Child tax credit overpayment number information

Home » News » Child tax credit overpayment number informationYour Child tax credit overpayment number images are ready in this website. Child tax credit overpayment number are a topic that is being searched for and liked by netizens now. You can Find and Download the Child tax credit overpayment number files here. Get all royalty-free vectors.

If you’re searching for child tax credit overpayment number pictures information related to the child tax credit overpayment number interest, you have come to the right blog. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Child Tax Credit Overpayment Number. Your reference will be 14 characters long and. Closed on Saturdays Sunday and Bank Holidays. I am from Pakistan and my wife is British. Youll find this on your notice to pay.

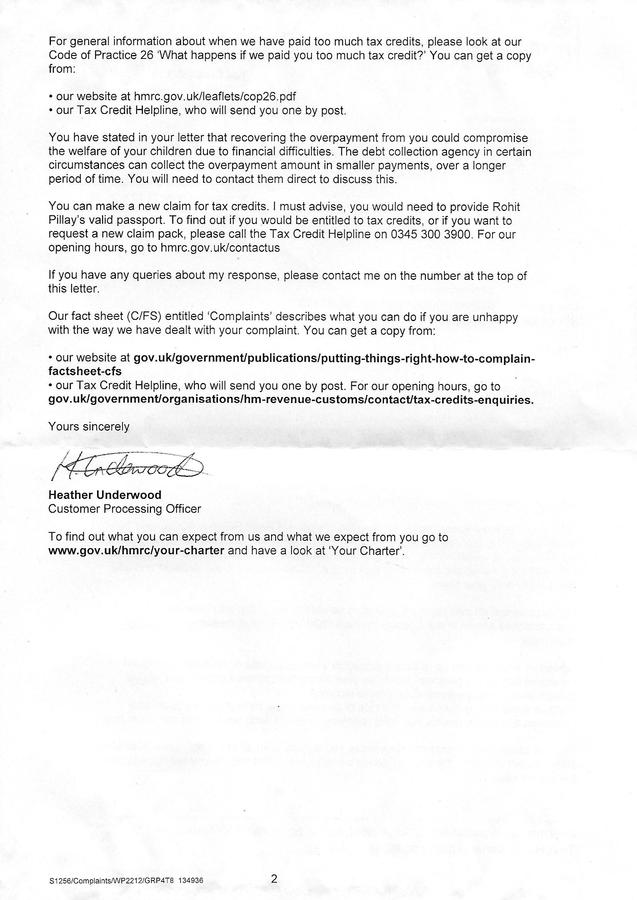

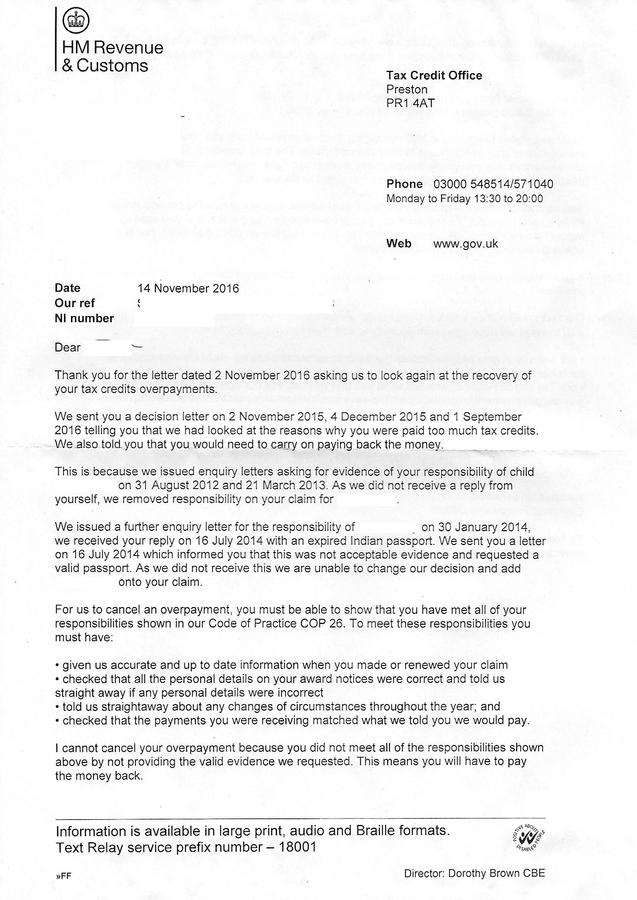

Being Harassed By Hmrc Or A Debt Company For Repayment Of A Tax Credit Overpayment Tax Credit Casualties Latest News From taxcc.org

Being Harassed By Hmrc Or A Debt Company For Repayment Of A Tax Credit Overpayment Tax Credit Casualties Latest News From taxcc.org

This is because when a tax credits award is made it is not final until a final entitlement decision is made which is usually after the end of the tax year for which it has been given or shortly after a claim is ended during a tax year where a person claims Universal Credit in the same tax year. Child tax credits overpayment. I was wondering if anyone can give us any advice on child tax credit overpayment. My case was in the home office for around 2 years and got my residence permit in June 2011. You may be asked to pay a penalty as well if the Tax Credit Office doesnt think you have a good excuse for not telling them. Thats weird and also really bad.

