Child tax credit bc information

Home » News » Child tax credit bc informationYour Child tax credit bc images are available. Child tax credit bc are a topic that is being searched for and liked by netizens now. You can Find and Download the Child tax credit bc files here. Download all royalty-free images.

If you’re searching for child tax credit bc images information connected with to the child tax credit bc topic, you have pay a visit to the right blog. Our website always gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

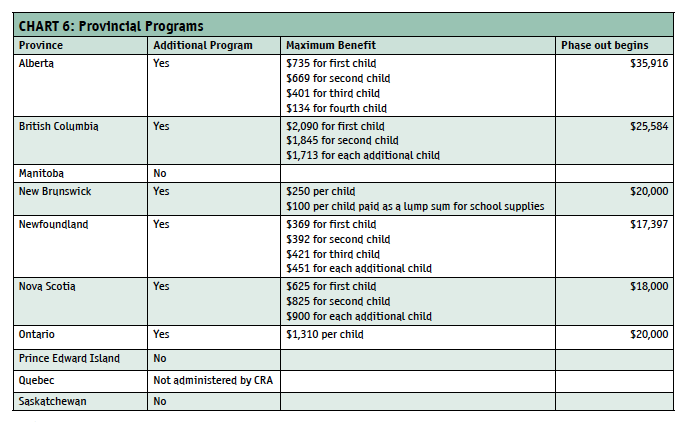

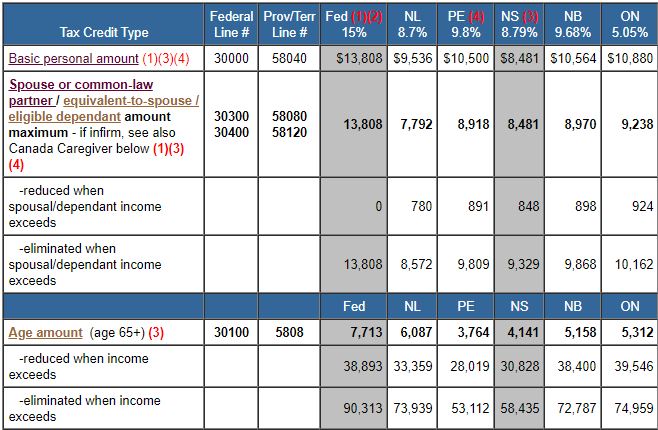

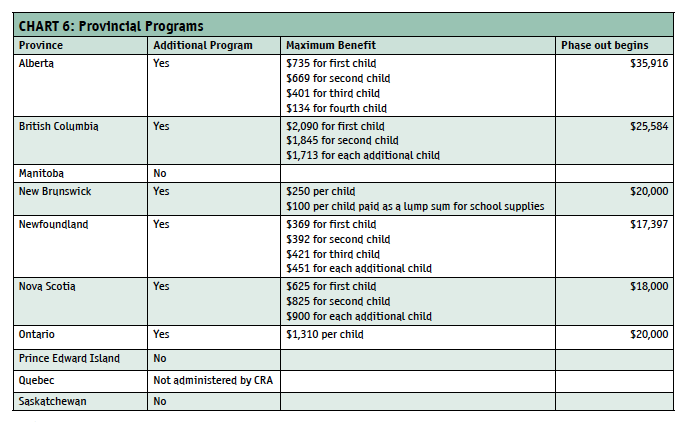

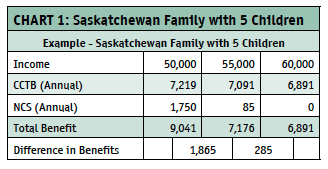

Child Tax Credit Bc. Each credit will be a non-refundable tax credit of 506 lowest tax rate of eligible expenditures up to 500 for each child providing a tax credit of up to 25 per child. For July 2021 to June 2022 the BCCATC provides a credit of up to 17400 for an individual 17400 for a spouse or common-law partner and 5100 per child 17400 for the first child in a single parent family. It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. Taxes owing to zero but wont provide a refund even if the total of the credits is higher than your BC.

