Child tax credit qualifications 2019 information

Home » Trending » Child tax credit qualifications 2019 informationYour Child tax credit qualifications 2019 images are available in this site. Child tax credit qualifications 2019 are a topic that is being searched for and liked by netizens today. You can Get the Child tax credit qualifications 2019 files here. Get all royalty-free images.

If you’re looking for child tax credit qualifications 2019 pictures information linked to the child tax credit qualifications 2019 interest, you have visit the right blog. Our site always gives you hints for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

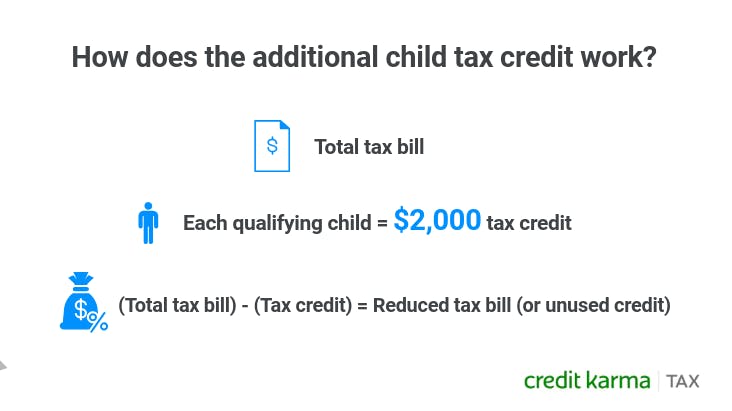

Child Tax Credit Qualifications 2019. MILITARY QUALIFICATIONS FOR THE CHILD TAX CREDIT A child is eligible for the Child Tax Credit if they meet six tests. The child tax credit refund is equal to 15 of qualifying earnings above 2500. The refund is capped at 1400. To qualify for the EITC a qualifying child must.

Gll78nu9rqovxm From

Gll78nu9rqovxm From

It is a credit. The refund is capped at 1400. Have a valid Social Security Number Meet all 4 tests for a qualifying child. Age relationship support dependent citizenship and residence. The credit will allow 17 year-old dependents to qualify and provide up to 3000 per qualifying child or 3600 per qualifying child under age 6. Your earned income must be more than 2500 for 2019 You must have three or more qualifying children.

If you have at least one qualifying child you can claim a credit of up to 15 of your earned income in excess of the earned income threshold 2500.

The refund is capped at 1400. August 19 2020 Tax Credits The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. To qualify single filers must have income less than 200000 and married joint filers must have income less than. This will be the first time those with children aged 17 will receive the tax credit. This credit calculates automatically. It is a credit.

