Child tax credit qualifications irs information

Home » Trending » Child tax credit qualifications irs informationYour Child tax credit qualifications irs images are ready. Child tax credit qualifications irs are a topic that is being searched for and liked by netizens now. You can Find and Download the Child tax credit qualifications irs files here. Get all free photos.

If you’re searching for child tax credit qualifications irs images information linked to the child tax credit qualifications irs topic, you have visit the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

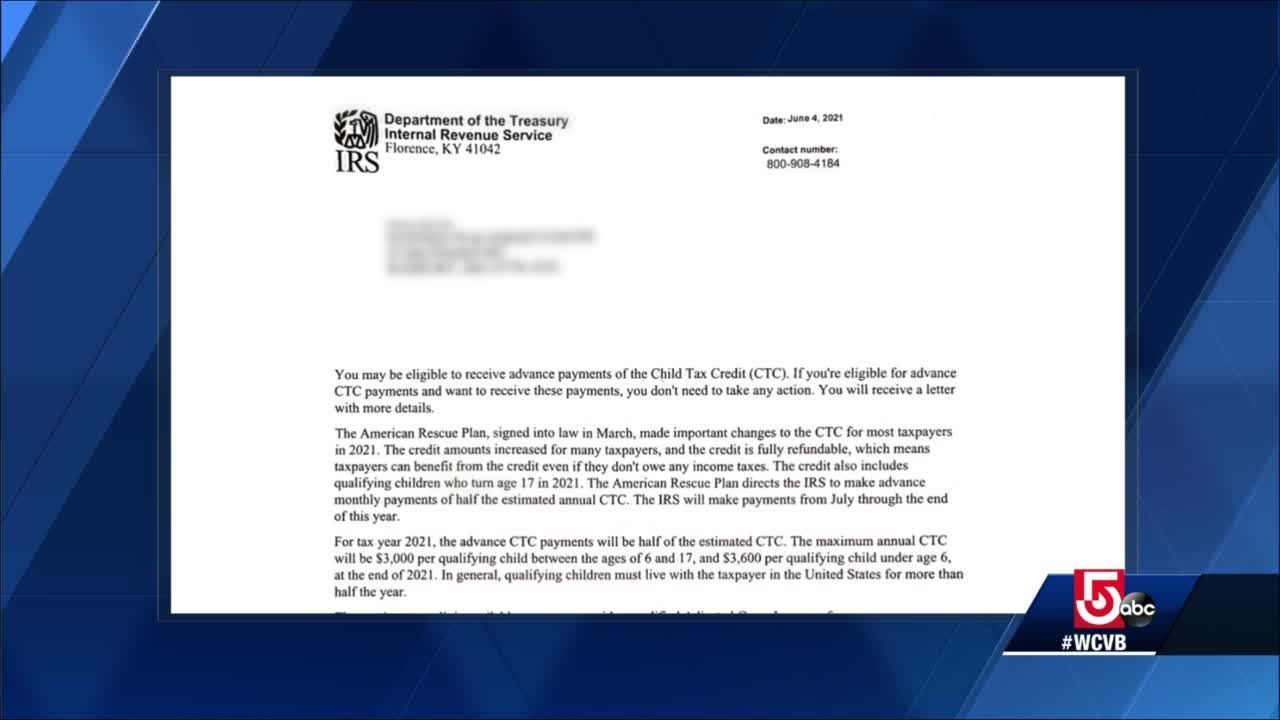

Child Tax Credit Qualifications Irs. The IRS portals allow parents to manage their child tax credit payments this summer and later on. The IRS will use your 2020 or 2019 tax return details meaning your income and dependent information to estimate your amount for the advanced Child Tax Credit. How to make changes with the IRS. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not.

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service From taxpayeradvocate.irs.gov

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service From taxpayeradvocate.irs.gov

This is a significant increase. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. Here are 10 important facts from the IRS about this credit and how it may benefit your family. If you have children and qualify for the Child Tax Credit but have not done your 2020 taxes the IRS is suggesting you file quickly in order to take advantage of the money. For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. Sarah TewCNET By tomorrow the first child tax credit payment will be going out from the IRS.

The third stimulus package increases the amount of the credit makes it fully.

IRS Tax Tip 2019-141 October 9 2019. For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. How Much is the Child Tax Credit. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. There is also a 300 credit for. Taxpayers who claim at least one child as their dependent on their tax return may be eligible to benefit from the child tax credit.

Source: wnep.com

Source: wnep.com

The third stimulus package increases the amount of the credit makes it fully. For 2021 the credit is 3000 children under age 18 or. The child tax credit isnt anything new but it has gotten a major overhaul in the American Rescue Plan Act of 2021. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. The Child Tax Credit is an important tax credit that may be worth as much as 1000 per qualifying child depending upon your income.

Source: fox2now.com

Source: fox2now.com

Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. The Internal Revenue Service IRS announced in May it will automatically send monthly child tax credit payments to families who qualify starting July. Here are 10 important facts from the IRS about this credit and how it may benefit your family. Visit the IRS website HERE for complete details. This is a significant increase.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

Visit the IRS website HERE for complete details. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. How to make changes with the IRS. There is also a 300 credit for. The IRS portals allow parents to manage their child tax credit payments this summer and later on.

