Child tax credit kentucky information

Home » Trending » Child tax credit kentucky informationYour Child tax credit kentucky images are ready. Child tax credit kentucky are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit kentucky files here. Download all free images.

If you’re searching for child tax credit kentucky images information connected with to the child tax credit kentucky interest, you have visit the right site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

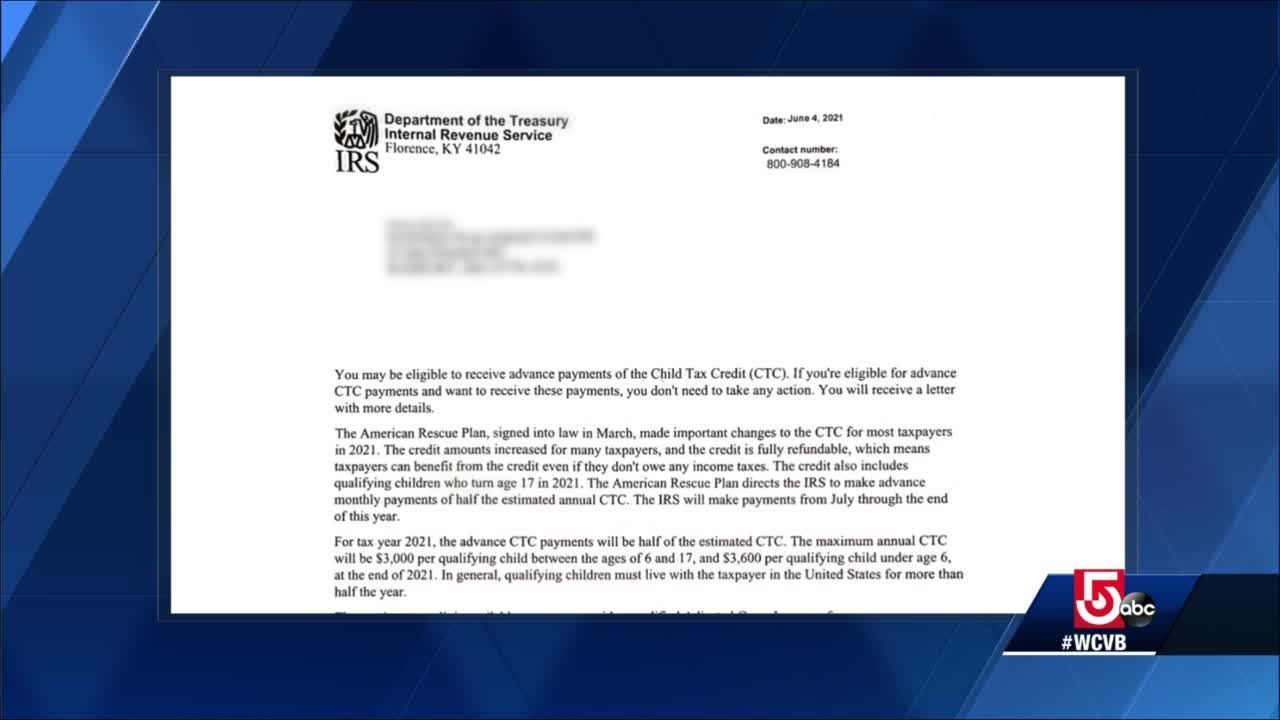

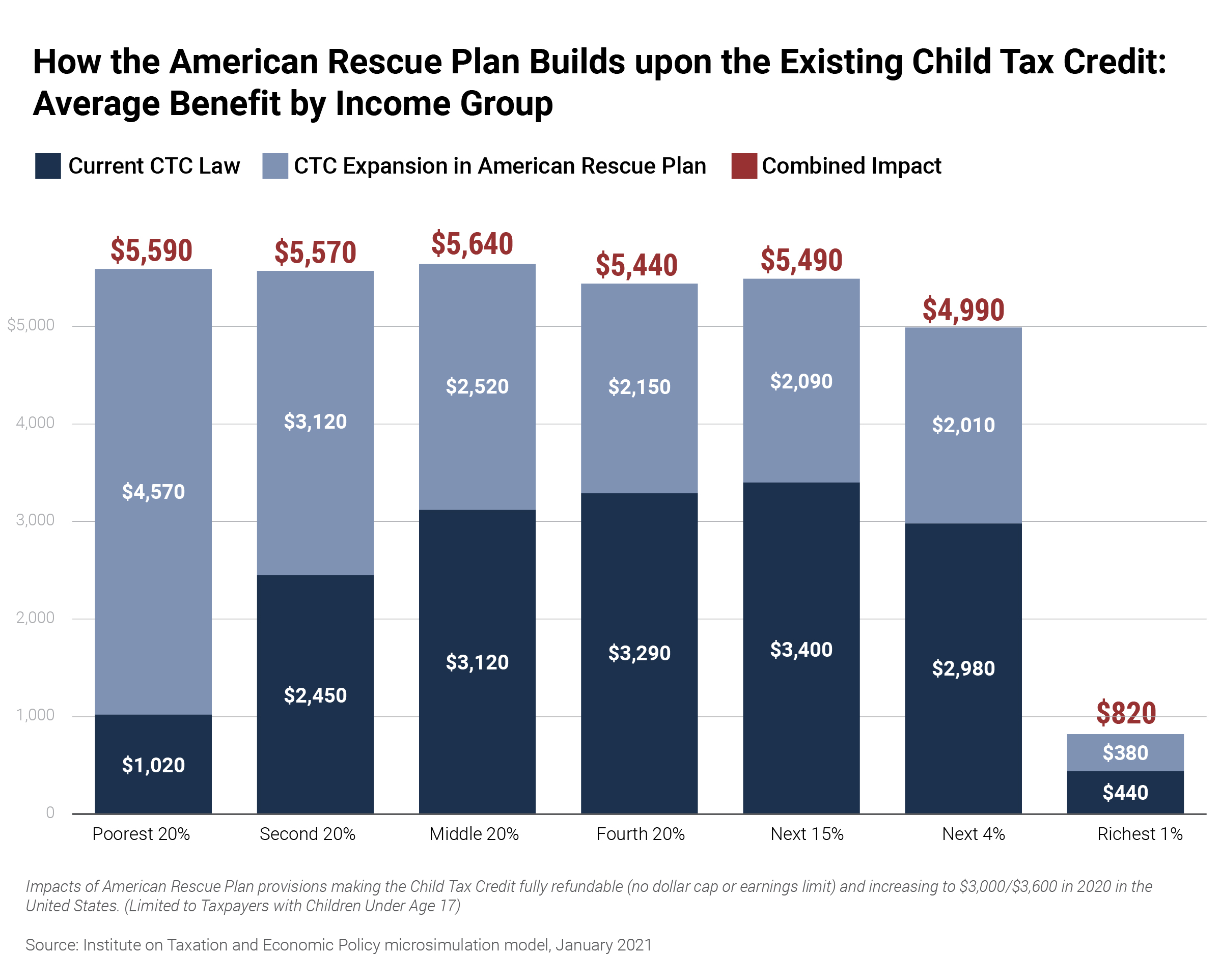

Child Tax Credit Kentucky. Starting Thursday most parents will now get a monthly child tax credit through the end of the year. Beshear did not include any changes in his budget proposal amid a state budget crunch. Will start receiving a monthly child tax credit payment Thursday through the American Rescue Plan a move Rep. American Rescue Plans Expanded Child Tax Credit Will Improve the Lives of Over a Million Kentucky Kids Dustin Pugel April 5 2021 The American Rescue Plan ARP Act includes a historic expansion of the Child Tax Credit CTC which will help an estimated 11 million Kentucky children and lift an estimated 69000 Kentucky kids above the poverty line reducing child poverty.