Source: investopedia.com

Source: investopedia.com

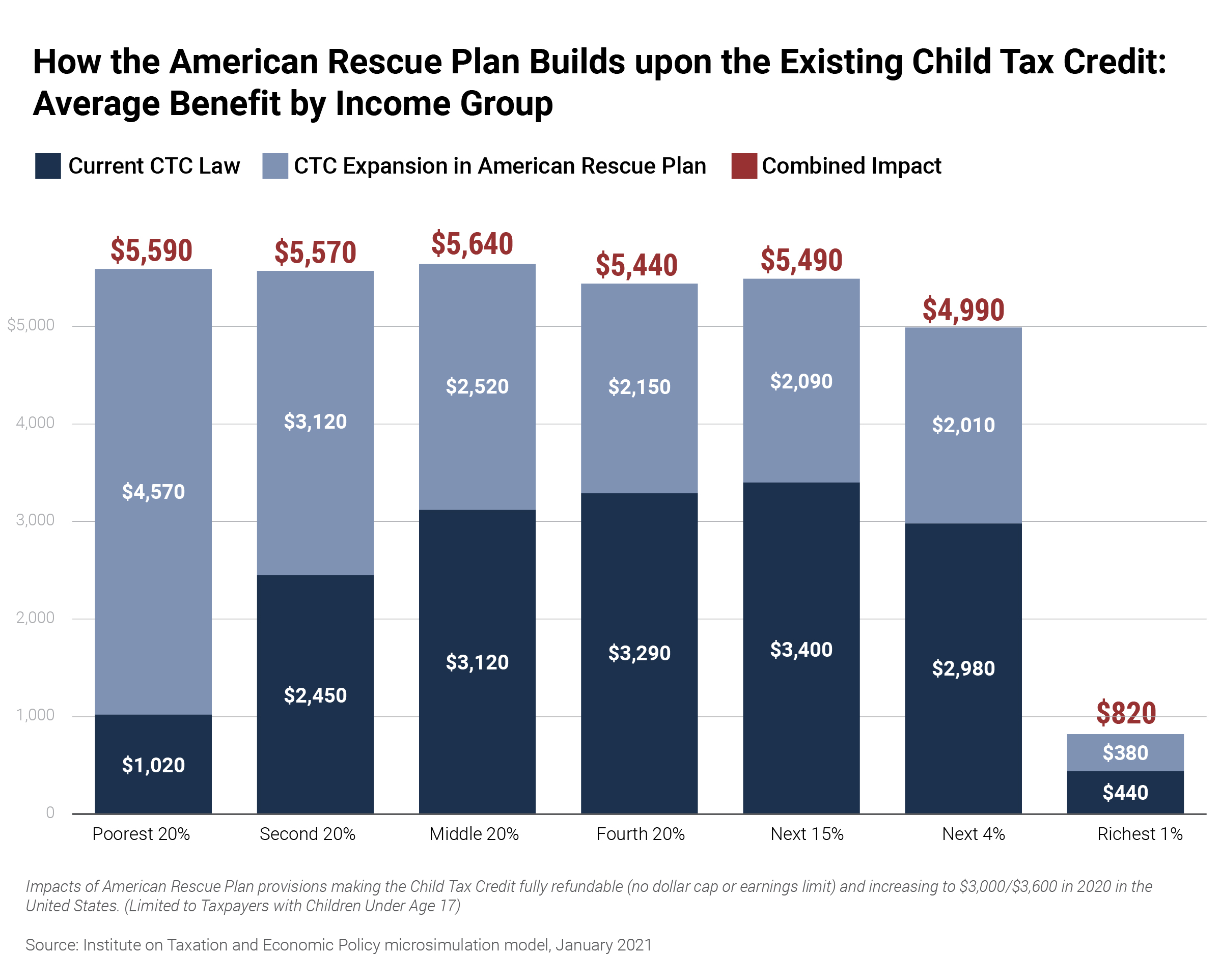

The new CTC rules bring the credit up to 3600 per child under age 6 and 3000 per child between age 6 and 17 for families that qualify. If you have higher income you can still get the 2000 child tax credit. National or resident alien of the United States. The full credit is available to married couples with children filing jointly with adjusted gross income less. It is a credit.

Source: creditkarma.com

Source: creditkarma.com

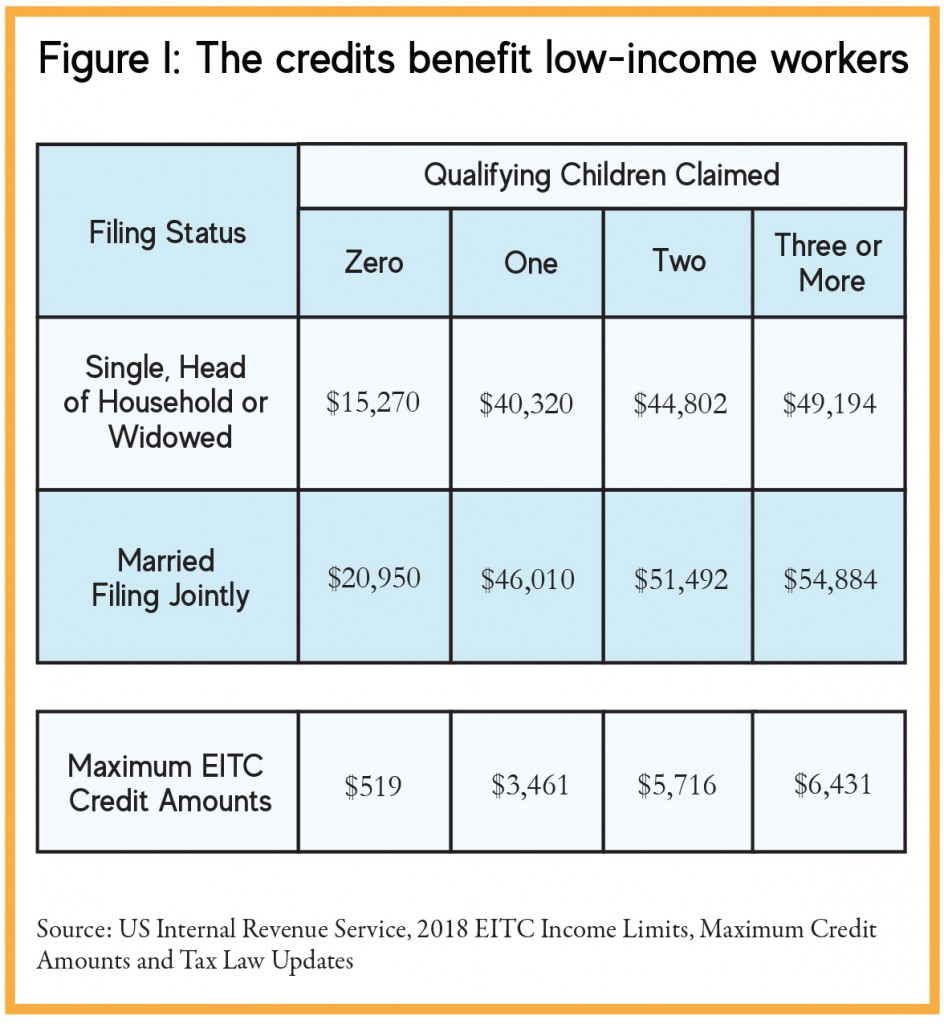

The refund is capped at 1400. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child. Your earned income must be more than 2500 for 2019 You must have three or more qualifying children. August 19 2020 Tax Credits The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. The new CTC rules bring the credit up to 3600 per child under age 6 and 3000 per child between age 6 and 17 for families that qualify.