Source: cnet.com

Source: cnet.com

Five Things to Know About the Child Tax Credit for updated information. IRS Tax Tip 2011-29 February 10 2011. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. Sarah TewCNET By tomorrow the first child tax credit payment will be going out from the IRS. Five Things to Know About the Child Tax Credit for updated information.

Source: cnet.com

Source: cnet.com

Advance Child Tax Credit payments. This is a significant increase. For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare. The IRS will use your 2020 or 2019 tax return details meaning your income and dependent information to estimate your amount for the advanced Child Tax Credit.

Source: en.as.com

Source: en.as.com

Advance Child Tax Credit payments. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child. There is also a 300 credit for. IRS Tax Tip 2011-29 February 10 2011. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not.

Source: news.yahoo.com

Source: news.yahoo.com

The IRS looks at your familys adjusted gross income or AGI the ages of your dependents and a handful of other things to determine if you meet the requirements for the child tax credit payments. Though the credit is geared toward working parents or guardians taxpayers who were full-time students or who were unemployed for part of the year may also qualify. This is a significant increase. The child tax credit isnt anything new but it has gotten a major overhaul in the American Rescue Plan Act of 2021. The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare.

Source: cnet.com

Source: cnet.com

The third stimulus package increases the amount of the credit makes it fully. Though the credit is geared toward working parents or guardians taxpayers who were full-time students or who were unemployed for part of the year may also qualify. The IRS portals allow parents to manage their child tax credit payments this summer and later on. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify.

Source: aarp.org

Source: aarp.org

The IRS has created an online portal to allow families to make changes to the information on-hand. The IRS looks at your familys adjusted gross income or AGI the ages of your dependents and a handful of other things to determine if you meet the requirements for the child tax credit payments. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child. The child tax credit isnt anything new but it has gotten a major overhaul in the American Rescue Plan Act of 2021. Taxpayers who claim at least one child as their dependent on their tax return may be eligible to benefit from the child tax credit.

Source: hrblock.com

Source: hrblock.com

The child tax credit isnt anything new but it has gotten a major overhaul in the American Rescue Plan Act of 2021. If you have children and qualify for the Child Tax Credit but have not done your 2020 taxes the IRS is suggesting you file quickly in order to take advantage of the money. The IRS portals allow parents to manage their child tax credit payments this summer and later on. There is also a 300 credit for. For 2021 the credit is 3000 children under age 18 or.

Source: cnet.com

Source: cnet.com

The IRS looks at your familys adjusted gross income or AGI the ages of your dependents and a handful of other things to determine if you meet the requirements for the child tax credit payments. Five Things to Know About the Child Tax Credit for updated information. For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. Visit the IRS website HERE for complete details. The Internal Revenue Service IRS announced in May it will automatically send monthly child tax credit payments to families who qualify starting July.

Source: forbes.com

Source: forbes.com

IRS Tax Tip 2019-141 October 9 2019. Parents have the option to opt-out and take all the money at tax time next spring if they chose to. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. The Internal Revenue Service IRS announced in May it will automatically send monthly child tax credit payments to families who qualify starting July. For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable.

Source: foxbusiness.com

Source: foxbusiness.com

The third stimulus package increases the amount of the credit makes it fully. Though the credit is geared toward working parents or guardians taxpayers who were full-time students or who were unemployed for part of the year may also qualify. Visit the IRS website HERE for complete details. The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not.

Source: cnet.com

Source: cnet.com

How to make changes with the IRS. The Child Tax Credit is an important tax credit that may be worth as much as 1000 per qualifying child depending upon your income. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. Parents have the option to opt-out and take all the money at tax time next spring if they chose to. IRS Tax Tip 2019-141 October 9 2019.

Source: hrblock.com

Source: hrblock.com

For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. There is also a 300 credit for.

Source: en.as.com

Source: en.as.com

The Internal Revenue Service IRS announced in May it will automatically send monthly child tax credit payments to families who qualify starting July. Five Things to Know About the Child Tax Credit for updated information. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. How Much is the Child Tax Credit. Sarah TewCNET By tomorrow the first child tax credit payment will be going out from the IRS.

Source: hrblock.com

Source: hrblock.com

Parents have the option to opt-out and take all the money at tax time next spring if they chose to. Visit the IRS website HERE for complete details. Taxpayers who claim at least one child as their dependent on their tax return may be eligible to benefit from the child tax credit. The third stimulus package increases the amount of the credit makes it fully. If you have children and qualify for the Child Tax Credit but have not done your 2020 taxes the IRS is suggesting you file quickly in order to take advantage of the money.

Source: cnet.com

Source: cnet.com

For 2020 the child tax credit is an income tax credit of up to 2000 per eligible child under age 17 that may be partially refundable. IRS Tax Tip 2011-29 February 10 2011. In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not. The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare. The Child Tax Credit is an important tax credit that may be worth as much as 1000 per qualifying child depending upon your income.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit qualifications irs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information