Child tax credit delay 2020 information

Home » Trending » Child tax credit delay 2020 informationYour Child tax credit delay 2020 images are available. Child tax credit delay 2020 are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit delay 2020 files here. Find and Download all royalty-free vectors.

If you’re looking for child tax credit delay 2020 images information linked to the child tax credit delay 2020 interest, you have visit the right site. Our website always gives you suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Child Tax Credit Delay 2020. So the earliest date anyone could expect to get a refund this year was Feb. You Claim Certain Credits. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The IRS is open again and currently processing mail tax returns.

All Around Business On Instagram How To Sell Anything To Anyone Tag A Friend Allaroun Business Money Business Ideas Entrepreneur Business Skills From pinterest.com

All Around Business On Instagram How To Sell Anything To Anyone Tag A Friend Allaroun Business Money Business Ideas Entrepreneur Business Skills From pinterest.com

The tax credit will. Because of the pandemic the IRS ran at restricted capacity in 2020 which put a strain on its ability to process tax returns. The Child Tax Credit is essentially an additional refund to be paid to filers with children who qualify for eligibility. If you miss the filing date which is the game plan of this pandemic parent who at this moment is bolstering your tax strategy rather than finishing her own accounting you. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. Delayed refunds containing the earned income tax credit EITC andor the additional child tax credit ACTC.

If you miss the filing date which is the game plan of this pandemic parent who at this moment is bolstering your tax strategy rather than finishing her own accounting you.

According to the law the IRS has to wait until Feb. So you could see a delay until the middle to end of February. According to the law the IRS has to wait until Feb. Meanwhile the additional child tax. 15 but the IRS is saying to expect your refund by the first week of March. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers.

Source: id.pinterest.com

Source: id.pinterest.com

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. As we are still in the midst of tax season 2020 and the IRS has also begun. Families can receive a credit of 3600 for each child under 6 and 3000 for each one under age 18 up from the current credit of up to 2000 per child under age 17. 15 but the IRS is saying to expect your refund by the first week of March. The IRS cant release these refunds before Feb.

Source: forbes.com

Source: forbes.com

The Biden administration announced Monday that the Internal Revenue Service will send the monthly child tax credit payments on the 15th of the. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The tax credit will. So you could see a delay until the middle to end of February. The IRS cant release these refunds before Feb.

Source: abc7news.com

Source: abc7news.com

Well issue the first advance payment on July 15 2021. Congress increased it to 3000 for children from the age of six until seventeen and. The IRS is open again and currently processing mail tax returns. The tax credit will. Families can receive a credit of 3600 for each child under 6 and 3000 for each one under age 18 up from the current credit of up to 2000 per child under age 17.

Source: pinterest.com

Source: pinterest.com

The IRS cant release these refunds before Feb. If you file early the IRS will hold your refund until February 15 and then begin processing your refund. You Claim Certain Credits. Typically the IRS sends most refunds within three weeks of taxpayers filing their return. The IRS cant release these refunds before Feb.

Source: pinterest.com

Source: pinterest.com

If you miss the filing date which is the game plan of this pandemic parent who at this moment is bolstering your tax strategy rather than finishing her own accounting you. The deadline is Jan. Backlog of income tax returns is growing delaying refunds to millions. 15 to issue a refund to taxpayers who claimed either of those credits. Well issue the first advance payment on July 15 2021.

Source: id.pinterest.com

Source: id.pinterest.com

But the millions of families that earn below that threshold will receive the expanded credit which is 3600 for each child under 6 and 3000 for each child between 6 to 17. The enhanced portion of the. If you miss the filing date which is the game plan of this pandemic parent who at this moment is bolstering your tax strategy rather than finishing her own accounting you. You Claim Certain Credits. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: pinterest.com

