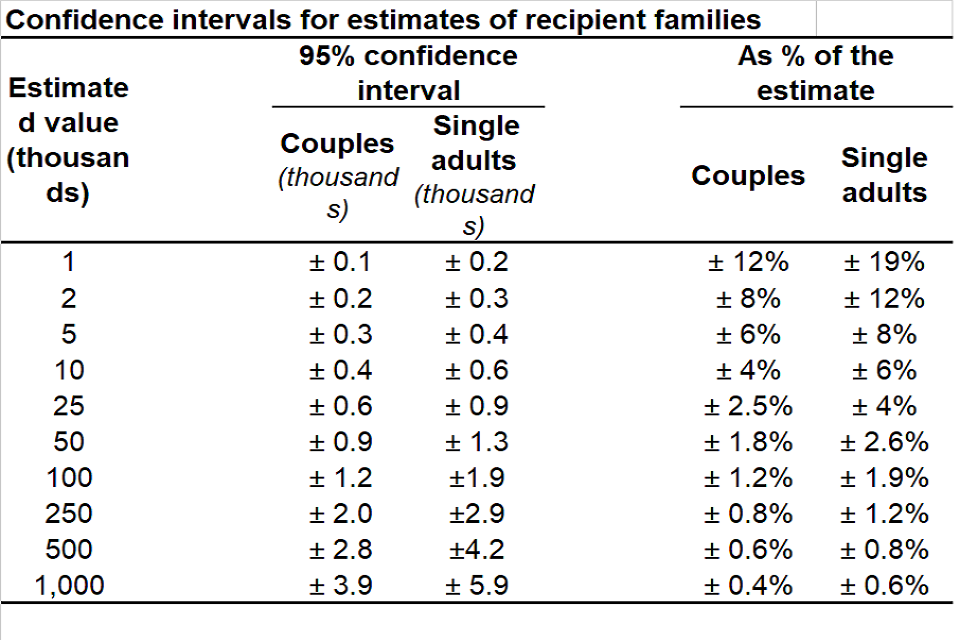

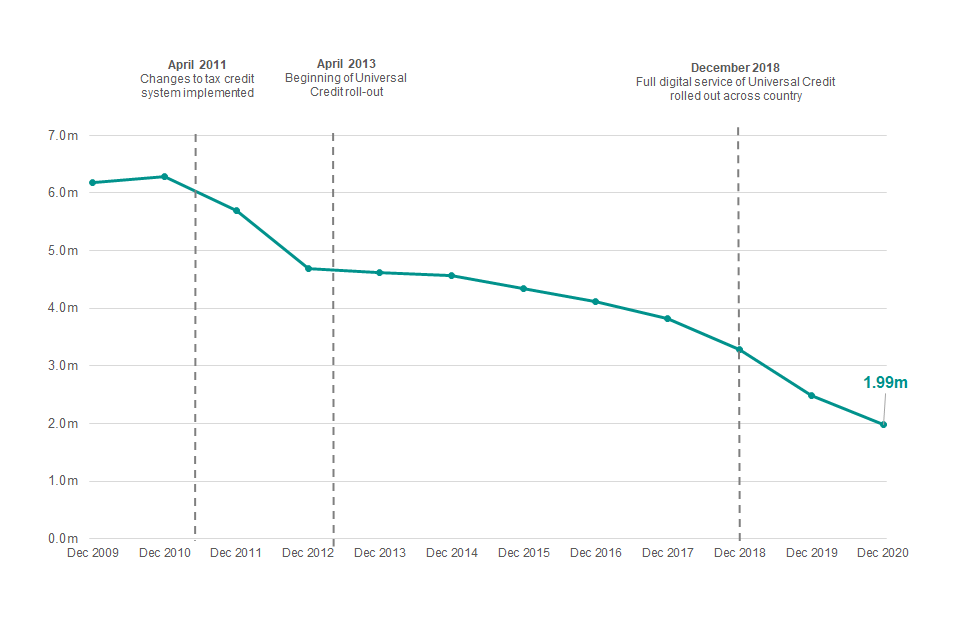

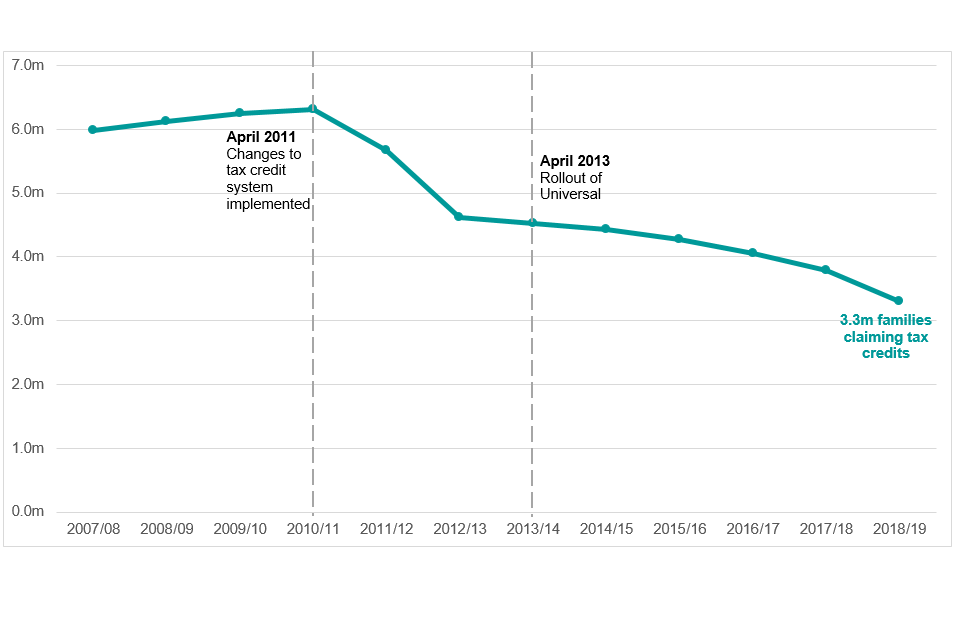

Child And Working Tax Credits Statistics Finalised Awards 2018 19 Gov Uk From gov.uk

Child And Working Tax Credits Statistics Finalised Awards 2018 19 Gov Uk From gov.uk

The basic amount has an upper threshold of 545. You can only claim Child Tax Credit for children you. Child Tax Credit supports families with children. From 2008-09 there is a 10 per cent starting rate for savings income only. Find out the rates thresholds and allowances for tax credits Child Benefit and Guardians Allowance. For 2017 the net unearned income for a child under the age of 19 or a full-time student under the age of 24 that is not subject to.

Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold.

Child Tax Credit will not affect your Child Benefit. The starting rate limit for savings is 2710 for 2012-13 and will increase in line with RPI to 2790 for 2013-14. However unlike John in the previous example Chrissies income is above the 6565 threshold which means that HMRC will reduce her maximum tax credits award. You can only claim Child Tax Credit for children you. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately. Use this table by selecting a row with the appropriate combination of tax credit elements and then look across that row to find the maximum income limit depending on the number of children.

Source: pinterest.com

Source: pinterest.com

The second income threshold was only used for the family element which remained protected. You dont need to be working to get child tax credit. The amount you can get depends on how many children youve got and whether youre. Child Tax Credit will not affect your Child Benefit. The following sections describe the exceptions to the general rule that Child Tax Credit will give support for a maximum of 2 children.

Source: litrg.org.uk

Source: litrg.org.uk

The following sections describe the exceptions to the general rule that Child Tax Credit will give support for a maximum of 2 children. Find out the rates thresholds and allowances for tax credits Child Benefit and Guardians Allowance. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. However unlike John in the previous example Chrissies income is above the 6565 threshold which means that HMRC will reduce her maximum tax credits award. For every 1 of income over this threshold you earn per year the amount of tax credit youll be paid decreases by 41p.

Source: in.pinterest.com

Source: in.pinterest.com

Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold. Withdrawal rate this is the percentage of your income ABOVE the threshold which is taken off your tax credit award 41. Child Tax Credit and Working Tax Credit do not affect Child Benefit payments which we pay separately. You can only claim Child Tax Credit for children you. Use this table by selecting a row with the appropriate combination of tax credit elements and then look across that row to find the maximum income limit depending on the number of children.

