Child tax credit amount july 15 information

Home » News » Child tax credit amount july 15 informationYour Child tax credit amount july 15 images are available. Child tax credit amount july 15 are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit amount july 15 files here. Download all free images.

If you’re searching for child tax credit amount july 15 images information linked to the child tax credit amount july 15 keyword, you have come to the right blog. Our website frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

Child Tax Credit Amount July 15. These changes apply to tax year 2021 only. To recap the tax credit is up to. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The monthly payments could be as much as 300 per month for children under the age of 6 and 250 per month for those between the ages of 6 and 17 for those in families eligible for the full credit.

Child Tax Credit Expansion Kicks In July 15 With Monthly Payments To Families Wsj From wsj.com

Child Tax Credit Expansion Kicks In July 15 With Monthly Payments To Families Wsj From wsj.com

New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15. You will claim the other half when you file your 2021 income tax return. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17.

Youll get half of the amount through monthly installments this year and the other.

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. CNN The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday. The monthly payments represent half of. It also made the. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5.

Source: marca.com

Source: marca.com

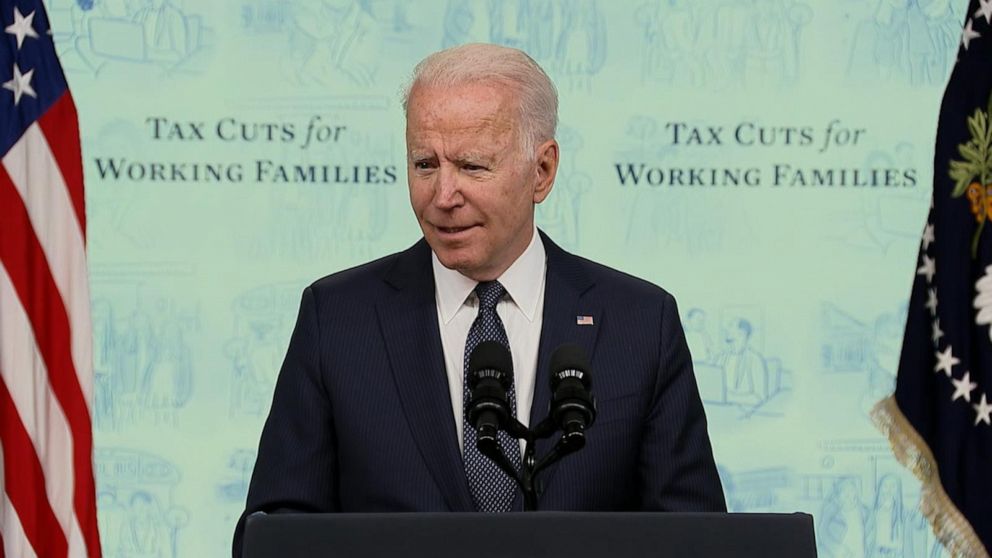

As noted above the expanded CTC provides a 3600 credit for each child under 6 years old and 3000 for each child age 6 to 17. Heres what to know. Payments for the new 3000 child tax credit start July 15. You will claim the other half when you file your 2021 income tax return. Child tax credits of 300 to hit bank accounts by July 15 as Biden pushes to make stimulus money permanent.

Source: pinterest.com

Source: pinterest.com

8 rows New parents are eligible for child tax credit payments Children born in 2021. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15. Payments for the new 3000 child tax credit start July 15. Child tax credits of 300 to hit bank accounts by July 15 as Biden pushes to make stimulus money permanent.

Source: pinterest.com

Source: pinterest.com

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Thats up to 7200 for twins This is on top of. These changes apply to tax year 2021 only. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source:

Source:

New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. Parents will claim the other half of the tax credit when filing taxes. To recap the tax credit is up to 3600 per child under age 6 and up to 3000 for each child ages 6 to 17. Thats up to 7200 for twins This is on top of. Youll get half of the amount through monthly installments this year and the other.