Source: pinterest.com

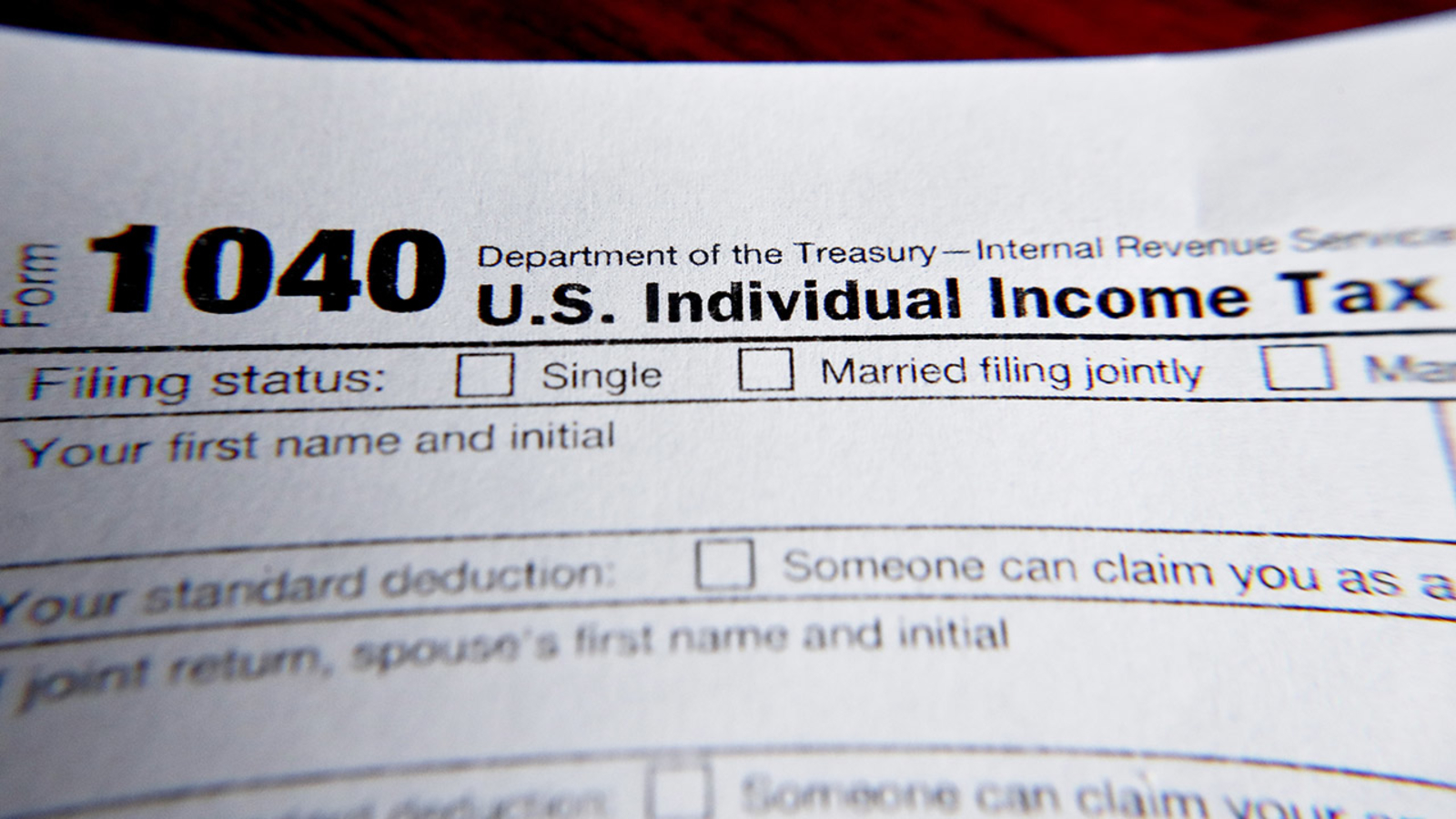

For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly. If you file early the IRS will hold your refund until February 15 and then begin processing your refund. But the millions of families that earn below that threshold will receive the expanded credit which is 3600 for each child under 6 and 3000 for each child between 6 to 17. Families must file a 2020 tax return or the IRS will not have the information it needs to deliver this child tax credit said Elaine Maag principal research associate at the Urban-Brookings Tax. The enhanced portion of the.