Xigag0axvm274m From

Xigag0axvm274m From

Those payments will be sent out as an advance on 2021 taxes. CHILD AND DEPENDENT CARE TAX CREDIT CDCTC Rate Non-Refundable. The Kentucky Center for Economic Policy said the families of almost 1 million Kentucky children and 66 million children across the country will. 20 of the federal credit up to 210 for one child and 420 for two or more children. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The credit is claimed on Line 25 of Form 740 or Form 740-NP by entering the amount of the federal credit from federal Form 2441 and multiplying by 20.

John Yarmuth says will greatly help poor Kentucky kids.

Anna Baumann July 15 2021. Kentucky taxpayers claiming the child and dependent care credit must file Form 740 or 740-NP. The Child Tax Credit and Payments to Parents and Caregivers By Kentucky Youth Advocates 2021-06-23T133455-0400 June 23rd 2021 Blog Economic Security Kids Count. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. CHILD AND DEPENDENT CARE TAX CREDIT CDCTC Rate Non-Refundable. Child and Dependent Care Credit.

Source: kftc.org

Source: kftc.org

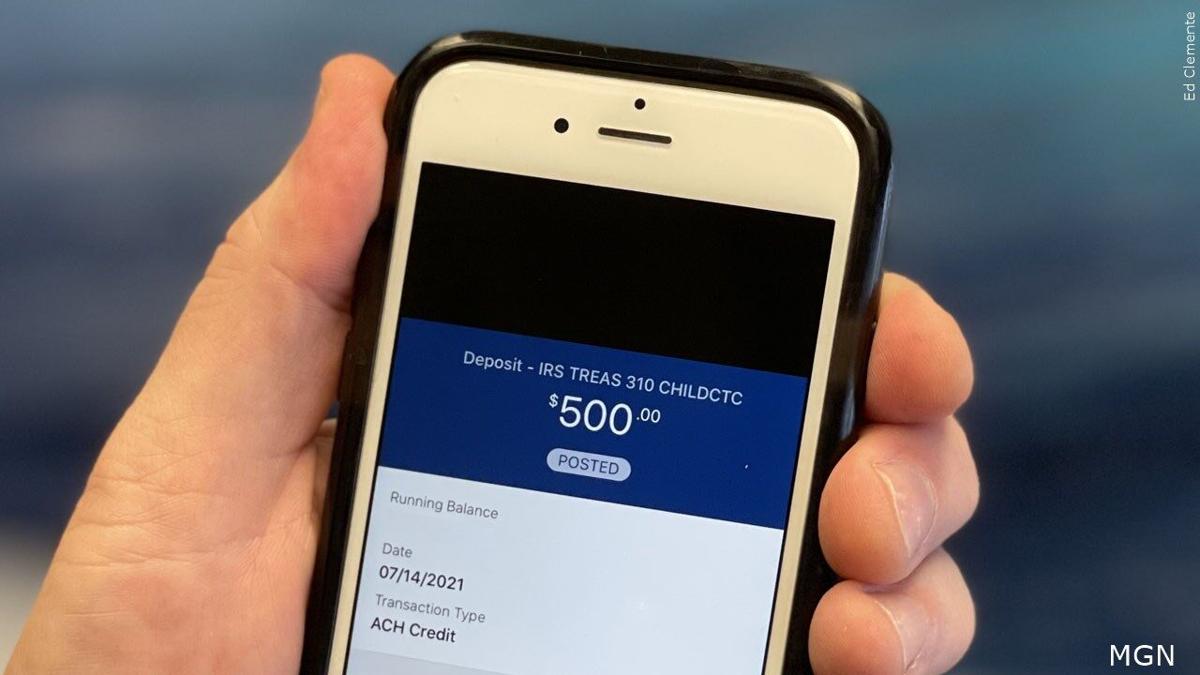

Families across the US. Beginning today July 15 the families of nearly 1 million Kentucky children and 66 million children nationwide will begin receiving much-needed monthly payments through the improved Child Tax Credit CTC included in the American Rescue Plan Act ARPA passed by Congress. Will start receiving a monthly child tax credit payment Thursday through the American Rescue Plan a move Rep. Jason Bailey Executive Director of the Kentucky Center for Economic Policy said the states poorest families will see their income increase by about one-third due to the tax credit. But six months of payments will be advanced on a monthly basis through the.

