Child tax credit meaning information

Home » Trending » Child tax credit meaning informationYour Child tax credit meaning images are ready. Child tax credit meaning are a topic that is being searched for and liked by netizens now. You can Download the Child tax credit meaning files here. Get all royalty-free vectors.

If you’re searching for child tax credit meaning images information related to the child tax credit meaning interest, you have come to the ideal blog. Our site always gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

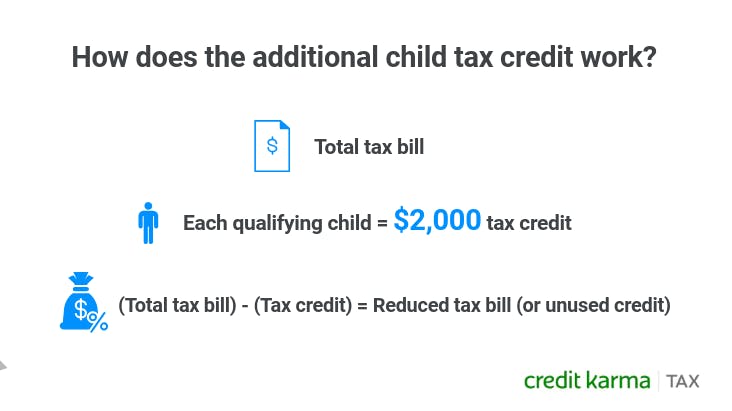

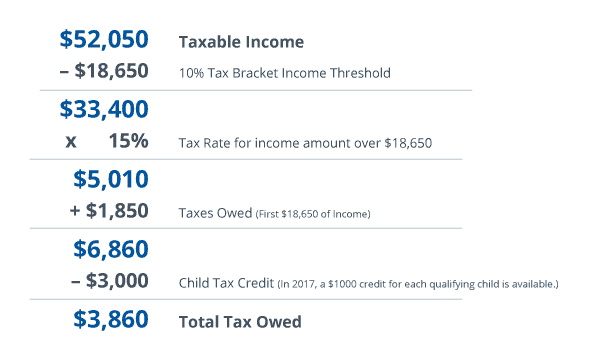

Child Tax Credit Meaning. Originally enacted as part of the Taxpayer Relief Act of 1997 the child tax credit was initially a 500 nonrefundable credit that could be applied by eligible families toward their federal income. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child. These changes apply to tax year 2021 only.

Child Tax Credit 2021 When Payments Start How To Opt Out From nymag.com

Child Tax Credit 2021 When Payments Start How To Opt Out From nymag.com

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The measure is generally referred to as a child tax credit but that doesnt completely capture the impact it will have on most American families. The parents of 60 million US. Child tax credit checks dont count as income so you wont have to pay income taxes on the. And for many families the pandemic has made it harder to make ends meet. Unlike the 2020 credit it covers children who turn 17 in 2021.

The annual child tax credit is up to 3000 for ages 6 to 17 up from 2000 and is 3600 up from 2000 for under 6.

Heres what parents need to know. The tax credit is refundable so all who qualify will receive a payment even if they dont have any earned income or typically earn too little to owe taxes. Even families who earned 0 in 2021 may still be eligible. Child tax credit is a means-tested benefit that can top up your income if you are responsible for at least one child or young person. The money is sorely needed given the ongoing financial stresses from the pandemic some parents told CBS MoneyWatch. Under the existing tax credit families were able to claim up to 2000 annually for children under 17.

Source: forbes.com

Source: forbes.com

Families will receive a maximum of. Child tax credit is a means-tested benefit that can top up your income if you are responsible for at least one child or young person. The Child Tax Credit which has been expanded significantly by Congress since it was first written into law nearly 25 years ago is a significant element of the federal governments effort to. Child Tax Credits if youre responsible for one child or more - how much you get tax credit calculator eligibility claim tax credits Child Tax Credit - GOVUK Cookies on GOVUK. The tax credit is fully refundable although parents should be aware of certain stipulations.

Source: forbes.com

Source: forbes.com

The Child Tax Credit which has been expanded significantly by Congress since it was first written into law nearly 25 years ago is a significant element of the federal governments effort to. Originally enacted as part of the Taxpayer Relief Act of 1997 the child tax credit was initially a 500 nonrefundable credit that could be applied by eligible families toward their federal income. Raising children means giving them plenty of healthy food a safe place to live and other essentials to help them grow and thrive. The short answer is no but there are some financial details you still need to know. The annual child tax credit is up to 3000 for ages 6 to 17 up from 2000 and is 3600 up from 2000 for under 6.

Source: nymag.com

Source: nymag.com

The parents of 60 million US. Unlike the 2020 credit it covers children who turn 17 in 2021. Families will receive a maximum of. The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families. And for many families the pandemic has made it harder to make ends meet.

Source: creditkarma.com

Source: creditkarma.com

Child Tax Credit Becomes more Valuable. The tax credit is refundable so all who qualify will receive a payment even if they dont have any earned income or typically earn too little to owe taxes. Under the existing tax credit families were able to claim up to 2000 annually for children under 17. Even families who earned 0 in 2021 may still be eligible. Unlike the 2020 credit it covers children who turn 17 in 2021.