Source: pinterest.com

Source: pinterest.com

15 but the IRS is saying to expect your refund by the first week of March. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. Delayed refunds containing the earned income tax credit EITC andor the additional child tax credit ACTC. If you file early the IRS will hold your refund until February 15 and then begin processing your refund. Families can receive a credit of 3600 for each child under 6 and 3000 for each one under age 18 up from the current credit of up to 2000 per child under age 17.

Source: forbes.com

Source: forbes.com

The Biden administration announced Monday that the Internal Revenue Service will send the monthly child tax credit payments on the 15th of the. The Biden administration announced Monday that the Internal Revenue Service will send the monthly child tax credit payments on the 15th of the. Delayed refunds containing the earned income tax credit EITC andor the additional child tax credit ACTC. Families can receive a credit of 3600 for each child under 6 and 3000 for each one under age 18 up from the current credit of up to 2000 per child under age 17. The Child Tax Credit is essentially an additional refund to be paid to filers with children who qualify for eligibility.

Source: efile.com

Source: efile.com

15 to issue a refund to taxpayers who claimed either of those credits. The tax credit will. The IRS cant release these refunds before Feb. The enhanced portion of the. Before the ARPA was passed the credit stood at 2000 per child per year.

Source: pinterest.com

Source: pinterest.com

15 but the IRS is saying to expect your refund by the first week of March. If you miss the filing date which is the game plan of this pandemic parent who at this moment is bolstering your tax strategy rather than finishing her own accounting you. You Claim Certain Credits. Before the ARPA was passed the credit stood at 2000 per child per year. So the earliest date anyone could expect to get a refund this year was Feb.

Source: pinterest.com

Source: pinterest.com

Enter Payment Info Here tool. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. 15 but the IRS is saying to expect your refund by the first week of March. Families must file a 2020 tax return or the IRS will not have the information it needs to deliver this child tax credit said Elaine Maag principal research associate at the Urban-Brookings Tax. For example in 2020 a married couple with two kids must have an adjusted gross income of no more than 53330 in order to claim the earned income tax credit.

Source: wavy.com

Source: wavy.com

The enhanced portion of the. 15 to issue a refund to taxpayers who claimed either of those credits. Typically the IRS sends most refunds within three weeks of taxpayers filing their return. The tax credit will. Because of the pandemic the IRS ran at restricted capacity in 2020 which put a strain on its ability to process tax returns.

Source: pinterest.com

Source: pinterest.com

The IRS cant release these refunds before Feb. For example in 2020 a married couple with two kids must have an adjusted gross income of no more than 53330 in order to claim the earned income tax credit. Before the ARPA was passed the credit stood at 2000 per child per year. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. According to the law the IRS has to wait until Feb.

Source: pinterest.com

Source: pinterest.com

But the millions of families that earn below that threshold will receive the expanded credit which is 3600 for each child under 6 and 3000 for each child between 6 to 17. Typically the IRS sends most refunds within three weeks of taxpayers filing their return. Meanwhile the additional child tax. Because of the pandemic the IRS ran at restricted capacity in 2020 which put a strain on its ability to process tax returns. 15 to issue a refund to taxpayers who claimed either of those credits.

Source: cnet.com

Source: cnet.com

Because of the pandemic the IRS ran at restricted capacity in 2020 which put a strain on its ability to process tax returns. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. 15 to issue a refund to taxpayers who claimed either of those credits. Families must file a 2020 tax return or the IRS will not have the information it needs to deliver this child tax credit said Elaine Maag principal research associate at the Urban-Brookings Tax. So the earliest date anyone could expect to get a refund this year was Feb.

Source: in.pinterest.com

Source: in.pinterest.com

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. 15 to issue a refund to taxpayers who claimed either of those credits. As we are still in the midst of tax season 2020 and the IRS has also begun. The deadline is Jan. The tax credit will.

Source: forbes.com

Source: forbes.com

If you file on the early side and claim the earned income tax credit EITC or the additional child tax credit ACTC you will have to wait a bit for a refund. According to the law the IRS has to wait until Feb. The IRS cant release these refunds before Feb. The IRS is open again and currently processing mail tax returns. Typically the IRS sends most refunds within three weeks of taxpayers filing their return.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit delay 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information