You may be asked to pay a penalty as well if the Tax Credit Office doesnt think you have a good excuse for not telling them.

Closed on Saturdays Sunday and Bank Holidays. Our phone line opening hours are. If one of the changes in number 3 above applies to you and you dont tell the Tax Credit Office not only may you need to repay an overpayment. I applied for nat. I called HMRC directly as there was a number on the letter and just said there was no way I could afford to pay it back as a lump sum and that despite our joint income I dont have access to my husbands bank account. If you still get tax credits or are now getting Universal Credit the money you owe will usually be taken from your future payments.

Source: bankruptcyadvice-online.co.uk

Source: bankruptcyadvice-online.co.uk

Closed on Saturdays Sunday and Bank Holidays. I was wondering if anyone can give us any advice on child tax credit overpayment. HMRC will accept your payment on the date you make it and not the date it reaches HMRC. Youll need your Child Benefit overpayment reference. I called HMRC directly as there was a number on the letter and just said there was no way I could afford to pay it back as a lump sum and that despite our joint income I dont have access to my husbands bank account.

Source: bankruptcyadvice-online.co.uk

Source: bankruptcyadvice-online.co.uk

My case was in the home office for around 2 years and got my residence permit in June 2011. Youll find this on your notice to pay. Write your tax credit reference number on the back of the cheque. For deficiency purposes the earned income credit is treated as a negative tax. The deficiency is arrived at by comparing the sum of the correct amount of tax imposed and the correct earned income credit with the sum of the tax shown on the return plus the credit shown.

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

Most advisers who deal with tax credits are likely to have dealt with a claimant who has been overpaid. My case was in the home office for around 2 years and got my residence permit in June 2011. You may be asked to pay a penalty as well if the Tax Credit Office doesnt think you have a good excuse for not telling them. In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ.

Source: gov.uk

Source: gov.uk

HM Revenue and Customs HMRC tax credits helpline Telephone. The form to tell HMRC about a tax credit overpayment by post has been updated for 2020 to 2021. The nature of the tax credits system means that overpayments are a natural part of it and can arise without fault by either the claimant or HMRC. Overpayments and underpayments are a normal part of the tax credits system. I was wondering if anyone can give us any advice on child tax credit overpayment.

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

You can find the reference on your letter about overpayments from HM Revenue and Customs HMRC. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ. I was wondering if anyone can give us any advice on child tax credit overpayment. If the tax agency doesnt have your bank account number in its Child Tax Credit Update Portal the check will be sent by mail. I applied for national insurance number.

Source: getbailiffadvice.co.uk

Source: getbailiffadvice.co.uk

Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ. Ive managed to find the letters referring to the. My case was in the home office for around 2 years and got my residence permit in June 2011. Youll need your Child Benefit overpayment reference. HMRC will accept your payment on the date you make it and not the date it reaches HMRC.

