Child tax credit qualifications 2021 information

Home » Trending » Child tax credit qualifications 2021 informationYour Child tax credit qualifications 2021 images are ready in this website. Child tax credit qualifications 2021 are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit qualifications 2021 files here. Find and Download all free photos.

If you’re looking for child tax credit qualifications 2021 pictures information related to the child tax credit qualifications 2021 topic, you have visit the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Child Tax Credit Qualifications 2021. And parents of twins can get up. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. In the tax year 2021. The tax credit has also increased from 2000 to 3600 per child for children under the age of six and 3000 for children ages six and older.

Child Tax Credit 2021 When Payments Start How To Opt Out From nymag.com

Child Tax Credit 2021 When Payments Start How To Opt Out From nymag.com

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. Adopted children and babies born in 2021 may qualify too. You do not need to take any additional action to get advance payments. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. Additionally the age limit for qualifying children was raised from age 16 to 17. All children who meet all other qualifications born on or before Dec.

2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child.

Those who are eligible will. The 2021 child tax credit was enacted as part of the same stimulus bill that brought Americans the third stimulus check but eligibility rules are not the same. And parents of twins can get up. Adopted children and babies born in 2021 may qualify too. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. You do not need to take any additional action to get advance payments.

Source: cnet.com

Source: cnet.com

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Additionally the age limit for qualifying children was raised from age 16 to 17. Those who are eligible will. For this year only the Child Tax Credit is fully refundable.

Source: cnbc.com

Source: cnbc.com

For couples filing jointly modified adjusted gross income must be below 150000. They will receive 3600 dollars. Adopted children and babies born in 2021 may qualify too. And Made less than certain income limits. 31 2021 will receive the full 3600 tax credit.

Source: philadelphia.cbslocal.com

Source: philadelphia.cbslocal.com

First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. For a child 5 years old or younger parents and caregivers can receive up to 3600 per child over 2021 and 2022 – and that includes babies born in 2021. To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December. For tax year 2021 families claiming the child tax credit will receive up to 3000 dollars per qualifying child between the ages of six and 17 at the end of 2021. In the tax year 2021.

Source: cnet.com

Source: cnet.com

Additionally the age limit for qualifying children was raised from age 16 to 17. To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. To qualify single filers must have income less than 200000 and married joint filers must have income less than. You and your child must be US citizens unlike mixed.

Source: nymag.com

Source: nymag.com

And Made less than certain income limits. They will receive 3600 dollars. The tax credit has also increased from 2000 to 3600 per child for children under the age of six and 3000 for children ages six and older. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. All children who meet all other qualifications born on or before Dec.

Source: usatoday.com

Source: usatoday.com

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. Those who are eligible will. 31 2021 will receive the full 3600 tax credit. Adopted children and babies born in 2021 may qualify too. To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December.

Source: philadelphia.cbslocal.com

Source: philadelphia.cbslocal.com

Adopted children and babies born in 2021 may qualify too. For a child 5 years old or younger parents and caregivers can receive up to 3600 per child over 2021 and 2022 – and that includes babies born in 2021. In the tax year 2021. Well use information you provided earlier to determine if you qualify and automatically enroll you for advance payments. Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit.

Source: cnet.com

Source: cnet.com

To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December. For couples filing jointly modified adjusted gross income must be below 150000. All children who meet all other qualifications born on or before Dec. You do not need to take any additional action to get advance payments. Well use information you provided earlier to determine if you qualify and automatically enroll you for advance payments.

Source: cnet.com

Source: cnet.com

For tax year 2021 families claiming the child tax credit will receive up to 3000 dollars per qualifying child between the ages of six and 17 at the end of 2021. The 2021 child tax credit was enacted as part of the same stimulus bill that brought Americans the third stimulus check but eligibility rules are not the same. First the legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. You and your child must be US citizens unlike mixed.

Source: cnet.com

Source: cnet.com

Adopted children and babies born in 2021 may qualify too. For tax year 2021 families claiming the child tax credit will receive up to 3000 dollars per qualifying child between the ages of six and 17 at the end of 2021. If you have higher income you can still get the 2000 child tax credit. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to.

Source: cnet.com

Source: cnet.com

Adopted children and babies born in 2021 may qualify too. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. More eligibility rules for the 2021 child tax credit The child youre claiming must live with you for at least six months out of the year. In the tax year 2021.

Source: cnet.com

Source: cnet.com

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. For each kid ages 6 to 17 parents and. Additionally the age limit for qualifying children was raised from age 16 to 17. Well use information you provided earlier to determine if you qualify and automatically enroll you for advance payments. In the tax year 2021.

Source:

Source:

For tax year 2021 families claiming the child tax credit will receive up to 3000 dollars per qualifying child between the ages of six and 17 at the end of 2021. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. For couples filing jointly modified adjusted gross income must be below 150000. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December.

Source: cnet.com

Source: cnet.com

Qualification Requirements for Child Care Tax Credit in 2021 In order to be eligible for the credit filers must have a modified adjusted gross income below a certain threshold depending on filing status. Adopted children and babies born in 2021 may qualify too. For couples filing jointly modified adjusted gross income must be below 150000. To get the benefits for the 2021 tax year dependents have to be 17 or younger by the end of December. For each kid ages 6 to 17 parents and.