Source: in.pinterest.com

Source: in.pinterest.com

From 2008-09 there is a 10 per cent starting rate for savings income only. Income rise disregard. Income threshold for families who meet conditions for both tax credits. You can claim child tax credit if youre responsible for a child under 16 or under 20 if they are in approved education or training. Child Tax Credit supports families with children.

Source: litrg.org.uk

Source: litrg.org.uk

Withdrawal rate this is the percentage of your income ABOVE the threshold which is taken off your tax credit award 41. For 2017 the net unearned income for a child under the age of 19 or a full-time student under the age of 24 that is not subject to. Threshold for those entitled to Child Tax Credit only. Child tax credit reductions example. This is compared to the 70 you could claim for childcare costs on Child Tax Credit.

Source: pinterest.com

Source: pinterest.com

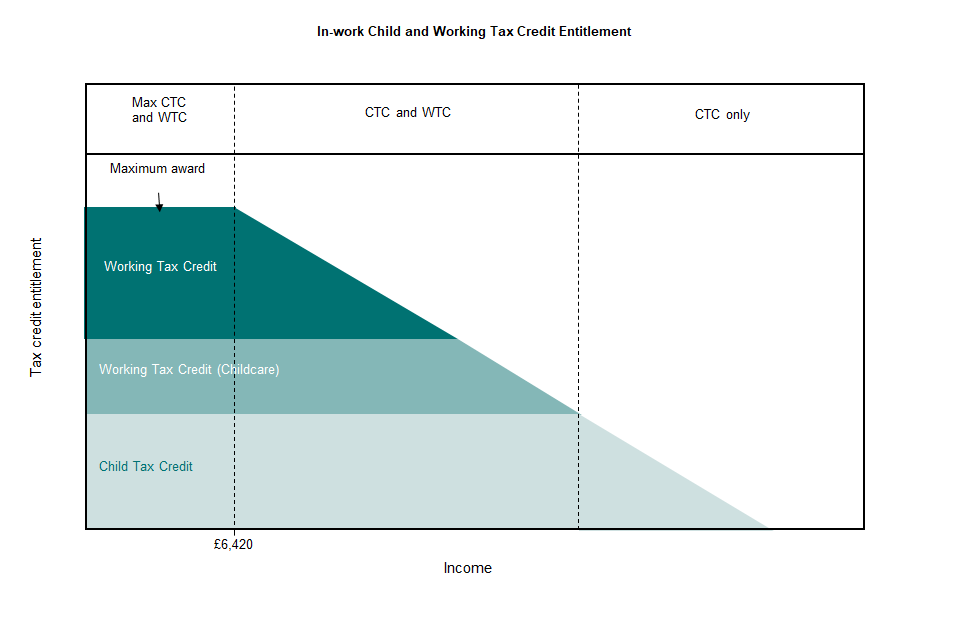

The first income threshold either 6420 or 15860 in 2011-2012 was used to calculate entitlement to all elements except for the family element of CTC. You can only claim Child Tax Credit for children you. You can claim child tax credit if youre responsible for a child under 16 or under 20 if they are in approved education or training. Child tax credit is made up of a number of elements. Withdrawal rate this is the percentage of your income ABOVE the threshold which is taken off your tax credit award 41.

Source: in.pinterest.com

Source: in.pinterest.com

This is compared to the 70 you could claim for childcare costs on Child Tax Credit. The amount you can get depends on how many children youve got and whether youre. You dont need to be working to get child tax credit. The threshold for the other child related tax credit known as the kiddie tax meaning the amount of unearned net income that a child can take home without paying any federal income tax was is 1050. The maximum income limit for a couple with 3 children working 35 hours with 1 disabled child is 46027 highlighted in yellow within the table.

Source: cz.pinterest.com

Source: cz.pinterest.com

The second income threshold was only used for the family element which remained protected. The maximum income limit for a couple with 3 children working 35 hours with 1 disabled child is 46027 highlighted in yellow within the table. On Universal Credit you may be able to claim back up to 85 of eligible childcare costs up to a maximum of 64635 for one child or 110804 for two or more children. The income threshold for receiving the maximum amount of child tax credit is 16480. The second income threshold was only used for the family element which remained protected.