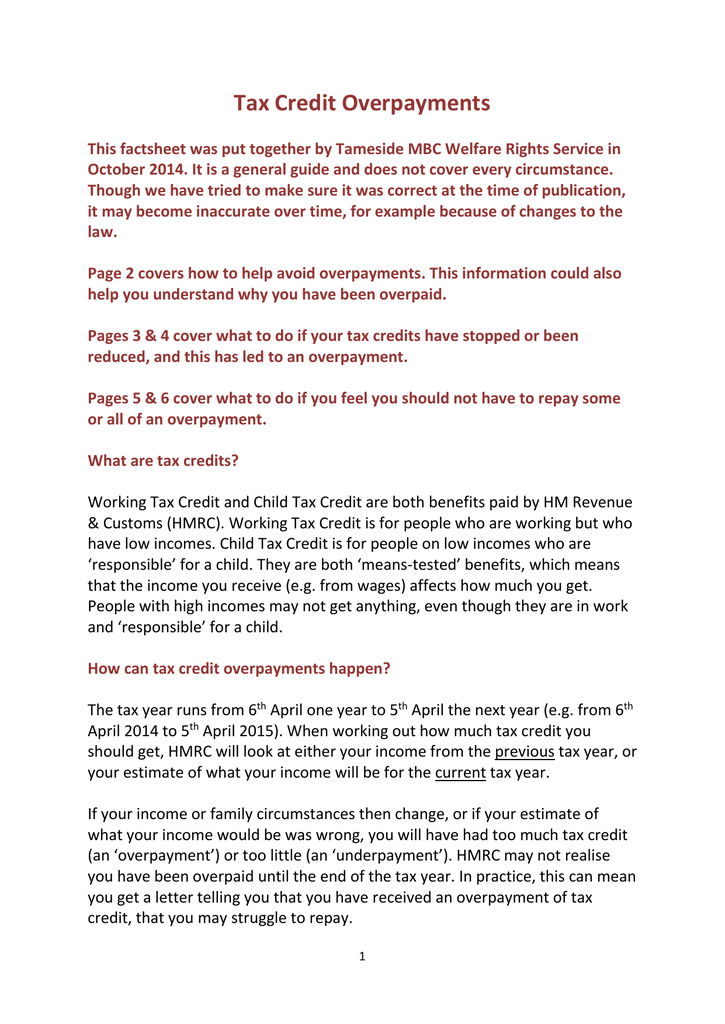

Source: studylib.net

Source: studylib.net

I was wondering if anyone can give us any advice on child tax credit overpayment. Write your tax credit reference number on the back of the cheque. My case was in the home office for around 2 years and got my residence permit in June 2011. The credit must be considered even if it is a negative number. Please keep this letter regarding your advance Child Tax Credit payments with your tax records.

Source: bankruptcyadvice-online.co.uk

Source: bankruptcyadvice-online.co.uk

I am from Pakistan and my wife is British. The nature of the tax credits system means that overpayments are a natural part of it and can arise without fault by either the claimant or HMRC. Please keep this letter regarding your advance Child Tax Credit payments with your tax records. You can find the reference on your letter about overpayments from HM Revenue and Customs HMRC. In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021.

Source: legalbeagles.info

I applied for nat. The form to tell HMRC about a tax credit overpayment. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ. If you still get tax credits or are now getting Universal Credit the money you owe will usually be taken from your future payments. Closed on Saturdays Sunday and Bank Holidays.

