Child tax credit amount history information

Home » Trending » Child tax credit amount history informationYour Child tax credit amount history images are available. Child tax credit amount history are a topic that is being searched for and liked by netizens now. You can Get the Child tax credit amount history files here. Find and Download all free photos.

If you’re searching for child tax credit amount history pictures information connected with to the child tax credit amount history keyword, you have pay a visit to the right site. Our website frequently gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

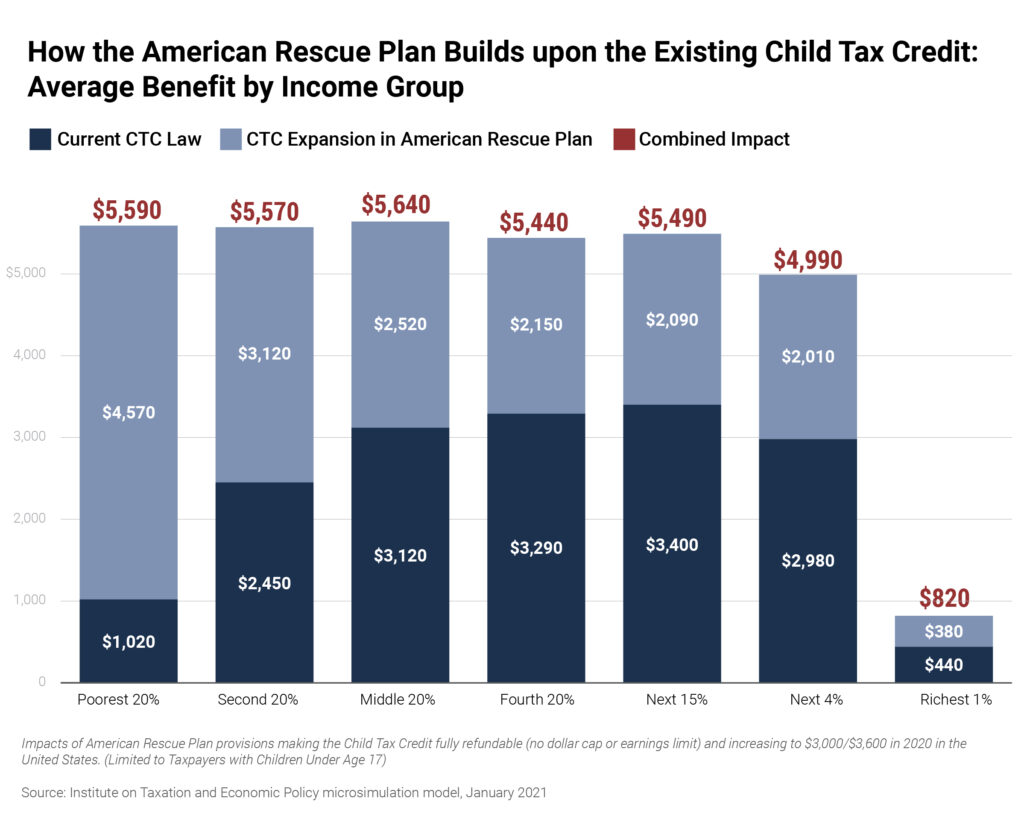

Child Tax Credit Amount History. Tax Credit for case of one qualifying child. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. If the credit exceeds taxes owed families may receive the excess amount as a refund.

Child Tax Credit Faq Everything To Know Before First Payment In 6 Days Cnet From cnet.com

Child Tax Credit Faq Everything To Know Before First Payment In 6 Days Cnet From cnet.com

For 2021 the Child Tax Credit provides a credit of up to 3600 per child under age 6 and 3000 per child from ages 6 to 17. You will claim the other half when you file your 2021 income tax return. The Child Tax Credit. For an individual to be eligible for the Child Tax Credit the following six tests must be met. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

How It Works and Who Receives It by Margot L.

The child tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a 400-per-child credit which increased to 500 for tax years after 1998 and accounted for over 60 percent of the 10-year cost of the entire bill Joint Committee on Taxation 1997. For more information on the child tax credit including the 500 nonrefundable credit for non-child tax credit dependents see CRS Report R41873 The Child Tax Credit. The Child Tax Credit. For an individual to be eligible for the Child Tax Credit the following six tests must be met. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. Thats up to 7200 for twins This is on top of.

Source: en.as.com

Source: en.as.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment from approximately 23 billion in 1998 to 118 billion in 2018 with the largest increase coming after the TCJA expansions as. The Child Tax Credit. The Child Tax Credit Amount by Income Level Note. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

Source:

Source:

With one child and parent filing singly or as head of household. Until now the credit was up to only 2000 per child under age 17. The Child Tax Credit. New parents are eligible for child tax credit payments Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. For income between 10540 and 19330 the tax credit is constant at 3584.