Source:

Source:

Congress increased this years credit which begins July 15 from 2000 per child to 3000-3600 per child. Families across the US. Anna Baumann July 15 2021. Kentucky taxpayers claiming the child and dependent care credit must file Form 740 or 740-NP. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Source: nkytribune.com

Source: nkytribune.com

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Beginning today July 15 the families of nearly 1 million Kentucky children and 66 million children nationwide will begin receiving much-needed monthly payments through the improved Child Tax Credit CTC included in the American Rescue Plan Act ARPA passed by Congress. Eligible families will receive up to 300 per month for children 5 and under and for children 6. Congress increased this years credit which begins July 15 from 2000 per child to 3000-3600 per child. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Source: usatoday.com

Source: usatoday.com

Families who make more than that may be eligible for a. Those payments will be sent out as an advance on 2021 taxes. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Families who make more than that may be eligible for a. That act made the CTC bigger available to more children and on hand.

Source: kftc.org

Source: kftc.org

The advance CTC payments come as part of the American Rescue Plan ARP Act which has enhanced the amount of CTC up to 3600 annually per child under age 6 and up to 3000 annually per child age 6 to 17. Kentucky taxpayers claiming the child and dependent care credit must file Form 740 or 740-NP. Starting Thursday most parents will now get a monthly child tax credit through the end of the year. The advance CTC payments come as part of the American Rescue Plan ARP Act which has enhanced the amount of CTC up to 3600 annually per child under age 6 and up to 3000 annually per child age 6 to 17. Anna Baumann July 15 2021.

Source: wgntv.com

Source: wgntv.com

Families who make more than that may be eligible for a. Beginning today July 15 the families of nearly 1 million Kentucky children and 66 million children nationwide will begin receiving much-needed monthly payments through the improved Child Tax Credit CTC included in the American Rescue Plan Act ARPA passed by Congress. The Kentucky Center for Economic Policy said the families of almost 1 million Kentucky children and 66 million children across the country will. Eligible families will receive up to 300 per month for children 5 and under and for children 6. Eligible families will begin receiving half of their credit as monthly payments from July through December of 2021.

Source: fox11online.com

Source: fox11online.com

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Experts Call Bigger Child Tax Credit a Game Changer for Kentucky Families. Starting Thursday most parents will now get a monthly child tax credit through the end of the year. Will start receiving a monthly child tax credit payment Thursday through the American Rescue Plan a move Rep. Eligible families will receive up to 300 per month for children 5 and under and for children 6.

Source: whas11.com

Source: whas11.com

Families across the US. The Child Tax Credit and Payments to Parents and Caregivers By Kentucky Youth Advocates 2021-06-23T133455-0400 June 23rd 2021 Blog Economic Security Kids Count. Eligible families will receive up to 300 per month for children 5 and under and for children 6. The program will begin starting in July and families with children can anticipate receiving checks from the IRS. American Rescue Plans Expanded Child Tax Credit Will Improve the Lives of Over a Million Kentucky Kids Dustin Pugel April 5 2021 The American Rescue Plan ARP Act includes a historic expansion of the Child Tax Credit CTC which will help an estimated 11 million Kentucky children and lift an estimated 69000 Kentucky kids above the poverty line reducing child poverty.

Source:

Source:

Jason Bailey Executive Director of the Kentucky Center for Economic Policy said the states poorest families will see their income increase by about one-third due to the tax credit. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Eligible families will begin receiving half of their credit as monthly payments from July through December of 2021. The advance CTC payments come as part of the American Rescue Plan ARP Act which has enhanced the amount of CTC up to 3600 annually per child under age 6 and up to 3000 annually per child age 6 to 17. Approximately 11 million Kentucky children and their families will be eligible for the one-year expanded tax credit.

