Child tax credit calculator 2020 information

Home » News » Child tax credit calculator 2020 informationYour Child tax credit calculator 2020 images are ready in this website. Child tax credit calculator 2020 are a topic that is being searched for and liked by netizens now. You can Find and Download the Child tax credit calculator 2020 files here. Download all royalty-free photos and vectors.

If you’re looking for child tax credit calculator 2020 pictures information connected with to the child tax credit calculator 2020 keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Child Tax Credit Calculator 2020. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. The advanced Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. The children ages are as of December 31 2021.

Try The Child Tax Credit Calculator For 2020 2021 From internettaxconnection.com

Try The Child Tax Credit Calculator For 2020 2021 From internettaxconnection.com

2You can claim 500 for each child aged 17 and 18 or for full-time college students between the ages of 19 and 24. What is the Child Tax Credit. Year 2021 -CTC Refund Rules. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. You will need to provide the number of children you have in two age brackets 5 and younger and 6 to 17. Example Limitations 2020 and prior.

Heres how to calculate how much youll get.

Tax credits calculator - GOVUK. Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. However because the credit is only partially refundable the maximum credit you could claim would be. Phaseout Begins Single Head of Household Widower 8790. If the amount of the credit you can claim is 2000 but the amount of your income tax liability is 400 the credit ordinarily will be limited to 1600 2000 - 400. What is the Child Tax Credit.

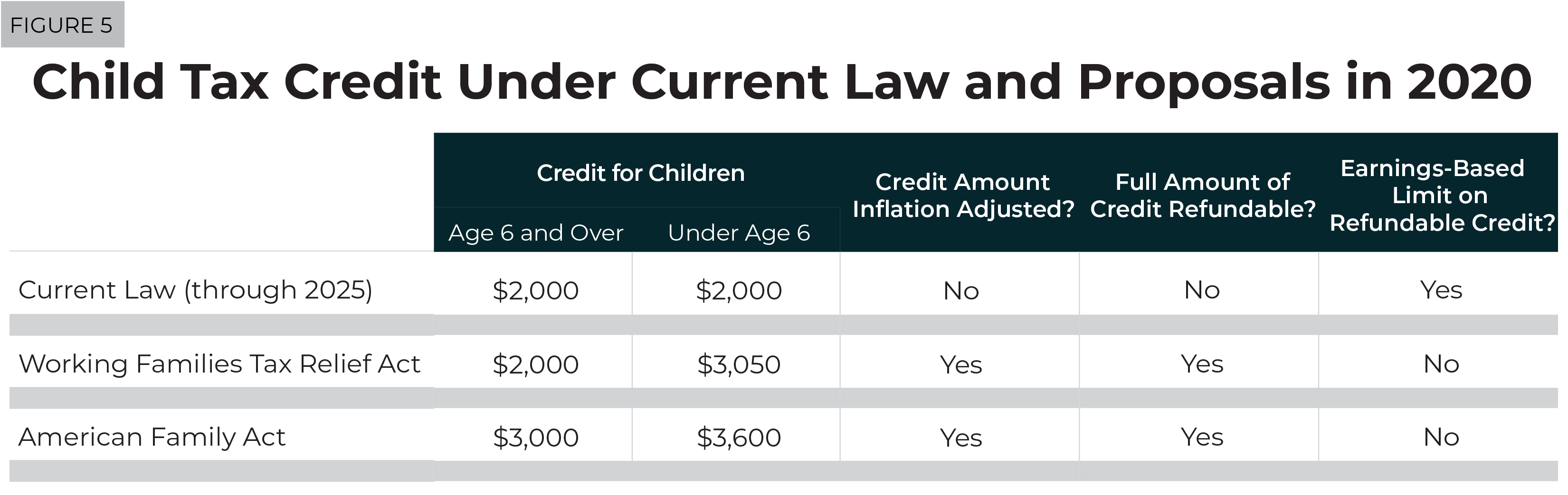

Source: itep.org

Source: itep.org

The children ages are as of December 31 2021. The tax credit is not a deduction so if you claim the full 2000 and you owe 3000 in Federal taxes youll now only owe 1000. Child Tax Credit calculator. Phaseout Begins Single Head of Household Widower 8790. The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit.

Source: cnet.com

Source: cnet.com

You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. If the amount of the credit you can claim is 2000 but the amount of your income tax liability is 400 the credit ordinarily will be limited to 1600 2000 - 400. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Child Tax Credit calculator.

Source: theofy.world

Source: theofy.world

The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. August 23 2020 Tax Credits. 2020 Tax Year Additional Child Tax Credit ACTC Relief. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. For the 2020 tax year the child tax credit was 2000 per qualifying child.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