Source: itep.org

Source: itep.org

The Child Tax Credit. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. The expanded credit was established in the American Rescue Plan signed into law in March. The Child Tax Credit. For 2021 the Child Tax Credit provides a credit of up to 3600 per child under age 6 and 3000 per child from ages 6 to 17.

Source:

Source:

You will claim the other half when you file your 2021 income tax return. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child. Threshold for those entitled to Child Tax Credit only. The Child Tax Credit like most tax credits has a phase-out at certain income levels. Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment from approximately 23 billion in 1998 to 118 billion in 2018 with the largest increase coming after the TCJA expansions as.

Source: cnet.com

Source: cnet.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. This is a stylized example assuming the taxpayer has one qualifying child. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. The Child Tax Credit Amount by Income Level Note.

Source: nmvoices.org

Source: nmvoices.org

Threshold for those entitled to Child Tax Credit only. Until now the credit was up to only 2000 per child under age 17. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child to 3600 for children. Equally important the Presidents proposal would make the credit fully refundable. If the credit exceeds taxes owed families may receive the excess amount as a refund.

Source:

Source:

The Child Tax Credit Amount by Income Level Note. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child. The Child Tax Credit. You will claim the other half when you file your 2021 income tax return. In 2021 the maximum enhanced child tax credit is 3600 for children.

Source: cnet.com

Source: cnet.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The expanded credit was established in the American Rescue Plan signed into law in March. The child tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a 400-per-child credit which increased to 500 for tax years after 1998 and accounted for over 60 percent of the 10-year cost of the entire bill Joint Committee on Taxation 1997. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: bread.org

Source: bread.org

Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18. How It Works and Who Receives It by Margot L. Equally important the Presidents proposal would make the credit fully refundable. The credit will also be available periodically throughout the year starting as early as July rather than as a lump sum at tax time.

Source: taxfoundation.org

Source: taxfoundation.org

If the credit exceeds taxes owed families may receive the excess amount as a refund. The child tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a 400-per-child credit which increased to 500 for tax years after 1998 and accounted for over 60 percent of the 10-year cost of the entire bill Joint Committee on Taxation 1997. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child to 3600 for children. Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment from approximately 23 billion in 1998 to 118 billion in 2018 with the largest increase coming after the TCJA expansions as. The Child Tax Credit.

Source: money.yahoo.com

That means the credit will be paid. The Child Tax Credit Amount by Income Level Note. In 2021 the maximum enhanced child tax credit is 3600 for children. Child Tax Credit Awareness Day The American Rescue Plan delivered major tax relief for working families with children through a historic expansion of the Child Tax Credit. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax.

Source:

Source:

Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. Equally important the Presidents proposal would make the credit fully refundable. The Child Tax Credit. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: bread.org

Source: bread.org

Child Tax Credit Awareness Day The American Rescue Plan delivered major tax relief for working families with children through a historic expansion of the Child Tax Credit. Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment from approximately 23 billion in 1998 to 118 billion in 2018 with the largest increase coming after the TCJA expansions as. Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. These changes apply to tax year 2021 only. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax.

Source:

Source:

The expanded credit was established in the American Rescue Plan signed into law in March. The credit will also be available periodically throughout the year starting as early as July rather than as a lump sum at tax time. For an individual to be eligible for the Child Tax Credit the following six tests must be met. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18. For income between 10540 and 19330 the tax credit is constant at 3584.

Source: en.as.com

Source: en.as.com

The Child Tax Credit. Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. Tax Credit for case of one qualifying child. Thats up to 7200 for twins This is on top of.

Source: taxfoundation.org

Source: taxfoundation.org

In 2021 the maximum enhanced child tax credit is 3600 for children. If the credit exceeds taxes owed families may receive the excess amount as a refund. New parents are eligible for child tax credit payments Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Tax Credit for case of one qualifying child. The Child Tax Credit.

Source:

Source:

Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. New parents are eligible for child tax credit payments Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18. Child Tax Credit Awareness Day The American Rescue Plan delivered major tax relief for working families with children through a historic expansion of the Child Tax Credit.

Source: pinterest.com

Source: pinterest.com

Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. The Child Tax Credit Amount by Income Level Note. The Child Tax Credit like most tax credits has a phase-out at certain income levels. You will claim the other half when you file your 2021 income tax return. These changes apply to tax year 2021 only.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit amount history by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Jordan spieth us open information

- American horror story new cast information

- Doja cat jack harlow information

- British open vegas odds information

- The open house netflix information

- Steam deck upgradable storage information

- Stream deck uses reddit information

- Royal st georges golf course british open information

- British open 2021 accommodation information

- Jordan spieth kramer hickok information