Source: forbes.com

Source: forbes.com

The annual child tax credit is up to 3000 for ages 6 to 17 up from 2000 and is 3600 up from 2000 for under 6. Child Tax Credit Becomes more Valuable. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families. Under the existing tax credit families were able to claim up to 2000 annually for children under 17.

Source: taxfoundation.org

Source: taxfoundation.org

The federal Child Tax Credit CTC can help make the cost of caring for children more affordable. Under the existing tax credit families were able to claim up to 2000 annually for children under 17. Traditionally the child tax credit provides parents who earn at least 2500 with a 2000 credit for each child under 17. Heres what parents need to know. Child Tax Credit is one of many benefits which are gradually being replaced by Universal Credit.

Source: blog.taxact.com

Source: blog.taxact.com

The tax credit is fully refundable although parents should be aware of certain stipulations. Child tax credit is a means-tested benefit that can top up your income if you are responsible for at least one child or young person. The money is sorely needed given the ongoing financial stresses from the pandemic some parents told CBS MoneyWatch. They doubled this amount to 1000 as part of the 2001 Bush tax cuts. Child tax credit is made up of a number of different payments called elements.

Source: revenuebenefits.org.uk

Source: revenuebenefits.org.uk

These changes apply to tax year 2021 only. The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child. Child Tax Credits if youre responsible for one child or more - how much you get tax credit calculator eligibility claim tax credits Child Tax Credit - GOVUK Cookies on GOVUK. The advance child tax credit program is part of the Biden administrations 19 trillion economic aid package called the American Rescue Plan that was passed in March. The tax credit is refundable so all who qualify will receive a payment even if they dont have any earned income or typically earn too little to owe taxes.

Source: taxfoundation.org

Source: taxfoundation.org

Child Tax Credit is a benefit which can help people financially who are responsible for a child. There are requirements stating which children qualify for. The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child. The federal Child Tax Credit CTC can help make the cost of caring for children more affordable. The advance child tax credit program is part of the Biden administrations 19 trillion economic aid package called the American Rescue Plan that was passed in March.

Source: cnet.com

Source: cnet.com

The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families. Children on Thursday began receiving monthly checks through the expanded federal Child Tax Credit a historic relief measure geared toward families of modest means. Child Tax Credit is a benefit which can help people financially who are responsible for a child. Originally enacted as part of the Taxpayer Relief Act of 1997 the child tax credit was initially a 500 nonrefundable credit that could be applied by eligible families toward their federal income. Traditionally the child tax credit provides parents who earn at least 2500 with a 2000 credit for each child under 17.

Source: cnet.com

Source: cnet.com

But these things can be expensive. Children on Thursday began receiving monthly checks through the expanded federal Child Tax Credit a historic relief measure geared toward families of modest means. They doubled this amount to 1000 as part of the 2001 Bush tax cuts. These changes apply to tax year 2021 only. There are requirements stating which children qualify for.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families. And for many families the pandemic has made it harder to make ends meet. Even families who earned 0 in 2021 may still be eligible. Child Tax Credits if youre responsible for one child or more - how much you get tax credit calculator eligibility claim tax credits Child Tax Credit - GOVUK Cookies on GOVUK. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: cnet.com

Source: cnet.com

The advance child tax credit program is part of the Biden administrations 19 trillion economic aid package called the American Rescue Plan that was passed in March. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Child Tax Credit which has been expanded significantly by Congress since it was first written into law nearly 25 years ago is a significant element of the federal governments effort to. Even families who earned 0 in 2021 may still be eligible. Unlike the 2020 credit it covers children who turn 17 in 2021.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Child Tax Credit is a benefit which can help people financially who are responsible for a child. That credit phased out gradually for every 1000 of income a parent reported over 200000 or 400000 for joint filers. Child Tax Credit Becomes more Valuable. Families will receive a maximum of. The Child Tax Credit which has been expanded significantly by Congress since it was first written into law nearly 25 years ago is a significant element of the federal governments effort to.

Source: financialgym.com

Source: financialgym.com

The annual child tax credit is up to 3000 for ages 6 to 17 up from 2000 and is 3600 up from 2000 for under 6. Child Tax Credit is a benefit which can help people financially who are responsible for a child. You dont have to be working to claim. The parents of 60 million US. The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child.

Source: cnet.com

Source: cnet.com

Raising children means giving them plenty of healthy food a safe place to live and other essentials to help them grow and thrive. The federal Child Tax Credit CTC can help make the cost of caring for children more affordable. You dont have to be working to claim. Heres what parents need to know. But these things can be expensive.

Source:

Source:

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Child Tax Credit is one of many benefits which are gradually being replaced by Universal Credit. The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families. The parents of 60 million US. But while the credit always had upper-income limits it also had lower income limits in its previous form because.

Source: taxfoundation.org

Source: taxfoundation.org

The advance child tax credit program is part of the Biden administrations 19 trillion economic aid package called the American Rescue Plan that was passed in March. Child tax credit is made up of a number of different payments called elements. The measure is generally referred to as a child tax credit but that doesnt completely capture the impact it will have on most American families. But these things can be expensive. That credit phased out gradually for every 1000 of income a parent reported over 200000 or 400000 for joint filers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information