Source: news.yahoo.com

Source: news.yahoo.com

John Yarmuth says will greatly help poor Kentucky kids. Starting Thursday most parents will now get a monthly child tax credit through the end of the year. Beshear did not include any changes in his budget proposal amid a state budget crunch. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Eligible families will begin receiving half of their credit as monthly payments from July through December of 2021.

Source: incometaxpro.net

Source: incometaxpro.net

Experts Call Bigger Child Tax Credit a Game Changer for Kentucky Families. The program will begin starting in July and families with children can anticipate receiving checks from the IRS. Jason Bailey Executive Director of the Kentucky Center for Economic Policy said the states poorest families will see their income increase by about one-third due to the tax credit. John Yarmuth at a news conference about the child tax credit that will be distributed to qualifying families beginning Thursday July 15. The Kentucky Center for Economic Policy said the families of almost 1 million Kentucky children and 66 million children across the country will.

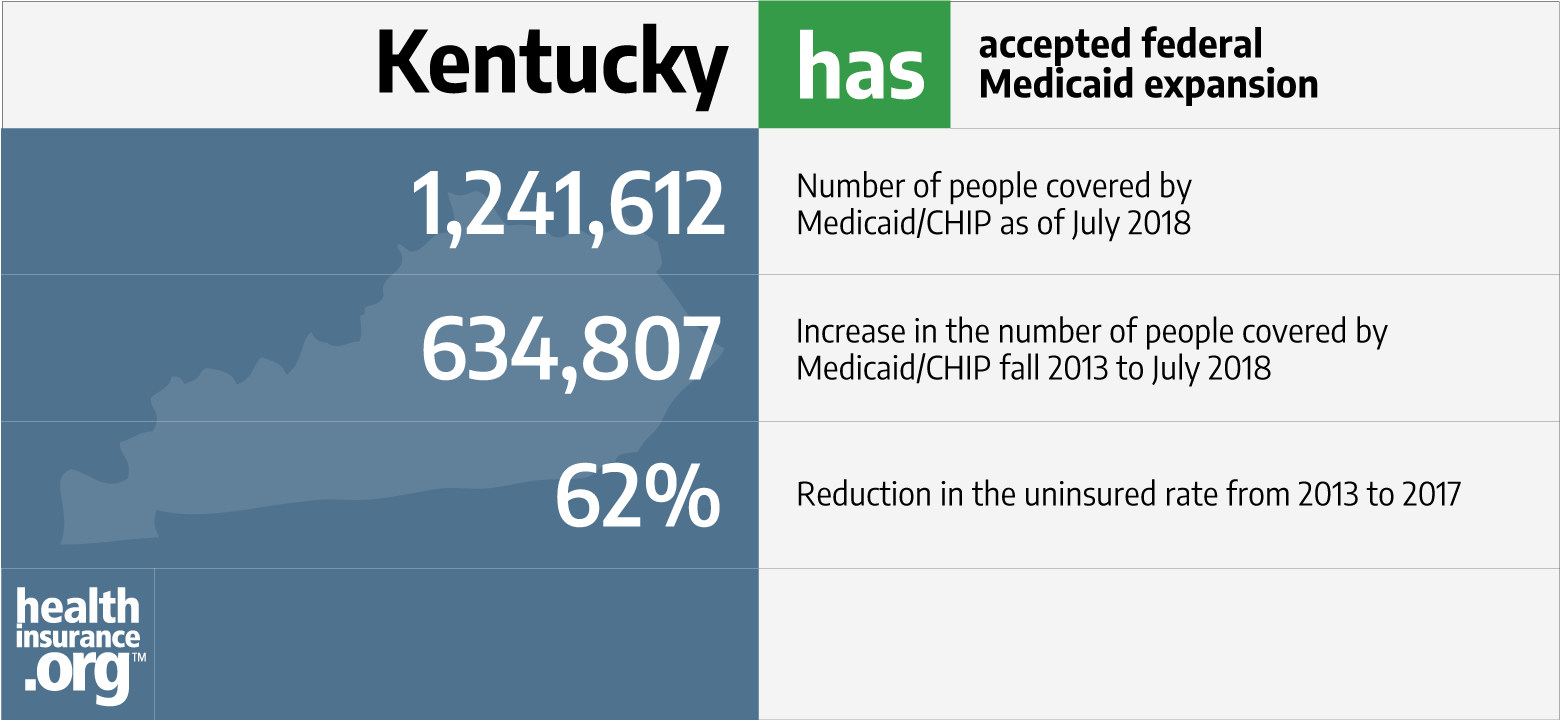

Source: healthinsurance.org

Source: healthinsurance.org

The program will begin starting in July and families with children can anticipate receiving checks from the IRS. Will start receiving a monthly child tax credit payment Thursday through the American Rescue Plan a move Rep. Families across the US. Anna Baumann July 15 2021. Jason Bailey Executive Director of the Kentucky Center for Economic Policy said the states poorest families will see their income increase by about one-third due to the tax credit.

Source: en.as.com

Source: en.as.com

That act made the CTC bigger available to more children and on hand. Anna Baumann July 15 2021. Will start receiving a monthly child tax credit payment Thursday through the American Rescue Plan a move Rep. That act made the CTC bigger available to more children and on hand. Congress increased this years credit which begins July 15 from 2000 per child to 3000-3600 per child.

Source: hhck.org

Source: hhck.org

Eligible families will receive up to 300 per month for children 5 and under and for children 6. Families who make more than that may be eligible for a. The program will begin starting in July and families with children can anticipate receiving checks from the IRS. John Yarmuth says will greatly help poor Kentucky kids. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Source: reddit.com