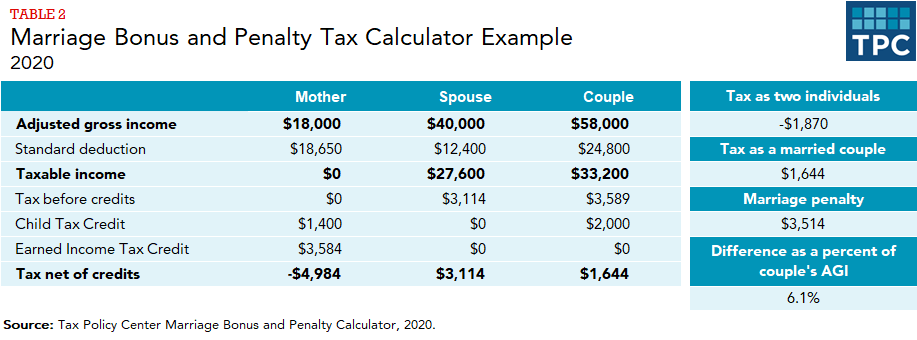

August 23 2020 Tax Credits. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. Earned Income Tax Credit for Tax Year 2020 No Children One Child Two Children Three or More Children. 2020 Earned Income Amount. For parents and guardians of dependent children the Internal Revenue Service IRS provides a tax credit that can help reduce your tax liability for the 2020 2021 tax season.

Source: abcnews.go.com

Source: abcnews.go.com

Phaseout Begins Single Head of Household Widower 8790. Heres how to calculate how much youll get. August 23 2020 Tax Credits. The children ages are as of December 31 2021. What is the Child Tax Credit.

Source:

Source:

Year 2020 -CTC Refund Rules. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. 2020 Tax Year Additional Child Tax Credit ACTC Relief. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit.

Source: cnet.com

Source: cnet.com

Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. The advanced Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021. Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. Earned Income Tax Credit for Tax Year 2020 No Children One Child Two Children Three or More Children. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

Source: cnet.com

Source: cnet.com

You will need to provide the number of children you have in two age brackets 5 and younger and 6 to 17. If the amount of the credit you can claim is 2000 but the amount of your income tax liability is 400 the credit ordinarily will be limited to 1600 2000 - 400. For the 2020 tax year the child tax credit was 2000 per qualifying child. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. If your earned income eg.

Source: creditkarma.com

Source: creditkarma.com

Phaseout Ends Single Head of Household Widower 15820. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The tax credit is not a deduction so if you claim the full 2000 and you owe 3000 in Federal taxes youll now only owe 1000. The children ages are as of December 31 2021. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: kff.org

Source: kff.org

Find out how much money you could get under the American Rescue Plans new rules for 2021 Parents get a maximum 3600 credit per child under 6 and 3000 for those ages 6 to 17. Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be. Phaseout Ends Single Head of Household Widower 15820.

Source: abcnews.go.com

Source: abcnews.go.com

The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or. Year 2020 -CTC Refund Rules. Year 2021 -CTC Refund Rules.

Source: abcnews.go.com

Source: abcnews.go.com

What is the Child Tax Credit. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or. W-2 wage income andor net earnings from self-employment andor certain disability payments was higher in 2019 than in 2020 you can use the 2019 amount to figure your ACTC for 2020. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. Phaseout Ends Single Head of Household Widower 15820.

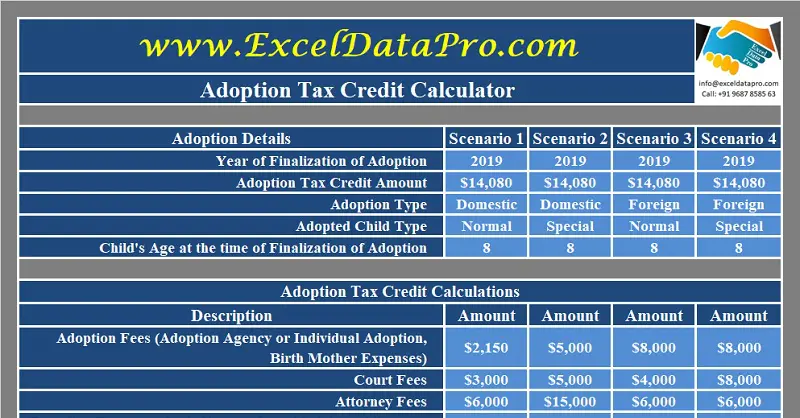

Source: exceldatapro.com

Source: exceldatapro.com

For parents and guardians of dependent children the Internal Revenue Service IRS provides a tax credit that can help reduce your tax liability for the 2020 2021 tax season. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or. Tax credits calculator - GOVUK. Child Tax Credit calculator. 1You get to claim the lesser of 15 of your earned income above 2500 or your unused Child Tax Credit amount up to 1400 per qualifying child aged upto 16 years.

Source: forbes.com

Source: forbes.com

Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. Year 2021 -CTC Refund Rules. The payments for the CCB young child supplement are not reflected in this calculation.

Source:

Source:

Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. 2You can claim 500 for each child aged 17 and 18 or for full-time college students between the ages of 19 and 24. Find answers on this page about the child tax credit payment the calculator and why you may want to use the IRS child tax credit portal.

Source: cnet.com

Source: cnet.com

Child and family benefits calculator. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. What is the Child Tax Credit. The advanced Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021.

Source: fox8.com

Source: fox8.com

Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. Thats up to 7200 for twins Thats on top of payments for any other qualified child dependents you claim. Tax credits calculator - GOVUK. Maximum 2020 Credit Amount. However because the credit is only partially refundable the maximum credit you could claim would be.

Source: internettaxconnection.com

Source: internettaxconnection.com

Child and family benefits calculator. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. 2You can claim 500 for each child aged 17 and 18 or for full-time college students between the ages of 19 and 24. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit calculator 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information