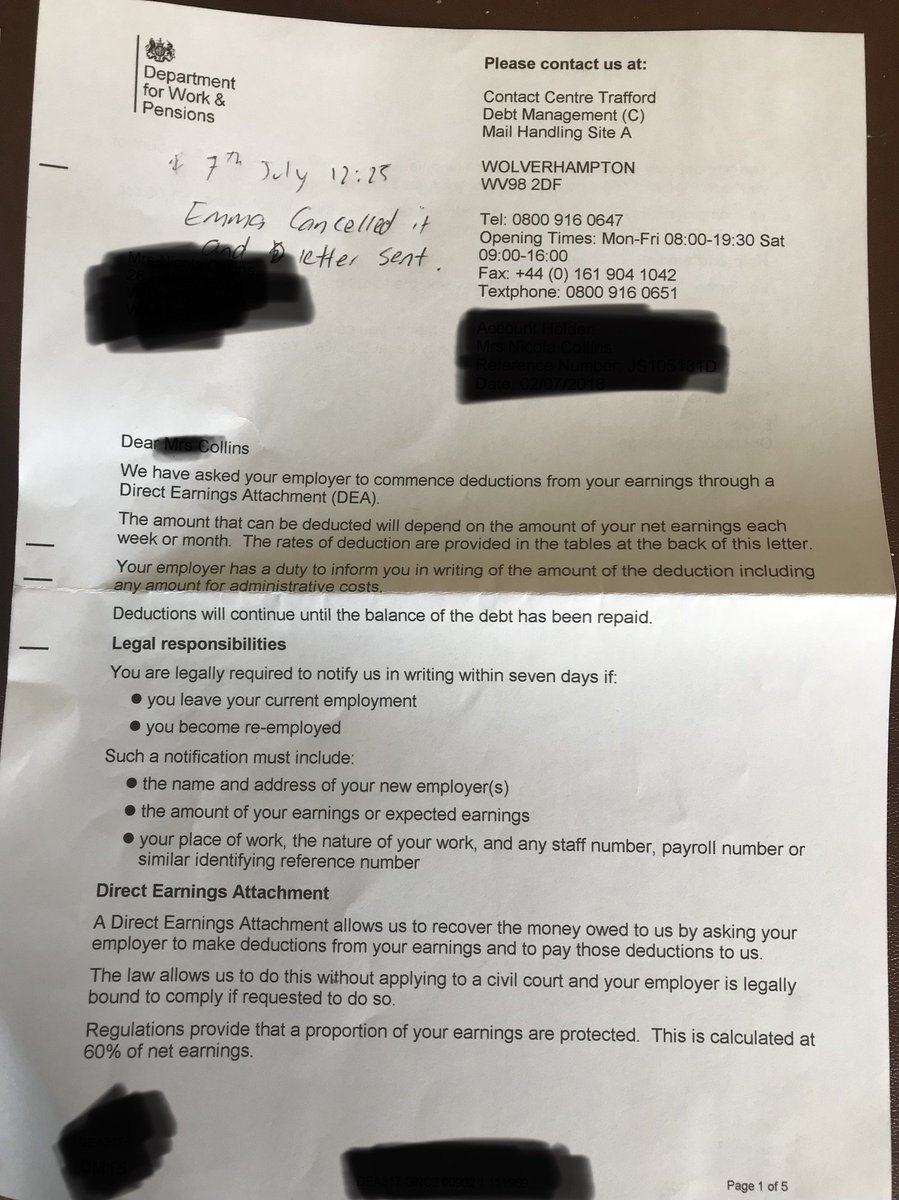

Source: twitter.com

Source: twitter.com

Most advisers who deal with tax credits are likely to have dealt with a claimant who has been overpaid. Youll need your Child Benefit overpayment reference. I applied for national insurance number. For deficiency purposes the earned income credit is treated as a negative tax. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ.

Source: consumeractiongroup.co.uk

Source: consumeractiongroup.co.uk

Write your tax credit reference number on the back of the cheque. Overpayments and underpayments are a normal part of the tax credits system. I applied for national insurance number. Ive managed to find the letters referring to the. You can find the reference on your letter about overpayments from HM Revenue and Customs HMRC.

Source: pdffiller.com

Source: pdffiller.com

My case was in the home office for around 2 years and got my residence permit in June 2011. The nature of the tax credits system means that overpayments are a natural part of it and can arise without fault by either the claimant or HMRC. I am from Pakistan and my wife is British. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ. HMRC will accept your payment on the date you make it and not the date it reaches HMRC.

Source: consumeractiongroup.co.uk

Source: consumeractiongroup.co.uk

Most advisers who deal with tax credits are likely to have dealt with a claimant who has been overpaid. Most advisers who deal with tax credits are likely to have dealt with a claimant who has been overpaid. Child tax credits overpayment. The form to tell HMRC about a tax credit overpayment. My case was in the home office for around 2 years and got my residence permit in June 2011.

Source: litrg.org.uk

Source: litrg.org.uk

This is because when a tax credits award is made it is not final until a final entitlement decision is made which is usually after the end of the tax year for which it has been given or shortly after a claim is ended during a tax year where a person claims Universal Credit in the same tax year. Youll need your Child Benefit overpayment reference. I applied for national insurance number. Youll find this on your notice to pay. The nature of the tax credits system means that overpayments are a natural part of it and can arise without fault by either the claimant or HMRC.

Source: getbailiffadvice.co.uk

Source: getbailiffadvice.co.uk

Child tax credits overpayment. You may need to refer to this letter when you file your 2021 tax return during the 2022 tax filing. My case was in the home office for around 2 years and got my residence permit in June 2011. This is because when a tax credits award is made it is not final until a final entitlement decision is made which is usually after the end of the tax year for which it has been given or shortly after a claim is ended during a tax year where a person claims Universal Credit in the same tax year. The credit must be considered even if it is a negative number.

Source: revenuebenefits.org.uk

Source: revenuebenefits.org.uk

6 April 2021. HMRC will accept your payment on the date you make it and not the date it reaches HMRC. Our phone line opening hours are. Please keep this letter regarding your advance Child Tax Credit payments with your tax records. If you no.

Source: taxcc.org

Source: taxcc.org

I called HMRC directly as there was a number on the letter and just said there was no way I could afford to pay it back as a lump sum and that despite our joint income I dont have access to my husbands bank account. Youll need your Child Benefit overpayment reference. Closed on Saturdays Sunday and Bank Holidays. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified financial planner at CBIZ. Thats weird and also really bad.

Source: news.bbc.co.uk

Source: news.bbc.co.uk

Most advisers who deal with tax credits are likely to have dealt with a claimant who has been overpaid. I am from Pakistan and my wife is British. I am from Pakistan and my wife is British. HMRC will accept your payment on the date you make it and not the date it reaches HMRC. The nature of the tax credits system means that overpayments are a natural part of it and can arise without fault by either the claimant or HMRC.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit overpayment number by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information