Source: taxfoundation.org

Source: taxfoundation.org

This will be the first time those with children aged 17 will receive the tax credit. Taxpayers that qualify for the credit can claim a maximum of 2000 per qualifying child. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child. August 19 2020 Tax Credits The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. The refund is capped at 1400.

Source: taxfoundation.org

Source: taxfoundation.org

Taxpayers that qualify for the credit can claim a maximum of 2000 per qualifying child. This will be the first time those with children aged 17 will receive the tax credit. Above 75000 the amount begins phasing out. The credit is up to 2000 per qualifying child. If you have higher income you can still get the 2000 child tax credit.

Source: cnet.com

Source: cnet.com

This credit calculates automatically. The full credit is available to married couples with children filing jointly with adjusted gross income less. Your earned income must be more than 2500 for 2019 You must have three or more qualifying children. The child tax credit refund is equal to 15 of qualifying earnings above 2500. Age relationship support dependent citizenship and residence.

Source: time.com

Source: time.com

The child tax credit will be available to parents with children under the age of 18. The full credit is available to married couples with children filing jointly with adjusted gross income less. It is a credit. Under age 17 at the end of the tax year. Child Tax Credit This is a credit intended to reduce the tax.

Source: nmvoices.org

Source: nmvoices.org

To qualify single filers must have income less than 200000 and married joint filers must have income less than. Child Tax Credit This is a credit intended to reduce the tax. The credit will allow 17 year-old dependents to qualify and provide up to 3000 per qualifying child or 3600 per qualifying child under age 6. The Additional Child Tax Credit ACTC is a refundable credit that you may receive if your 2019 Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500. MILITARY QUALIFICATIONS FOR THE CHILD TAX CREDIT A child is eligible for the Child Tax Credit if they meet six tests.

Source: cnet.com

Source: cnet.com

Child Tax Credit This is a credit intended to reduce the tax. This part of the credit isnt refundable. National or resident alien of the United States. Age relationship support dependent citizenship and residence. It is a credit.

Source: cnet.com

Source: cnet.com

The full credit is available to married couples with children filing jointly with adjusted gross income less. To qualify one of these must apply. National or resident alien of the United States. If you have at least one qualifying child you can claim a credit of up to 15 of your earned income in excess of the earned income threshold 2500. It is a credit.

Source:

Source:

The child tax credit will be available to parents with children under the age of 18. Keep in mind that this is not a deduction. The child tax credit will be available to parents with children under the age of 18. National or resident alien of the United States. Your earned income must be more than 2500 for 2019 You must have three or more qualifying children.

Source: aarp.org

Source: aarp.org

The new CTC rules bring the credit up to 3600 per child under age 6 and 3000 per child between age 6 and 17 for families that qualify. It is a credit. Age relationship support dependent citizenship and residence. The refund is capped at 1400. If you have higher income you can still get the 2000 child tax credit.

Source:

Source:

This part of the credit isnt refundable. Keep in mind that this is not a deduction. The child tax credit refund is equal to 15 of qualifying earnings above 2500. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. Age relationship support dependent citizenship and residence.

Source: foxbusiness.com

Source: foxbusiness.com

Have a valid Social Security Number Meet all 4 tests for a qualifying child. National or resident alien of the United States. The credit is up to 2000 per qualifying child. To qualify one of these must apply. If you have higher income you can still get the 2000 child tax credit.

Source: communitytax.com

Source: communitytax.com

The Child Tax Credit will work differently in 2021 as well as see an increased amount. The child tax credit refund is equal to 15 of qualifying earnings above 2500. To qualify single filers must have income less than 200000 and married joint filers must have income less than. August 19 2020 Tax Credits The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. Under age 17 at the end of the tax year.

Source: communitytax.com

Source: communitytax.com

2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. Have a valid Social Security Number Meet all 4 tests for a qualifying child. The child tax credit refund is equal to 15 of qualifying earnings above 2500. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. To qualify one of these must apply.

Source: itep.org

Source: itep.org

The Child Tax Credit will work differently in 2021 as well as see an increased amount. MILITARY QUALIFICATIONS FOR THE CHILD TAX CREDIT A child is eligible for the Child Tax Credit if they meet six tests. The credit is up to 2000 per qualifying child. Under age 17 at the end of the tax year. Have a valid Social Security Number Meet all 4 tests for a qualifying child.

Source: forbes.com

Source: forbes.com

To qualify single filers must have income less than 200000 and married joint filers must have income less than. As long as your adjusted gross income or AGI is 75000 or less single taxpayer parents will qualify for the full child tax credit amount. National or resident alien of the United States. The refund is capped at 1400. The full credit is available to married couples with children filing jointly with adjusted gross income less.

Source: cnet.com

Source: cnet.com

August 19 2020 Tax Credits The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. Most American families qualify for some amount of money through the child tax credit. To qualify single filers must have income less than 200000 and married joint filers must have income less than. The Additional Child Tax Credit ACTC is a refundable credit that you may receive if your 2019 Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500. Child Tax Credit Changes The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit qualifications 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information