How To Use Rrsp Contributions To Maximize Child Tax Benefit Canadian Moneysaver From canadianmoneysaver.ca

How To Use Rrsp Contributions To Maximize Child Tax Benefit Canadian Moneysaver From canadianmoneysaver.ca

That breaks down to 300 per month. BC CPI for the 12-month period ended on September 30 of the previous year. Children with disabilities will receive an additional amount for the Child Disability Benefit. The BC Recovery Benefit provided a one-time tax-free payment of up to 1000 for eligible families and single parents and up to 500 for eligible individuals. Early Childhood Tax Benefit BCECTB is a tax-free monthly payment made to eligible families to help with the cost of raising young children under age 6. If you owe 1000 in income taxes and your BC.

Introduced by the BC 2012 Budget these credits are applicable to the 2012 and later taxation years.

The CCB may include the child disability benefit and any related provincial and territorial programs. The amount you receive is dependent on. The BC Recovery Benefit application is closed effective July 1 2021. The BC Recovery Benefit provided a one-time tax-free payment of up to 1000 for eligible families and single parents and up to 500 for eligible individuals. CRA offers Canada Child Benefit which is a non-taxable benefit for each eligible family to cover the cost of raising children under the age of 18. For each child under age 6 it is 3600.

Source: canadianmoneysaver.ca

Source: canadianmoneysaver.ca

BC CPI for the 12-month period ended on September 30 of the previous year. How the child tax credit payments will be divided between 2021 and 2022 might be confusing. You can claim 5000 for a disabled child over the age of 16 who does not qualify for the disability tax credit but was still dependent on you and required care. It was calculated based on net income from your 2019 tax return. For each child under age 6 it is 3600.

Source: canadianmoneysaver.ca

Source: canadianmoneysaver.ca

Taxes owing to zero but wont provide a refund even if the total of the credits is higher than your BC. Child Opportunity Benefit amount families. The child disability benefit CDB is a tax-free monthly payment made to families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions. Children with disabilities will receive an additional amount for the Child Disability Benefit. Benefits from this program are combined with the federal Canada Child Benefit CCB into a single monthly payment.

Source: canadianmoneysaver.ca

Source: canadianmoneysaver.ca

Early Childhood Tax Benefit BCECTB is a tax-free monthly payment made to eligible families to help with the cost of raising young children under age 6. If you owe 1000 in income taxes and your BC. What is the CCB. Each credit will be a non-refundable tax credit of 506 lowest tax rate of eligible expenditures up to 500 for each child providing a tax credit of up to 25 per child. For each qualifying child age 5 and younger up.

Source: youtube.com

Source: youtube.com

Line 31300 Adoption expenses Find out what expenses are eligible for this credit and how to calculate and claim them. Benefits from this program are combined with the federal Canada Child Benefit CCB into a single monthly payment. Children with disabilities will receive an additional amount for the Child Disability Benefit. Non-refundable tax credits will only reduce your BC. Child Opportunity Benefit amount families.

Source: savvynewcanadians.com

Source: savvynewcanadians.com

For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit. That breaks down to 300 per month. What is the CCB. Benefits from this program are combined with the federal Canada Child Benefit CCB into a single monthly payment. It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age.

Source: globalnews.ca

Source: globalnews.ca

That breaks down to 300 per month. Line 31300 Adoption expenses Find out what expenses are eligible for this credit and how to calculate and claim them. Introduced by the BC 2012 Budget these credits are applicable to the 2012 and later taxation years. These tax credits are not increased for indexation. Tamika Daniel poses for a photo in Richmond Va Thursday July 15 2021.

Source: savvynewcanadians.com

Source: savvynewcanadians.com

The BC CPI used to calculate 2020 amounts was 25 and 11 for 2021. For each child under age 6 it is 3600. That breaks down to 300 per month. How the child tax credit payments will be divided between 2021 and 2022 might be confusing. These tax credits are not increased for indexation.

The CCB is a tax-free benefit available to eligible families. Taxes owing to zero but wont provide a refund even if the total of the credits is higher than your BC. CRA offers Canada Child Benefit which is a non-taxable benefit for each eligible family to cover the cost of raising children under the age of 18. The extra 1000 a month for the next year could be a life-changer for Daniel who now works as a community organizer for a Richmond nonprofit. Tamika Daniel poses for a photo in Richmond Va Thursday July 15 2021.