Source: pinterest.com

Source: pinterest.com

CNN The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday. These payments will amount to half of the credit. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. 8 rows New parents are eligible for child tax credit payments Children born in 2021. The first phaseout can reduce the Child Tax Credit to 2000 per child.

Source: pinterest.com

Source: pinterest.com

The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. To recap the tax credit is up to 3600 per child under age 6 and up to 3000 for each child ages 6 to 17. Parents will claim the other half of the tax credit when filing taxes. These payments will amount to half of the credit.

Source: wsj.com

Source: wsj.com

The advance payments and increased amount are. It also made the. These changes apply to tax year 2021 only. The monthly payments represent half of. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15.

Source: pinterest.com

Source: pinterest.com

New parents may be eligible for the child tax credit too Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Households will begin receiving periodic Child Tax Credit CTC payments worth up to 300 on July 15 a new benefit from the. Child tax credits of 300 to hit bank accounts by July 15 as Biden pushes to make stimulus money permanent. It also made the. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17.

Source: pinterest.com

Source: pinterest.com

Thats up to 7200 for twins This is on top of. Heres what to know. The monthly payments could be as much as 300 per month for children under the age of 6 and 250 per month for those between the ages of 6 and 17 for those in families eligible for the full credit. The first phaseout can reduce the Child Tax Credit to 2000 per child. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

New parents may be eligible for the child tax credit too Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. As noted above the expanded CTC provides a 3600 credit for each child under 6 years old and 3000 for each child age 6 to 17. The advance payments and increased amount are. New parents may be eligible for the child tax credit too Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: pinterest.com

Source: pinterest.com

To recap the tax credit is up to 3600 per child under age 6 and up to 3000 for each child ages 6 to 17. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. Around 39 million US. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5. CNN The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday.

Source:

Source:

Around 39 million US. To recap the tax credit is up to. You will claim the other half when you file your 2021 income tax return. 1800 for younger children and 1500 for older children. Youll get half of the amount through monthly installments this year and the other.

Source: pinterest.com

Source: pinterest.com

The monthly payments could be as much as 300 per month for children under the age of 6 and 250 per month for those between the ages of 6 and 17 for those in families eligible for the full credit. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. Child tax credits of 300 to hit bank accounts by July 15 as Biden pushes to make stimulus money permanent. The monthly payments represent half of. 1800 for younger children and 1500 for older children.

Source: pinterest.com

Source: pinterest.com

Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. These payments will amount to half of the credit. To recap the tax credit is up to. Households will begin receiving periodic Child Tax Credit CTC payments worth up to 300 on July 15 a new benefit from the. The monthly payments represent half of.

Source: cnet.com

Source: cnet.com

It also made the. The IRS plans to send a second letter to confirm that youre eligible and to estimate how much child tax credit money you could get when payments start July 15. To recap the tax credit is up to 3600 per child under age 6 and up to 3000 for each child ages 6 to 17. Parents will claim the other half of the tax credit when filing taxes. New parents may be eligible for the child tax credit too Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: cnet.com

Source: cnet.com

Around 39 million US. Around 39 million US. Heres what to know. Youll get half of the amount through monthly installments this year and the other. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Source: pinterest.com

Source: pinterest.com

Heres what to know. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Thats up to 7200 for twins This is on top of. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: time.com

Source: time.com

Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Households will begin receiving periodic Child Tax Credit CTC payments worth up to 300 on July 15 a new benefit from the. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. These payments will amount to half of the credit. Heres what to know.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit amount july 15 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- American horror story spin off cast information

- Child tax credit limits information

- Phil mickelson majors won information

- The open championship prize money information

- Joc pederson kelsey williams information

- Dwayne haskins pro day information

- Stream deck for non streamers information

- Phil mickelson us open wins information

- Neutrogena sunscreen spray recall information

- Dr death joshua jackson information