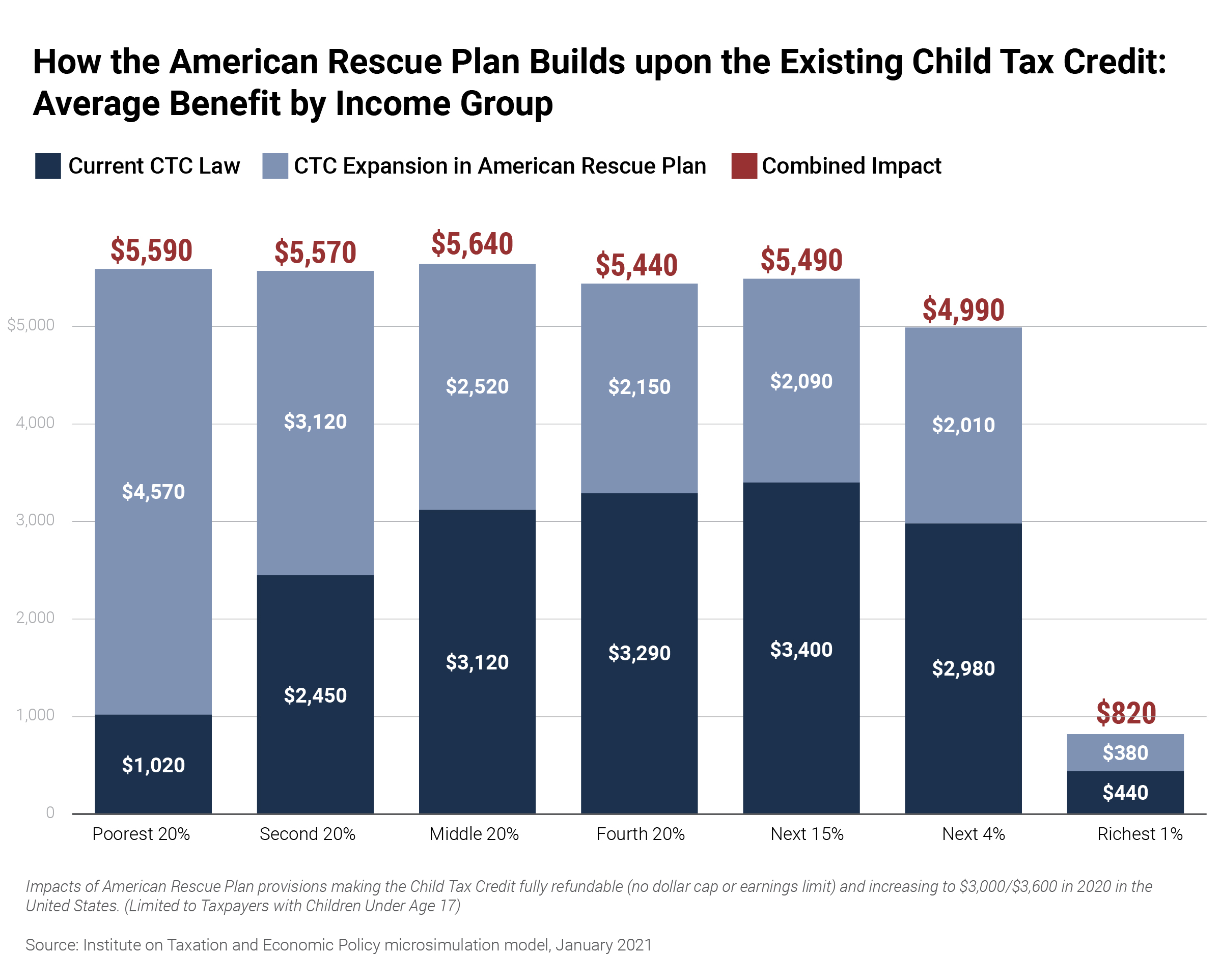

Source: itep.org

Source: itep.org

Adopted children and babies born in 2021 may qualify too. 31 2021 will receive the full 3600 tax credit. For each kid ages 6 to 17 parents and. For couples filing jointly modified adjusted gross income must be below 150000. They will receive 3600 dollars.

Source:

Source:

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. The 2021 child tax credit was enacted as part of the same stimulus bill that brought Americans the third stimulus check but eligibility rules are not the same. Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. Those who are eligible will. If you have higher income you can still get the 2000 child tax credit.

Source: marca.com

Source: marca.com

In the tax year 2021. More importantly half of the 2021 expanded child tax credit will be prepaid in the form of monthly payments to. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. For this year only the Child Tax Credit is fully refundable. They will receive 3600 dollars.

Source: forbes.com

Source: forbes.com

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. You do not need to take any additional action to get advance payments. The 2021 child tax credit was enacted as part of the same stimulus bill that brought Americans the third stimulus check but eligibility rules are not the same. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit qualifications 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information