Source: bcparent.ca

Source: bcparent.ca

CRA offers Canada Child Benefit which is a non-taxable benefit for each eligible family to cover the cost of raising children under the age of 18. For the July 2021 to June 2022 payment cycle the CCB provides a maximum annual benefit of 6833 for each child under age 6 and up to 5765 per year for each child between the age of 6 and 17. How the child tax credit payments will be divided between 2021 and 2022 might be confusing. Child Opportunity Benefit which replaced the BC. For disabled dependent children of any age who qualify for the disability tax credit the amount to claim for that child is 11000.

Source: taxtips.ca

Source: taxtips.ca

Line 31300 Adoption expenses Find out what expenses are eligible for this credit and how to calculate and claim them. Early Childhood Tax Benefit effective October 1 2020 provides a tax-free monthly payment to families with children under the age of 18. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit. These tax credits are not increased for indexation. Daniel a 35-year-old mother of four will start receiving the Child Tax Credit on Thursday.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

The CCB may include the child disability benefit and any related provincial and territorial programs. For July 2021 to June 2022 the BCCATC provides a credit of up to 17400 for an individual 17400 for a spouse or common-law partner and 5100 per child 17400 for the first child in a single parent family. Child Opportunity Benefit amount families. These tax credits are not increased for indexation. The child tax credit math is somewhat involved this time around.

Source: cn2.com

Source: cn2.com

The child disability benefit CDB is a tax-free monthly payment made to families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions. Line 31300 Adoption expenses Find out what expenses are eligible for this credit and how to calculate and claim them. BC climate action tax credit The BC climate action tax credit BCCATC is a tax-free payment made to low-income individuals and families to help offset the carbon taxes they pay. For the July 2021 to June 2022 payment cycle the CCB provides a maximum annual benefit of 6833 for each child under age 6 and up to 5765 per year for each child between the age of 6 and 17. For each qualifying child age 5 and younger up.

Source: canadianmoneysaver.ca

Source: canadianmoneysaver.ca

Child Opportunity Benefit which replaced the BC. For the July 2021 to June 2022 payment cycle the CCB provides a maximum annual benefit of 6833 for each child under age 6 and up to 5765 per year for each child between the age of 6 and 17. The CCB is a tax-free benefit available to eligible families. BC climate action tax credit The BC climate action tax credit BCCATC is a tax-free payment made to low-income individuals and families to help offset the carbon taxes they pay. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit.

Source: canadianimmigrant.ca

Source: canadianimmigrant.ca

These tax credits are not increased for indexation. For children ages 6-17 it is 3000 or a breakdown of 250 per month. The amount you receive is dependent on. Children with disabilities will receive an additional amount for the Child Disability Benefit. How the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Source: canadianmoneysaver.ca

Source: canadianmoneysaver.ca

Each credit will be a non-refundable tax credit of 506 lowest tax rate of eligible expenditures up to 500 for each child providing a tax credit of up to 25 per child. The child tax credit math is somewhat involved this time around. Training tax credit is 2500 your taxes owing will be reduced to zero and youll receive a refund of 1500. Each credit will be a non-refundable tax credit of 506 lowest tax rate of eligible expenditures up to 500 for each child providing a tax credit of up to 25 per child. Line 30499 and 30500 Canada caregiver amount for infirm children under 18 years of age Find out if you are eligible for this credit and how to claim it.

Source: mdtax.ca

Source: mdtax.ca

Training tax credit is 2500 your taxes owing will be reduced to zero and youll receive a refund of 1500. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a 2021 tax credit. The BC Recovery Benefit application is closed effective July 1 2021. These tax credits are not increased for indexation. For each qualifying child age 5 and younger up.

Source:

Source:

Non-refundable tax credits will only reduce your BC. The BC CPI used to calculate 2020 amounts was 25 and 11 for 2021. Early Childhood Tax Benefit BCECTB is a tax-free monthly payment made to eligible families to help with the cost of raising young children under age 6. Line 32600 Amounts transferred from your spouse or common-law partner. For each qualifying child age 5 and younger up.

Source: cnet.com

Source: cnet.com

The child disability benefit CDB is a tax-free monthly payment made to families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions. Early Childhood Tax Benefit BCECTB is a tax-free monthly payment made to eligible families to help with the cost of raising young children under age 6. It was calculated based on net income from your 2019 tax return. The BC Recovery Benefit provided a one-time tax-free payment of up to 1000 for eligible families and single parents and up to 500 for eligible individuals. Child Opportunity Benefit which replaced the BC.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit bc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information