Source: reddit.com

That act made the CTC bigger available to more children and on hand. That act made the CTC bigger available to more children and on hand. Beginning today July 15 the families of nearly 1 million Kentucky children and 66 million children nationwide will begin receiving much-needed monthly payments through the improved Child Tax Credit CTC included in the American Rescue Plan Act ARPA passed by Congress. This includes low-income families who have not historically made enough or have no income at all will be eligible. The program will begin starting in July and families with children can anticipate receiving checks from the IRS.

Source: wdrb.com

Source: wdrb.com

Eligible families will receive up to 300 per month for children 5 and under and for children 6. Single filers who make 75000 or less each year and joint filers making 150000 or less will be eligible for the full child tax credit. The Kentucky Center for Economic Policy said the families of almost 1 million Kentucky children and 66 million children across the country will. Beginning today July 15 the families of nearly 1 million Kentucky children and 66 million children nationwide will begin receiving much-needed monthly payments through the improved Child Tax Credit CTC included in the American Rescue Plan Act ARPA passed by Congress. Families who make more than that may be eligible for a.

Source:

Source:

Single filers who make 75000 or less each year and joint filers making 150000 or less will be eligible for the full child tax credit. In 2011 Kentucky advocates worked to expand the CDCTC and make it refundable but Gov. Families across the US. The advance CTC payments come as part of the American Rescue Plan ARP Act which has enhanced the amount of CTC up to 3600 annually per child under age 6 and up to 3000 annually per child age 6 to 17. CHILD AND DEPENDENT CARE TAX CREDIT CDCTC Rate Non-Refundable.

Source: itep.org

Source: itep.org

Eligible families will receive up to 300 per month for children 5 and under and for children 6. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. That act made the CTC bigger available to more children and on hand. In 2011 Kentucky advocates worked to expand the CDCTC and make it refundable but Gov. The Kentucky Center for Economic Policy said the families of almost 1 million Kentucky children and 66 million children across the country will.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit kentucky by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information