Source: gov.uk

Source: gov.uk

Use this table by selecting a row with the appropriate combination of tax credit elements and then look across that row to find the maximum income limit depending on the number of children. Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold. The following sections describe the exceptions to the general rule that Child Tax Credit will give support for a maximum of 2 children. Find out the rates thresholds and allowances for tax credits Child Benefit and Guardians Allowance. The second income threshold was only used for the family element which remained protected.

Source: gov.uk

Source: gov.uk

Child Tax Credit Rates 202122 Tax Year. The first income threshold either 6420 or 15860 in 2011-2012 was used to calculate entitlement to all elements except for the family element of CTC. The maximum income limit for a couple with 3 children working 35 hours with 1 disabled child is 46027 highlighted in yellow within the table. Threshold for maximum Child Tax Credit where neither partner meets conditions for Working Tax Credit. However unlike John in the previous example Chrissies income is above the 6565 threshold which means that HMRC will reduce her maximum tax credits award.

Source: gov.uk

Source: gov.uk

You can only claim Child Tax Credit for children you. Income rise disregard. The starting rate limit for savings is 2710 for 2012-13 and will increase in line with RPI to 2790 for 2013-14. The first income threshold either 6420 or 15860 in 2011-2012 was used to calculate entitlement to all elements except for the family element of CTC. Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold.

Source: researchgate.net

Source: researchgate.net

This can include children until their 16th birthday and young persons aged from 16 but under 20 years old. The threshold for the other child related tax credit known as the kiddie tax meaning the amount of unearned net income that a child can take home without paying any federal income tax was is 1050. Chrissies maximum award of 6075 will be reduced by 325335 because her income is above the threshold. Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold. You dont need to be working to get child tax credit.

Source: in.pinterest.com

Source: in.pinterest.com

The maximum income limit for a couple with 3 children working 35 hours with 1 disabled child is 46027 highlighted in yellow within the table. From 2008-09 there is a 10 per cent starting rate for savings income only. For every 1 of income over this threshold you earn per year the amount of tax credit youll be paid decreases by 41p. The starting rate limit for savings is 2710 for 2012-13 and will increase in line with RPI to 2790 for 2013-14. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021.

Source: pinterest.com

Source: pinterest.com

This can include children until their 16th birthday and young persons aged from 16 but under 20 years old. Income threshold for families who meet conditions for both tax credits. Threshold for maximum Child Tax Credit where neither partner meets conditions for Working Tax Credit. Child Tax Credit will not affect your Child Benefit. From 2008-09 there is a 10 per cent starting rate for savings income only.

Source: gov.uk

Source: gov.uk

Child Tax Credit supports families with children. The amount you can get depends on how many children youve got and whether youre. Use this table by selecting a row with the appropriate combination of tax credit elements and then look across that row to find the maximum income limit depending on the number of children. From 2008-09 there is a 10 per cent starting rate for savings income only. The first income threshold either 6420 or 15860 in 2011-2012 was used to calculate entitlement to all elements except for the family element of CTC.

Source: gov.uk

Source: gov.uk

The maximum income limit for a couple with 3 children working 35 hours with 1 disabled child is 46027 highlighted in yellow within the table. Working Tax Credit is for working people on a low income. Threshold for maximum Child Tax Credit where neither partner meets conditions for Working Tax Credit. You can only claim Child Tax Credit for children you. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021.

Source: litrg.org.uk

Source: litrg.org.uk

This is compared to the 70 you could claim for childcare costs on Child Tax Credit. Child Tax Credit rates for 202122 yearly amount shown Child Tax Credit income threshold. Child Tax Credit supports families with children. The reduction in income is calculated as follows. The basic amount has an upper threshold of 545.

Source: pinterest.com

Source: pinterest.com

For every 1 of income over this threshold you earn per year the amount of tax credit youll be paid decreases by 41p. Threshold for maximum Child Tax Credit where neither partner meets conditions for Working Tax Credit. It will depend on your circumstances income and whether your child has a disability. Child Tax Credit supports families with children. It gets paid out each year for the family element but you may get extra elements on top.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit threshold uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information